Financial Risk Solutions (FRS) delivers fund administration software that reduces operational costs, increases efficiencies and mitigates risk for life assurance companies.

Founded by a team of actuaries and IT specialists, FRS developed the award-winning Invest|Pro™ platform that currently manages in excess of 150,000 funds for more than 60 blue-chip financial clients such as MetLife, Prudential, Accenture, Aviva, Generali and Zurich.

FRS is headquartered in Dublin, Ireland, and has offices in London, Hong Kong and Sydney.

Fund management platform for financial companies

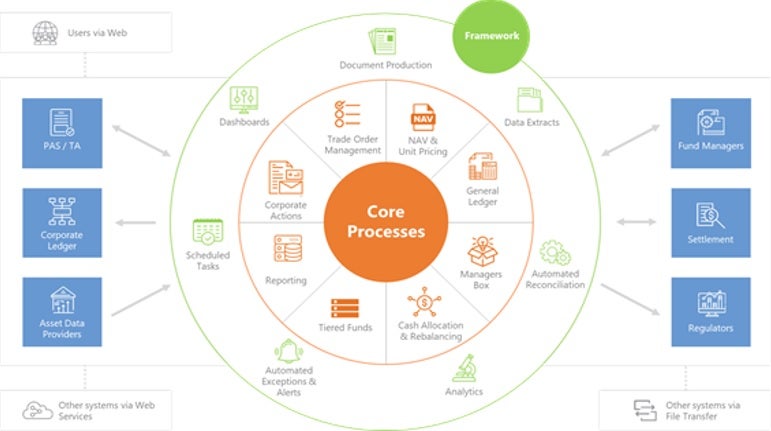

Delivered on-site or Cloud-hosted, Invest|Pro™ securely automates multiple complex fund administration processes such as unit-pricing, cash allocation and rebalancing, oversight and validation of operational activity performed by outsourced partners.

In Europe, it can also perform monitoring and reporting for packaged retail and insurance-based investment products (PRIIPs), key information document (KID) requirements, and Pillar III quantitative reporting template (QRT) asset reporting for Solvency II.

Scalable, modular and flexible, Invest|Pro™ continues to respond to fast-changing industry needs to ensure clients can stay focused on growing their businesses while manufacturing and managing the best-in-class products on the platform.

Its dashboard provides transparency across operational functions and resources, providing a single platform to optimise operational efficiency and reduce operational risk.

Unit-linked investment administration

Invest|Pro™ securely automates multiple complex fund administration processes within a single application.

Core functionalities include daily cash allocation and rebalancing, trade order management, daily net asset values (NAVs) / unit pricing and investment accounting.

Task scheduling and process automation tools

Invest|Pro™’s task scheduling capabilities enable automated processes, so complex multi-stage investment processes can be run automatically utilising high-powered servers.

This approach removes the risk of human error in data entry and process management to minimise operational and reputational risk while optimising operational efficiency.

By offering a comprehensive integrated system to manage front and back-office processes, Invest|Pro™ also automates the validation of operational activity performed by outsourcing partners. This enables firms to supervise outsourced functions and data, as well as manage the associated risks.

Exception-based processing capabilities

Invest|Pro™’s rules management module independently checks your processes and data for issues that could potentially lead to errors or process failure. Rule exceptions when they occur are broadcast to a defined distribution list by email.

Rules can block other processes from running when the system detects non-normal data patterns and requires such exceptions to be signed off by nominated parties.

Risk and compliance analytics

The Invest|GRC™ analytics-driven compliance engine combines data from internal and external sources to help insurers and asset managers meet PRIIPs and KID requirements, along with Pillar III asset reporting standards for Solvency II.

Cloud-hosting capabilities

The Invest|Retail™ self-service web application allows third parties to have secure web access to the Invest|Pro™ application. Companies can incorporate the web application into their existing corporate website and have a single user login.

It is suitable for independent financial advisers, investment advisers, end clients and head office accounting departments, and each user type can be configured to have different access rights to the Invest|Pro™ application.

Analytics and reporting tools

FRS offers a comprehensive reporting toolset that connects the user to the business processes running on the Invest|Pro™ Server.

A web-based business intelligence tool for life office investment administration, its optimised report design enables users to remotely create and quickly view reports on large datasets (more than ten million rows).

Analytics can also be quickly configured to access data outside the Invest|Pro™ databases to allow clients to use the system as their general reporting tool within the enterprise and create multi-database reports to enhance the decision-making process.

Optimum operating model solutions

The level of functionality in the Invest|Pro™ platform, combined with FRS’ extensive industry knowledge and blue-chip client base, allows the team to provide optimum operating model solutions for different regulatory environments.

A model that offers flexibility, is modular and provides a comprehensive investment fund administration platform to manage cash flows between the company’s member administration system and its external investment managers, as well as calculate fund NAVs and unit prices.

This optimum operating model comprises five parts:

- Highly sophisticated valuation/NAV calculation engine, including real-time tax accruals

- A full general ledger that integrates with accounting systems and is used to generate portfolio financial statements

- Automated cash allocation and rebalancing in a multi-tiered fund of fund structure with automated ‘box management’ capabilities

- Trade order management system for automated or manual asset transaction execution

- Cash and asset reconciliation module, delivered on a powerful web-based solution that includes analytics, automated exception handling and scheduled task-driven process management

Client testimonials

CTIS business support director Paul Rowlands said: “FRS’s unrivalled experience in the life assurance investment administration space is reflected in its Invest|Pro™ system. The broad range of functionality it provides for both unitised funds and portfolio bond administration is unique, and has hugely benefited our business operationally.”

Friends First’s head of group finance said: “Investment administration operations have changed so much over the years and our legacy systems were old and unable to provide the functionality we required. We chose Invest|Pro™ to automate and consolidate our administration functions and the 35% cost savings and efficiencies that have resulted have been exceptional.”

Louise Duncan from Zurich International Life said: “The team from Financial Risk solutions did an excellent job implementing Invest|Pro™, their industry knowledge added hugely to the project. The system has made a significant improvement to our entire investment administration department by increasing controls, improving processing times and facilitating significant scalability.”

Mobius Life’s head of business development said: “Invest|Pro™ provides a robust solution to manage Mobius Life pension scheme investments into our unit-linked funds and onwards to the investment markets. Invest|Pro™ adds significant tangible value through increased automation and control.”