All articles by GlobalData Financial

GlobalData Financial

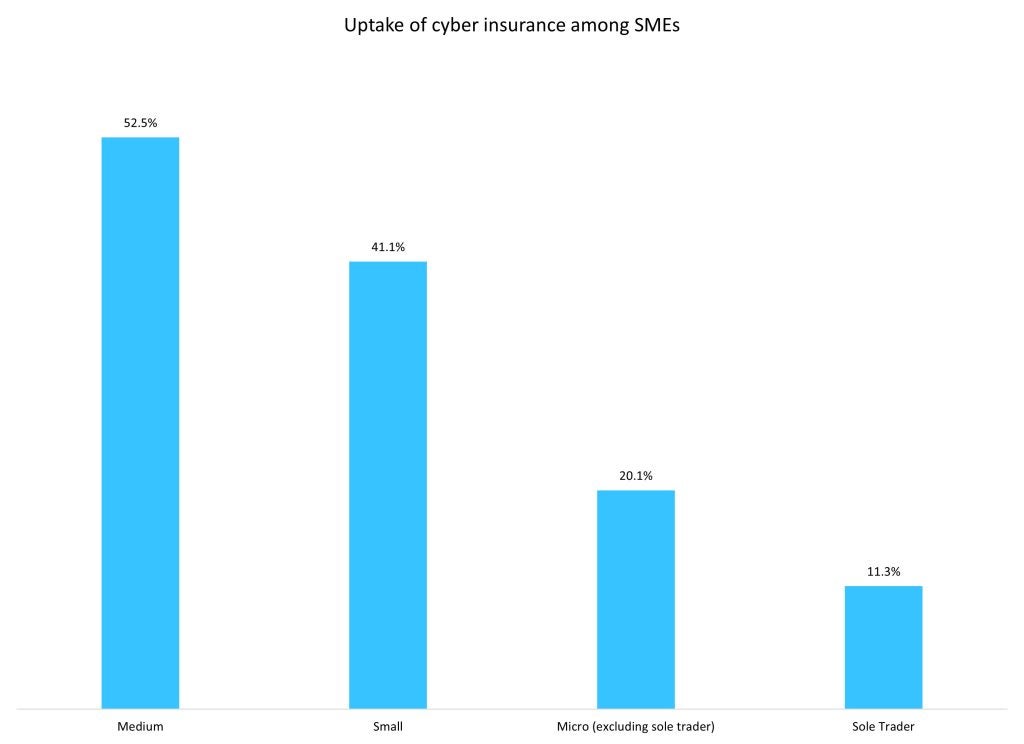

Insurers should look to target the cyber insurance gap among SMEs

With 63.9% of medium-sized businesses expressing some level of concern about cybercrime in 2023, GlobalData’s survey emphasises the high level of worry among these businesses.

Insurers must cut claim costs as high motoring costs push consumers away from driving

The rising costs of car ownership and operation are pushing a growing number of consumers to consider abandoning driving altogether

Insurers must offer a wider range of payment options to attract younger consumers

A study suggests younger consumers tend to embrace a wider array of payment methods when managing their insurance transactions.

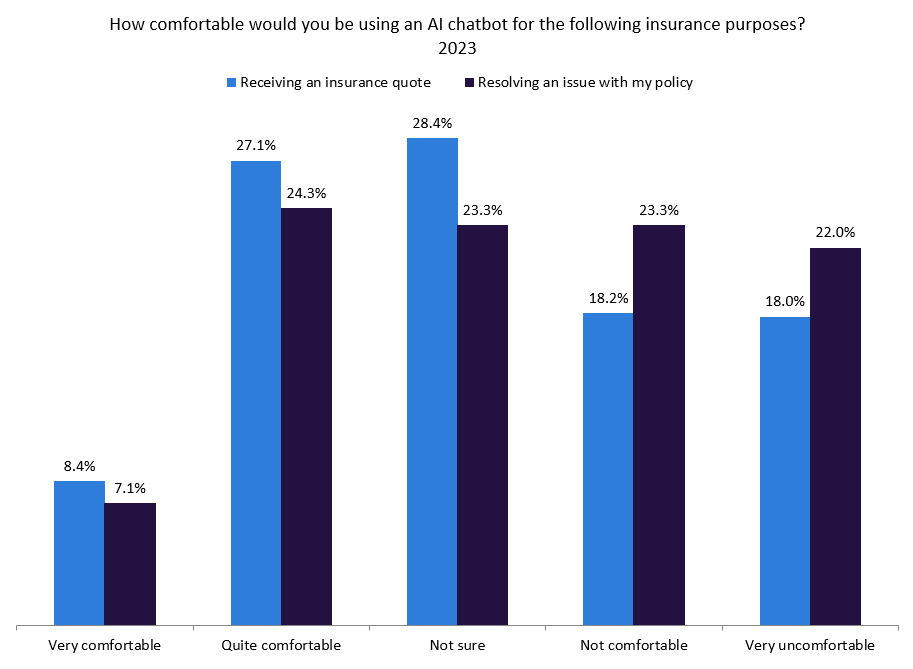

Many UK consumers are already open to interacting with insurance chatbots

GlobalData’s 2023 UK Insurance Consumer Survey found that 35.5% of consumers would already be comfortable receiving a quote from an insurer via a chatbot.

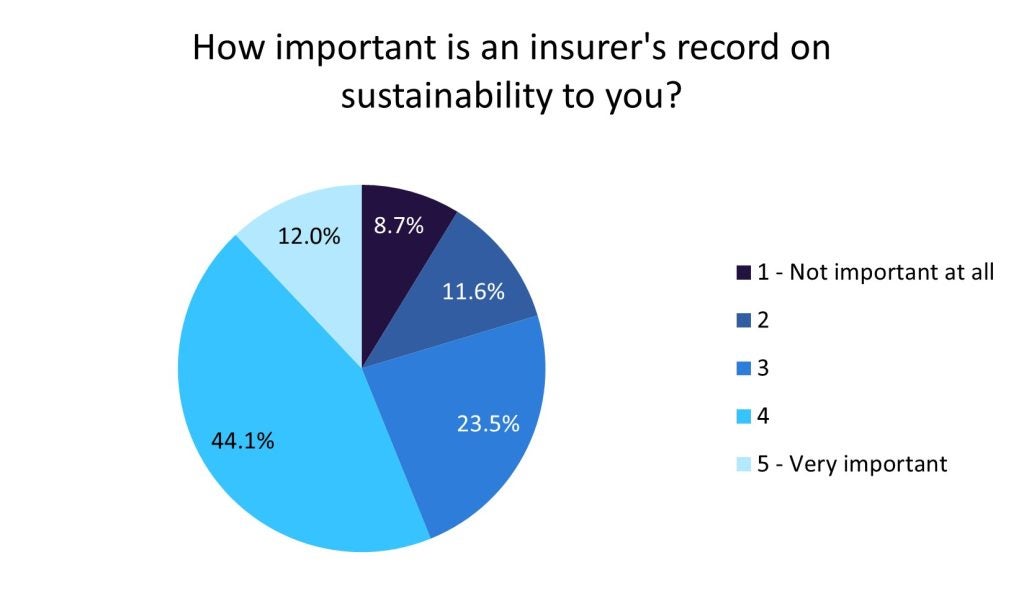

The Green Insurer targets drivers who value sustainability

The proposal from The Green Insurer is an attempt to help both the environment and consumers.

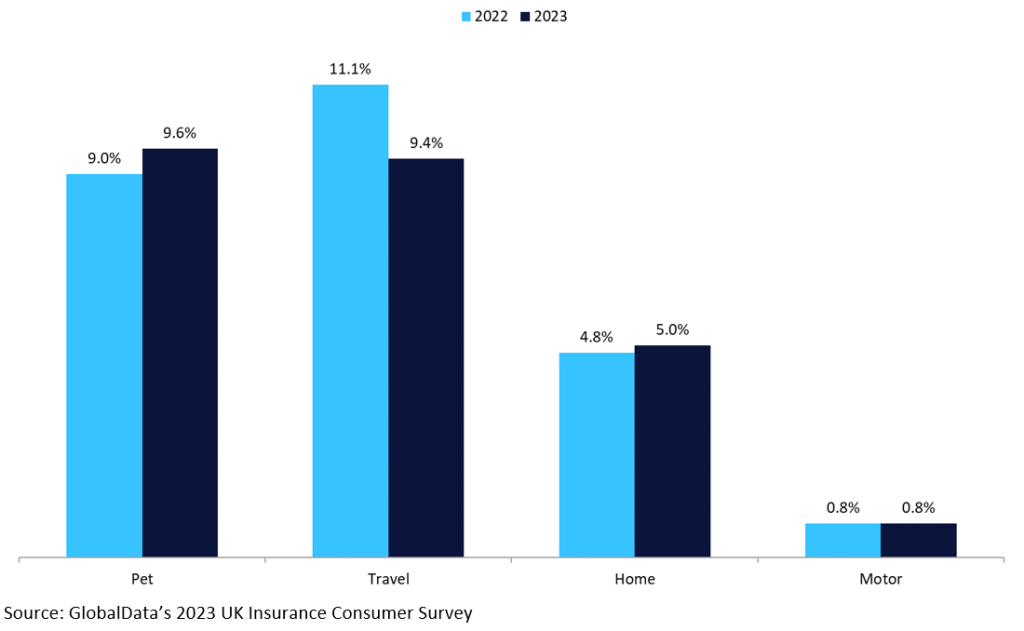

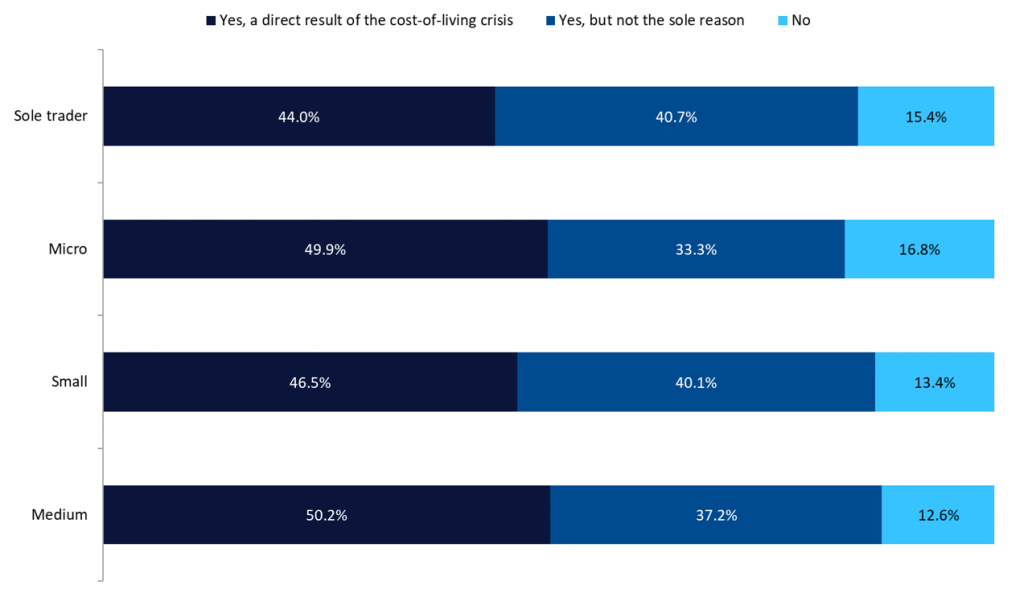

Pet and travel policies are frequently cancelled amid the cost-of-living crisis

Although disinflation in the UK economy suggests there is some light at the end of the tunnel, many UK consumers have resorted to insurance policy cancellations to reduce their costs.

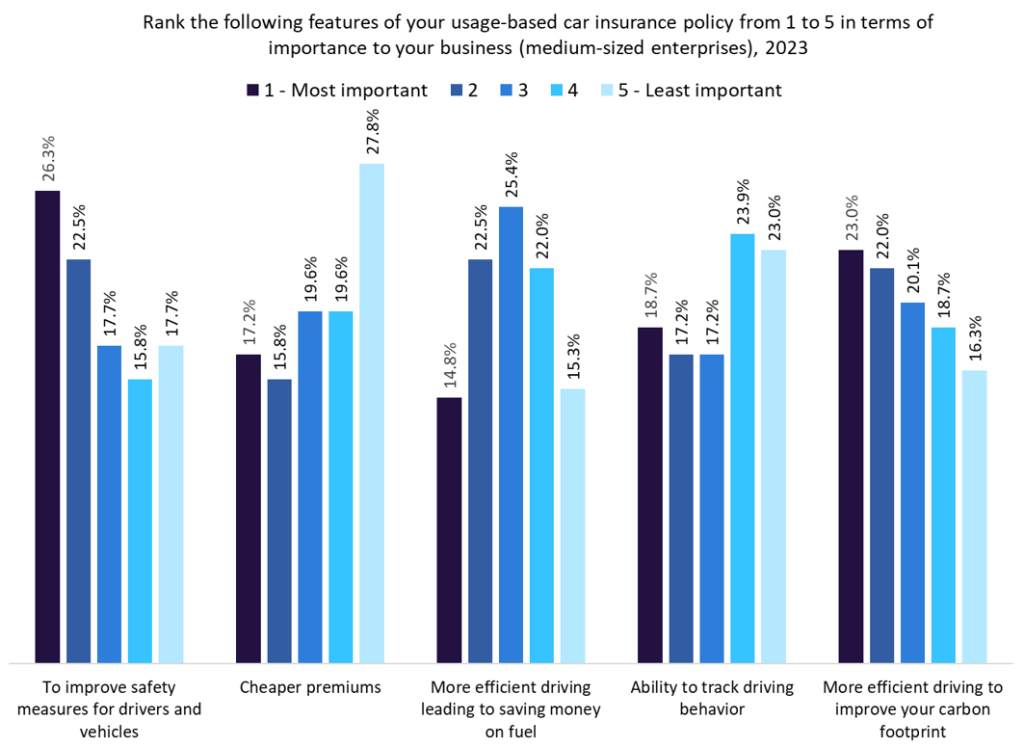

Larger SMEs rank safety features as the most important feature of a UBI policy

According to GlobalData, 26.3% of medium-sized enterprises (SMEs) prioritise enhanced safety measures as the key feature of a UBI policy.

Aspen targets mental health and well-being in the construction sector

Aspen’s initiative emerges as a beacon of support, offering assistance to workers experiencing mental health issues in a field experiencing an increase in tragedies.