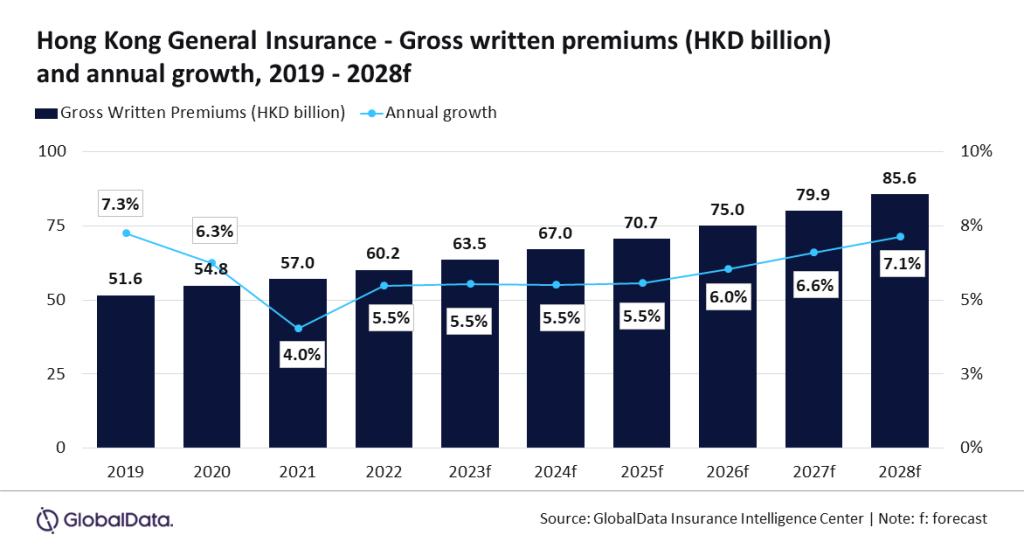

The general insurance market in Hong Kong is set to grow at a CAGR of 6.3% from HKD67bn ($8.6bn) in 2024 to $10.9bn in 2028.

This is in terms of gross written premiums, according to GlobalData.

In addition, the general insurance industry in Hong Kong is predicted to grow by 5.5% in 2024 and 2025, according to the GlobalData Insurance Database.

This growth will be supported by major insurance lines, such as personal accident and health (PA&H), liability, and property, which altogether account for 75% of the general insurance GWP in 2023.

PA&H insurance is the leading line of business in Hong Kong general insurance, accounting for 31.4% of the market in 2023. It is projected to grow by 7.2% in 2024, primarily driven by an increase in health awareness and a a recovery in the demand for health insurance policies from mainland China after the removal of extended travel restrictions.

Liability insurance is the second largest line, accounting for a 24.1% share of the general insurance GWP in 2023. Hong Kong was the fourth-largest liability insurance market in the APAC region in 2023.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Anurag Baliarsingh, insurance analyst at GlobalData, commented: “Hong Kong general insurance industry witnessed a consistent growth of 5.5% in 2022 and 2023. The growth was supported by a recovery in the demand for health and travel insurance policies from mainland Chinese customers, mandatory insurance classes, and rising medical inflation that resulted in an increase in the premiums for health insurance policies. The trend is expected to continue in 2024 and 2025.

“Chinese customers are mostly attracted by the superior care, high-quality medical facilities, and shorter waiting times offered in Hong Kong. The health insurance policies offered in Hong Kong include options for additional coverage for family members, higher coverage for specific types of illness, and severity-based protection that are not available in the policies offered in Mainland China.”