The rules have changed when it comes to customer service. With social media and an always-connected world, it’s less a question of if insurance providers should engage with conversations about them and more about how to respond, with brand reputations at stake, according to GlobalData Financial Services.

Connectivity and social media have fundamentally transformed the way people learn about brands, form opinions, and provide feedback. Digitalization has empowered individuals to challenge brands in new ways, with the power of word-of-mouth made large so that the ‘truth’ is now set by the customer.

Take a second to consider how you, too, have become part of this change. When you purchase an item on Amazon or decide to organize your holiday by looking on Trip Advisor, have your decisions not been molded by the ‘star ratings,’ personal reviews, and recommendations of strangers?

It is within this context that insurers need to get to grips with not only where their brand is being talked about, but how to respond in nuanced and personable ways to a) extinguish negative stories, b) ‘hug your haters,’ and c) win over undecideds. While improving on this front, the insurance industry has a long way to go here.

While by no means a full reflection of all reviews and perceptions online, let’s take a look at what Trustpilot.com – an online review community – has to say about insurers.

How to engage with social media

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe rules have changed when it comes to customer service. With social media and an always-connected world, it’s less a question of if insurance providers should engage with conversations about them and more about how to respond, with brand reputations at stake.

Connectivity and social media have fundamentally transformed the way people learn about brands, form opinions, and provide feedback. Digitalization has empowered individuals to challenge brands in new ways, with the power of word-of-mouth made large so that the ‘truth’ is now set by the customer.

Take a second to consider how you, too, have become part of this change. When you purchase an item on Amazon or decide to organize your holiday by looking on Trip Advisor, have your decisions not been molded by the ‘star ratings,’ personal reviews, and recommendations of strangers?

It is within this context that insurers need to get to grips with not only where their brand is being talked about, but how to respond in nuanced and personable ways to a) extinguish negative stories, b) ‘hug your haters,’ and c) win over undecideds. While improving on this front, the insurance industry has a long way to go here.

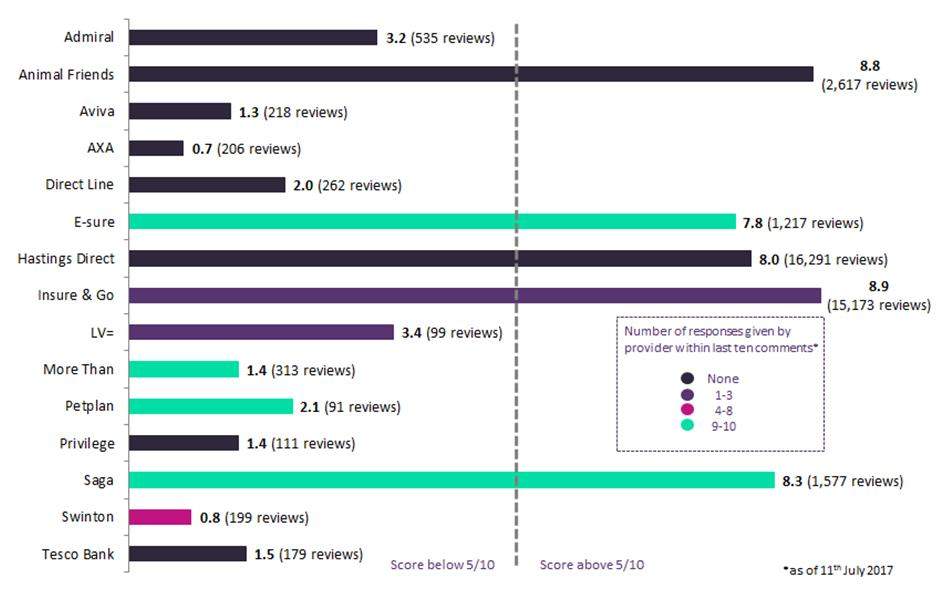

Online approval scores for insurers

While by no means a full reflection of all reviews and perceptions online, let’s take a look at what Trustpilot.com – an online review community – has to say about insurers.

Below is a view of the ‘scores’ out of 10 attributed to a selection of providers that often fall within the top 20 brands for either car, home, travel, or pet insurance within GlobalData’s Consumer Insurance Surveys.

A few stand out for performance – for example, Saga accounts for not only an average score of 8.3 but also (perhaps inter-related) provided a response to all of the last 10 comments on its Trustpilot page.

However, a majority of insurers fall far short of even approaching an average score and are doing little to respond to this trial-by-social-network.

Source: Trustpilot.com

There is little safety in the fact that this is a widespread industry issue. All this does is to amplify a broader, negative perception of ‘traditional’ insurers in the minds of consumers, widening the opportunity for outside players that have forged reputations in other areas like tech and retail or even to new insurance propositions that – no coincidence – more often than not explicitly point to being different to the ‘old’ model or are ‘insurance 2.0.’