Exponential growth and complexity in the funds industry over the last ten years has resulted in increased client and regulatory pressure for firms to manage oversight differently in this new paradigm. Talking about ways to satisfy such growth needs to be matched and proved by evidence and action in the back office.

Around the world several governments are swiftly moving ahead with mandatory pension provision, moving much of the cost of old age off the state balance sheet. With these enormous annual in-flows to the funds industry, for example, 8 percent of gross salaries in the United Kingdom and 9.5 percent in Australia now contributing to pensions, comes both a significant opportunity and responsibility for fund administrators. Add to this institutional and corporate in-flows in a world where unicorns (privately held startup firms valued at over $1bn) are created monthly.

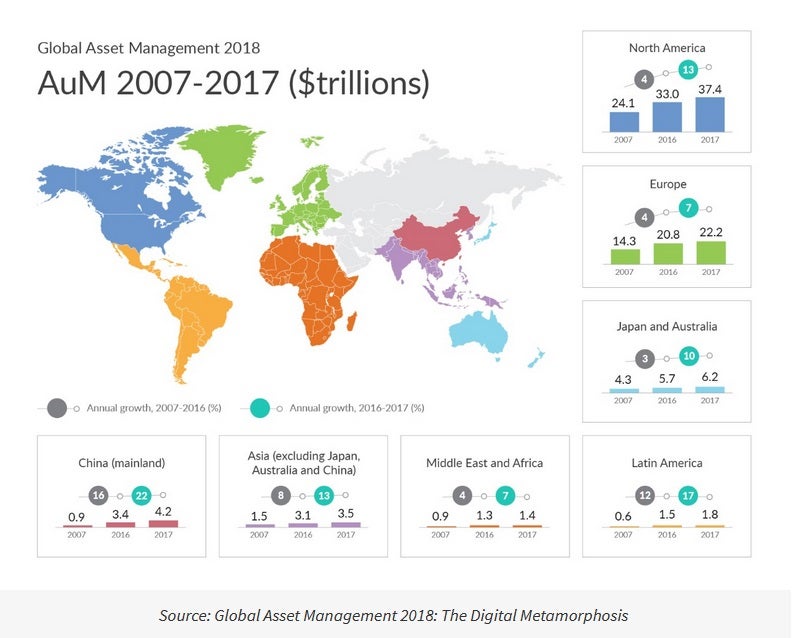

Assets under management increased in all regions in 2017, led notably by growth in China and the United States as seen here:

The aggregate of unit-linked Assets Under Management (AUM) in the European Union and Variability Annuity (VA) in the United States reached $5.5 Trillion in 2017 and has been increasing at a five-year Compound Annual Growth Rate of 6.9 per cent, mainly driven from the life industry.

All of this combined means that the industry needs to ensure their back offices or outsourced partners are ready for the steady increase in funds and assets, not only to support growth and maintain operational efficiencies but also because the industry and regulators have no appetite for less than the strongest operating models.

Increased regulatory pressure

Oversight and accountability have been a strong theme across all regulators since the 2009 financial crisis. Today, regulatory pressure is growing as assets under management increase, putting fund administrators and insurers under greater scrutiny than ever before. We only need to look at recent examples from Australia’s Royal Commission, the United Kingdom’s Prudential Regulation Authority reviews or the Central Bank in Ireland’s review of outsourcing, and separately but related UCITS performance fees.

While not all regulators name the detail of offences uncovered, fines levied and the brand of the offending firm, more are adopting this heavy-handed approach which encourages best practice and acts as a significant deterrent to sub-standard operating models. For those jurisdictions that do publish this information, a common theme amongst these breaches is inadequate systems and controls to support and evidence oversight and governance for outsourced fund administration and fund valuations.

Competitive tension driving higher standards

The result of increased regulatory pressure can be positive in that many fund providers are striving for higher standards, both with their people and systems. We work with three types of firms investing in robust technology monitoring and reporting solutions to mitigate operational risk in fund valuation and administration more generally:

• Disruptors: a small number of dynamic fund administrators who seek best-of-breed technology vendors from day one to support a client-led service offering that is cost-effective, scalable and flexible.

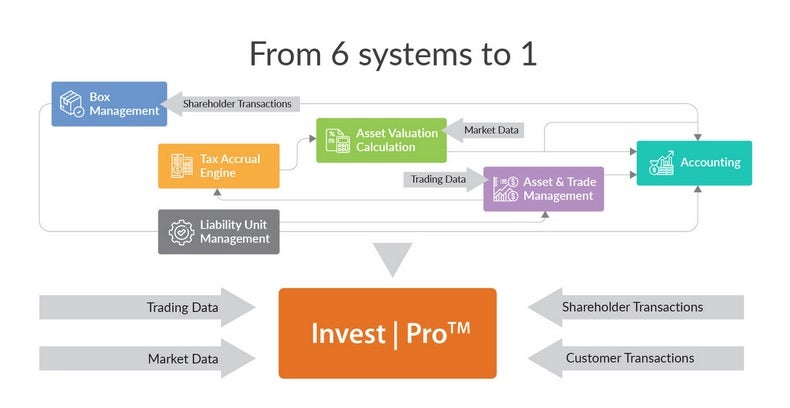

• Established service providers: investing in digital transformation to stay relevant in a fast-changing market, these providers are revising their operating models and working closely with technology vendors to streamline operations, often reducing the number of specialist systems used to increase efficiency and reduce risk.

• Major acquirers: faced by big technology challenges as they merge many books of business, these firms are striving to maintain daily fund valuation back-office operations and act in the best interests of the policyholder while mitigating risk. They look to experienced technology vendors to assist with the delivery of optimum operating model solutions and migration.

Evolution of the operating model

Central to robust oversight is the operating model. Over the past twenty years, we have seen the back office operating model evolve from a mix of disparate proprietary systems to a streamlined and often outsourced model.

Today’s operating model is streamlined into six logical steps that are wrapped around a rules and compliance engine.

At FRS, we are forging a best-practice path, offering compliance and oversight software for fund administrators and their outsourcing partners, that identifies and alerts clients to exceptions before they become costly problems.

With over twenty years in business, we see time and time again the results of adding new and improved use cases to the Invest|Pro™ platform that evolve with the ever-changing challenges of growth, regulatory pressures and competition. The success of our clients and their relationships with regulators is the best evidence we have that ‘Action’ equals or exceeds ‘Talk’ when it comes to compliance and oversight.