The use of AI to issue insurance policy quotes generates mixed feelings among consumers, with the proportion who are comfortable with the technology comparable to the number who are not. Insurers face the challenge of convincing consumers to trust AI to handle tasks such as quoting, despite some scepticism. Swiss Re’s introduction of the Swiss Re Life Guide Scout, a generative AI-powered underwriting tool, exemplifies the industry’s commitment to leveraging AI for improved underwriting processes.

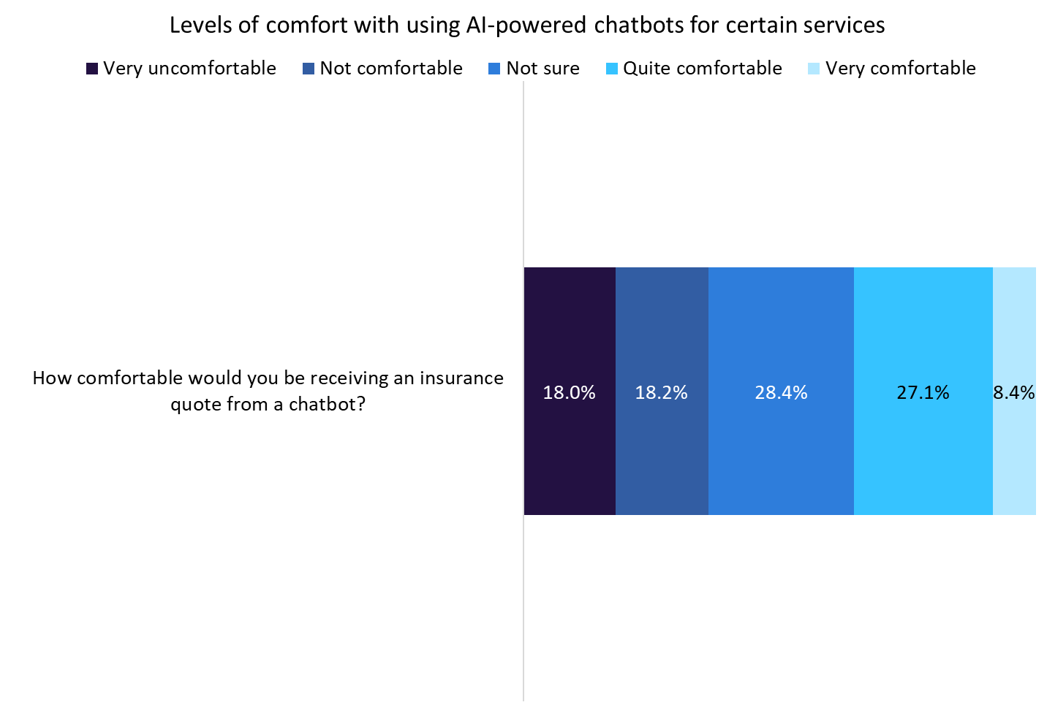

GlobalData’s 2023 UK Insurance Consumer Survey sheds light on consumer attitudes towards AI-powered solutions in insurance. The data reveals that 35.5% of consumers are comfortable receiving a quote from an AI-powered chatbot, compared to 36.2% who are not. This highlights the need for insurers to build trust and provide positive experiences to sway the opinions of those who are hesitant about AI technology. By demonstrating the benefits and reliability of AI-driven underwriting tools, insurers can bridge the gap in consumer confidence and drive the adoption of these innovative solutions.

Swiss Re’s Life Guide Scout, powered by generative AI and the Microsoft Azure OpenAI Service, aims to streamline the underwriting process by providing AI-generated responses to professional queries, enabling faster and more accurate risk assessment. This tool is targeted at life insurance, where onboarding is typically slow. The tool aims to enhance decision-making by allowing underwriters to access knowledge and receive AI-generated responses faster, in turn speeding up the onboarding process.

While consumers do not directly interact with the AI tool, the underlying technology may raise concerns among some individuals about the transparency and fairness of the quoting process. Insurers must prioritise building consumer confidence in AI-driven solutions by emphasising the benefits, accuracy, and ethical use of AI in underwriting. As the industry evolves, there may be opportunities to develop more consumer-facing AI processes that address these concerns directly, ensuring a smoother transition to widespread AI adoption in insurance. Confidence and transparency are key factors in bridging the gap between consumer scepticism and the benefits of AI technology in the insurance value chain.

As insurers continue to develop AI-powered solutions for underwriting and other areas of the insurance value chain, the potential applications of this technology are vast. From expediting risk assessment to enhancing knowledge transfer, AI offers significant benefits for insurers and consumers alike. However, building trust among consumers remains a crucial aspect of AI adoption. By showcasing the value and reliability of AI-driven tools like the Swiss Re Life Guide Scout, insurers can navigate the gap in consumer confidence and drive widespread acceptance of AI technology in the insurance sector.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData