dacadoo is a global technology company and innovative business partner that is driving the digital transformation in life insurance and healthcare.

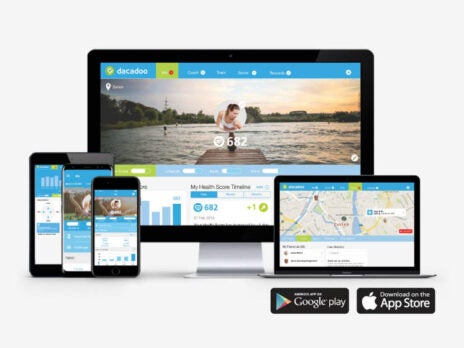

Based in Zurich, Switzerland, dacadoo strengthens health and wellbeing through active engagement and artificial intelligence. dacadoo develops and operates a mobile-first digital health engagement platform that helps people live healthier, more active lives through a combination of motivational techniques from behavioral science, online gaming and social networks, as well as artificial intelligence and automated coaching.

The patented, scientifically calculated dacadoo Health Score

Based on more than 200 million person-years of clinical data, its patented, real-time Health Score makes health individually measurable, which provides users with a unique engagement experience, while also offering dacadoo’s enterprise customers an effective way to measure the true health impact of wellness programmes.

With the explosion of health and fitness-related wearable devices and applications in the market, it has never been easier for people to get access to a variety of health and fitness-related data. This also presents a challenge, as no one can handle such a multitude of data and make sense out of it without any support.

Making sense out of a large number of health and wellbeing data is exactly what the dacadoo Health Score does. It simplifies the health status of an individual into just one number, the patented dacadoo Health Score, so that it can be universally understood. Fundamentally, the dacadoo Health Score is based on who you are (body), how you feel (mind) and how you live (lifestyle).

The digital engagement platform for life insurance

For life insurers, dacadoo provides ongoing digital engagement for members from the point of acquisition, creating customers for life, along with dynamic underwriting capabilities.

Policy holder engagement:

- Win-win – develop healthy, high-value, lifelong clients

- Rewards, such as reduced premiums, for hitting health goals

- Cross Sell – conversation opener for other products

Dynamic underwriting:

- Calculate customer’s health and risk changes in real-time.

- Target high-risk customers with specific programs to improve their health.

- Offer premium discounts to customers that improve their Health Score – Pay-As-You-Live pricing model

Flexible multilingual technology solutions with direct device integrations

Available in more than 11 languages, dacadoo’s technology is provided as a fully branded, white-label solution or it can be integrated into customer products through its API. In addition to the integrated fitness tracker in the dacadoo app (iPhone, Android), dacadoo also supports many of the most popular fitness tracking devices and apps, such as Fitbit, Jawbone, Withings, Garmin vivo, Runkeeper, Endomondo, and Moves.

dacadoo’s customers include life and health insurance companies, health and wellness service organisations as well as large and mid-sized employers for health promotion in the workplace.

About Peter Ohnemus, President, CEO, and Chairman of dacadoo ag

Peter Ohnemus is the founder of the dacadoo Health Score/dacadoo ag, Zurich/Switzerland. Peter has been involved in high-tech and bio-tech investments over the last 25 years and this had led to four IPO’s and multiple trade sells. Peter was CEO & co-founded ASSET4 in 2004 with Goldman Sachs and Merrill Lynch as investors (the world’s leading provider of extra-financial information), which was sold to Thomson Reuters, New York, in November 2009. Peter Ohnemus previously held senior executive positions with Sybase, Logic Works, The Fantastic Corporation and COS, which all went public during his tenure.

Peter is a frequent speaker and commenter on high-tech and healthcare globally. He has spoken at World Economic Forum (WEF), Fortune Brainstorm Health, Google Tech Talks, McKinsey’s Life Leaders CEO Forum, The Royal Society of Medicine, Stanford LIGHT Conference, CommunicAsia, Mobile World, European Health Forum by the EU, Economist Global Healthcare Forum, Mobile Health Summit DC, European Tech Tour, Red Herring, WWW/Digital Disease Detection, etc.

Peter Ohnemus was Entrepreneur of the Year (EoY) for Switzerland by EY. Peter lives outside Zürich, is married and has five daughters.