Young adults will be one of the worst-affected groups financially as a result of the coronavirus pandemic. Non-essential expenditures, like some insurance policies, are likely to be disposable in order to safeguard money for indispensable expenses like groceries and house bills.

Those in this demographic entering the workforce will typically have lower salaries and will also have had less time to start building savings. 48.2% of 18–24-year-olds have less than £1,000 in their savings account, according to GlobalData’s 2019 UK Life & Pensions Survey. 58.3% have an average monthly balance of less than £1,000 in their current accounts.

Young adults currently have low levels of job security due to their heavy presence in the leisure, retail, and hospitality sectors, which have been severely affected by lockdowns brought into place to reduce the spread of coronavirus. Many of these workers’ wages will be negatively impacted by coronavirus, and although they can receive financial assistance from the UK government, reduced job security will encourage individuals to save more. This will encourage young adults to look for any savings where they can.

Insurance is one area where customers could look to recoup some monthly expenses. With most of the country in lockdown and people instructed to remain at home, traditional products like home and gadget insurance should see a fall in uptake. One reason is that people may feel that they are less likely to be burgled or misplace their devices nowadays.

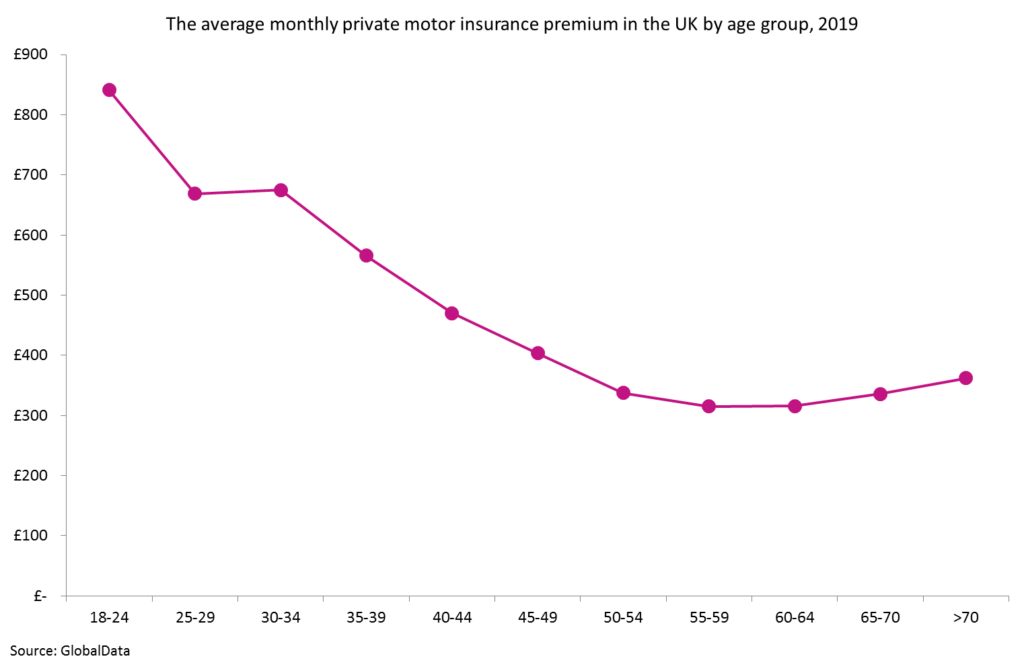

Consumers may be more inclined to purchase gadget insurance where the cover is only active outside the home. The level of car insurance cover will also be affected. While it is more difficult to cancel car insurance due to legal requirements, vehicle owners could look to switch from comprehensive policies to third-party only in order to reduce costs when they reach the renewal date. This could be especially popular among young drivers as they face much higher premiums due to their inexperience.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

While this shift in behaviour could be a problem for the larger incumbents, smaller insurtechs stand to benefit. Usage-based insurance providers will become more popular, as customers will pay reduced premiums during periods when they use the insured asset less. On-demand insurance will also become more popular, whereby customers can simply switch cover on and off and only pay for periods when they need to be covered. Coronavirus will have lasting impacts on consumer behaviour, and while these types of insurance policies are not very popular now, the virus will act as a catalyst to help drive their growth.