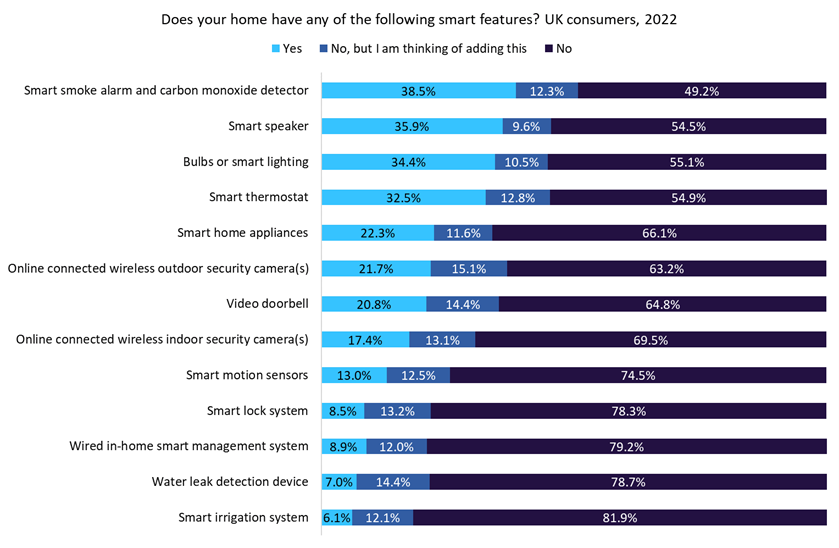

After a successful trial, Ondo InsurTech is rolling out LeakBot across Sweden in partnership with Länsförsäkringar, the country’s largest non-life insurer. Despite their proven success in mitigating water damage claims, GlobalData’s 2022 UK Insurance Consumer Survey indicates that just 7% of UK household insurance customers use a water leak detection device.

As the insurance industry evolves towards the claims prevention model of ‘predict and prevent’, smart devices such as water leak detectors will continue to prove their worth to insurers and homeowners alike. Ondo InsurTech is showcasing the value of its LeakBot device, with Sweden becoming the fourth country in which the product is being rolled out. Länsförsäkringar suggests it has up to two million home insurance customers who are at risk of water damage. Given that water damage claims are estimated to cost up to GBP14 billion (in the UK and US alone), the savings potential for insurers and insureds is massive.

Despite this huge cost, just 7% of UK home insurance customers use a leak detector in their home, highlighting how much work can be done by both technology and insurance providers to increase uptake of the kit. Ondo provides LeakBot to insurance customers free of charge (it is self-installed), with the data fed back to the insurer. According to our 2022 UK Insurance Consumer Survey, 66.2% of consumers indicated that they would share smart device data with an insurer in return for financial savings. This data sharing through LeakBot is therefore beneficial to consumers through savings and insurers through enhanced data collection and consumer insight. The Internet of Things is starting to have a concerted and noticeable impact on home insurance, with leak detectors playing a key role in eliminating water claims damage.

In its trial period, Länsförsäkringar Södermanland saw a 50% increase in home insurance sales, as well as positives in retention and claims. Thus, not only can leak detectors save insurers from significant claims (an ever-important facet, especially in the context of global inflation), but they can also improve acquisition and retention rates.

Ondo’s further partnerships with leading insurers in Denmark, the UK, and the US will allow the insurtech to continue to grow, bringing the benefits of leak detectors into the sights of consumers and other insurers. Insurers should ensure they do not get left behind by evolving technology within the home and the benefits they bring to consumers and themselves.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData