A study from Access PaySuite has found that younger consumers consider diverse payment options a major factor in choosing an insurance provider. Meanwhile, GlobalData surveying suggests consumers across various age groups exhibit varied preferences when it comes to insurance payment methods.

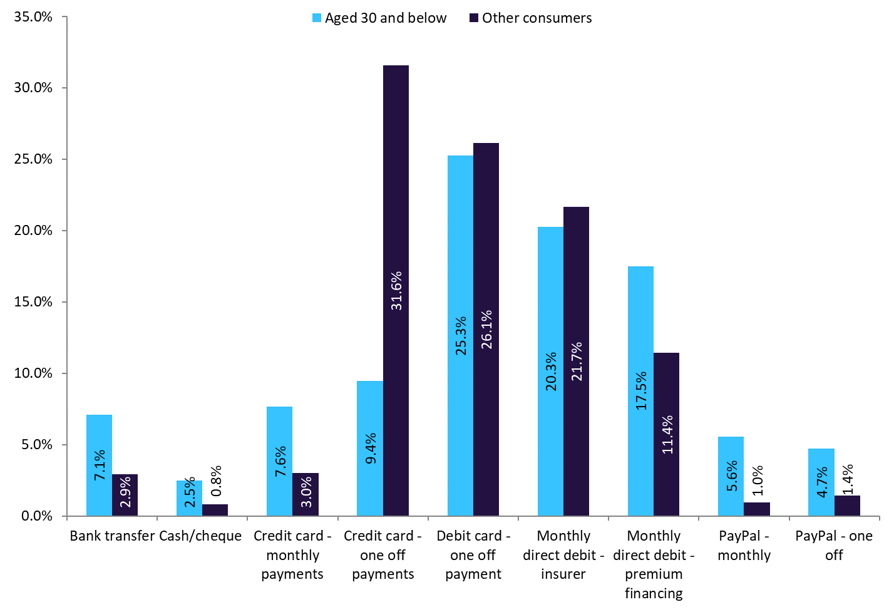

As per GlobalData’s 2023 UK Insurance Consumer Survey, consumers aged 30 and below exhibit a broader spectrum of choices compared to those aged over 30. While the younger demographic shows a comparatively higher inclination towards diverse options such as monthly credit card payments (7.6%), monthly PayPal payments (5.6%), and bank transfers (7.1%), consumers aged over 30 display a more concentrated preference for one-off credit card payments (31.6%). This suggests that younger consumers tend to embrace a wider array of payment methods when managing their insurance transactions, reflecting greater flexibility and adaptability in their financial preferences.

Preferred payment options for car and home insurance, 2023

Meanwhile, the research segment of Access PaySuite’s latest report, titled, “Future-Proofing Payments in the Insurance Sector,” indicates that 80% of Gen Z respondents and 77% of millennials consider a variety of payment options as a significant factor in selecting an insurance provider. The report also underscores the significance of security and flexibility for consumers in their insurance payment processes, with 42% of participants emphasizing the importance of secure data handling. However, the study also sheds light on notable concerns within the sector. More than a third of consumers report negative experiences related to paying their insurance premiums. These issues include instances where payments were made without full customer awareness (39%), difficulties in cancelling payments (35%), and instances of being overcharged (33%).

The emphasis on diverse payment options reflects a broader trend in the financial services industry, whereby flexibility and convenience are increasingly becoming non-negotiable aspects of consumer engagement. Insurance providers that successfully adapt to these changing dynamics stand to not only meet the current demands of their customer base but also position themselves favourably in attracting new customers, particularly from younger age groups who prioritise modern and adaptable payment methods.

Overall, insurers poised to succeed are those capable of agile adaption to evolving customer needs, especially in response to the growing demand for diverse and innovative payment solutions. As the landscape of consumer preferences continues to transform, insurance providers that proactively adjust their offerings stand to not only retain their current customer base but also attract a broader and more diverse audience.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData