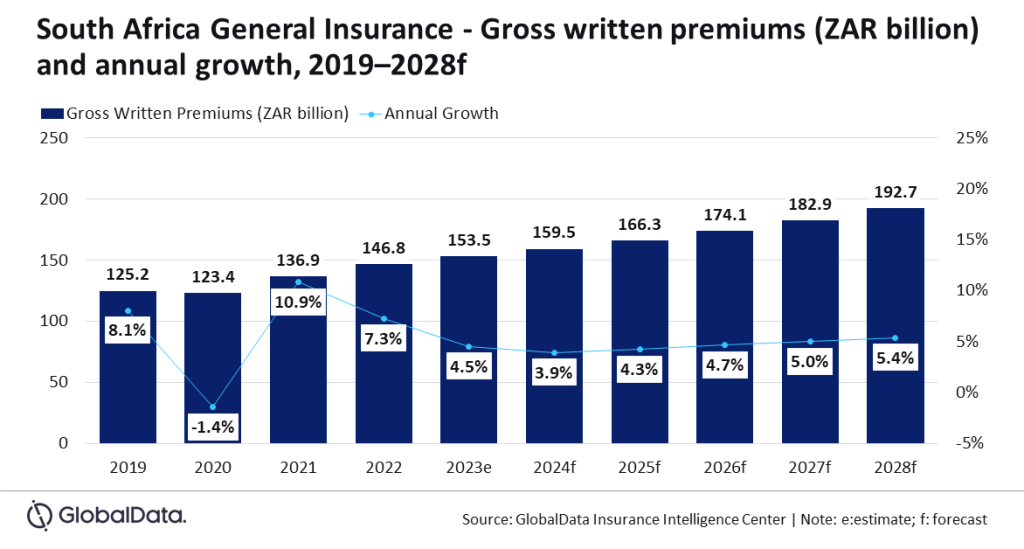

The general insurance sector in South Africa is predicted to grow at a CAGR of 4.8% from ZAR159.5bn ($9.4bn) in 2024 to $10.4bn in 2028 in terms of GWP.

This is according to GlobalData, which also expects general insurance in South Africa to grow by 3.9% in 2024. The growth is thanks to motor and property insurance lines, which accounted for around 83.6% of the market in 2023.

Sravani Ampabathina, insurance analyst at GlobalData, said: “The South African general insurance industry’s growth rate slowed down by 2.8 percentage points (pp) in 2023, driven by weak business sentiment, as the country’s real GDP grew marginally by 0.5% last year. While the slowdown is expected to continue in 2024, general insurance industry growth is poised to gain traction from 2025 onwards in line with the economic recovery.”

Motor insurance is the leader in South Africa general insurance, making up 42.6% of the sector in terms of GWP in 2023. It also grew by 4.8% in 2023 despite flat vehicle sales.

In addition, motor insurance growth is also expected to be driven by increased premium rates due to high instances of vehicle theft. According to Statistics South Africa, vehicle theft incidences increased to around 98,000 in 2022–23 from around 42,000 in 2021–22.

Moreover, GlobalData forecasts motor insurance to grow at a CAGR of 4.9% over 2024–28.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAmpabathina added: “Increasing claims from nat-cat events have also prompted reinsurers to increase reinsurance rates. This will increase the premium rates of home and construction insurance policies, which will support property insurance growth.”