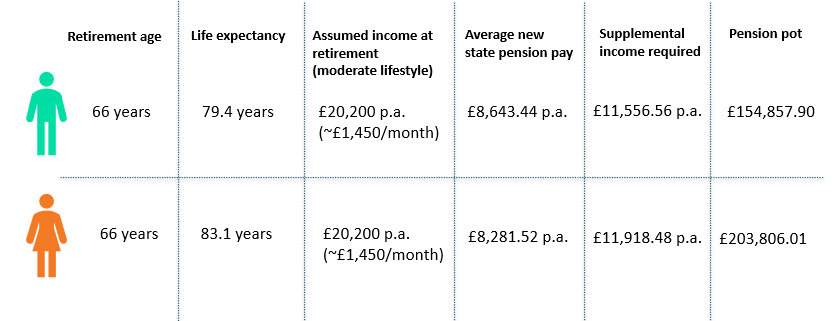

Longer life expectancies mean that women need larger pension pots than men for the same retirement income. GlobalData analysis shows that for a retirement income of around £20,000 a year, women need to raise almost £50,000 more in funds than men. Yet, owing to the gender pay gap, men can typically build larger pots than women over the course of their working life.

Individuals commonly retire at the state pension age, at which point they can claim the state pension. According to GlobalData’s UK Pensions Market 2021 report, single individuals receiving the average amount of new state pension pay will need to supplement their annual retirement income by more than £11,500 to achieve a moderate lifestyle in retirement. Women will need higher top-ups than men given that their state pay is lower on average. But because women also live longer than men on average, they will need to supplement their state pension for longer. Women retiring at the state pension age will have to supplement their state pensions for around 17 years, compared to 13.4 years for men. This means that on average, women will need larger pension pots than men. For a retirement income of £20,200 a year, women will need pension pots worth over £200,000, almost £50,000 more than men, without taking inflation into account.

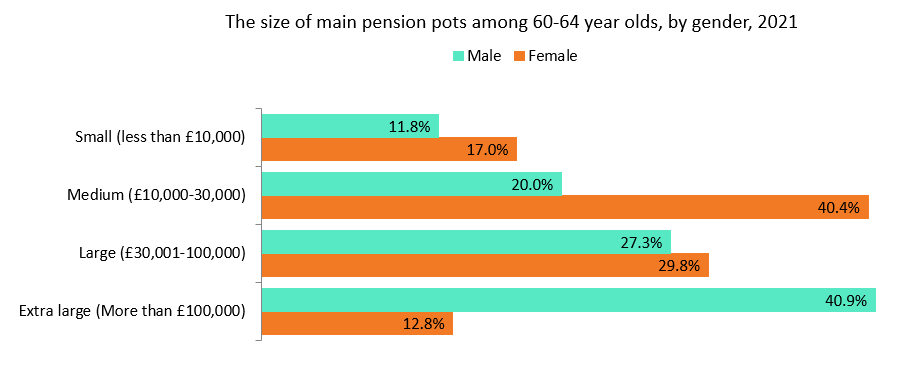

Societal barriers such as the gender pay gap and taking career breaks to raise children mean that it is harder for women than men to build larger pension pots. Our 2021 UK Life & Pensions Survey reveals that by the time individuals approach the state pension age, women will have considerably smaller pension pots than men. 40.4% of non-retired women in the 60–64 age category have medium-sized pension pots. In contrast, a similar proportion of men have extra-large pension pots.

The gap in pensions means that many women will effectively retire with a lower retirement income than men, coupled with a lower state post-work pay. The state pension age had traditionally been lower for women than men, but in recent years it has been increased sharply, bringing it on par with men’s. Nonetheless, there is optimism in the industry that as the gender pay gap lessens, the difference in pension pot sizes will narrow.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData