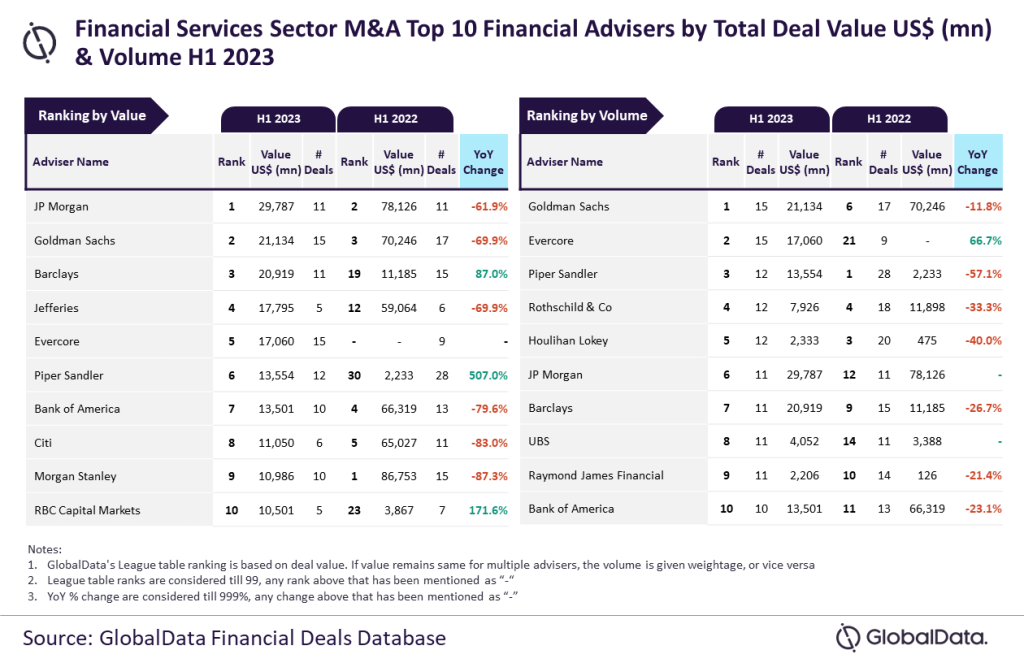

In H1 2023, JPMorgan was top for value in M&A and Goldman Sachs led the way in terms of volume, according to the latest Financial Advisers League Table from GlobalData.

JPMorgan advised on $29.8bn worth of M&A in H1 2023. However, Goldman Sachs advised on a total of 15 deals in the same period, which was also second in terms of value with $21.2bn worth of deals.

Barclays finished third in terms of value in H1 2023 with $20.9bn, followed by Jefferies with $17.8bn and Evercore with $17.1bn.

Furthermore, Evercore was second in terms of volume with 15 deals, followed by Piper Sandler (12), Rothschild & Co (12) and Houlihan Lokey with (12).

Aurojyoti Bose, lead analyst at GlobalData, commented: “Apart from leading by volume, Goldman Sachs was among the only three advisers with more than $20bn in total deal value in H1 2023. It advised on four billion-dollar deals*, which also included one mega deal valued more than $10bn. Involvement in such big-ticket deals helped Goldman Sachs occupy the second position by value as well.

“Meanwhile, JPMorgan, which led the chart by value, advised on seven billion-dollar deals* that also included a mega deal valued more than $10bn. In fact, JPMorgan was shy of around $200m only from hitting $30bn in total deal value in H1 2023.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

*Deal value ≥ $1 billion