GlobalData’s 2023 UK Insurance Consumer Survey found that a third of UK motor insurance customers saw their premiums rise by over 20% in 2023. With a growing number of consumers willing to abandon driving in the face of spiralling costs, insurers must be increasingly proactive in minimising claims costs to stem their losses.

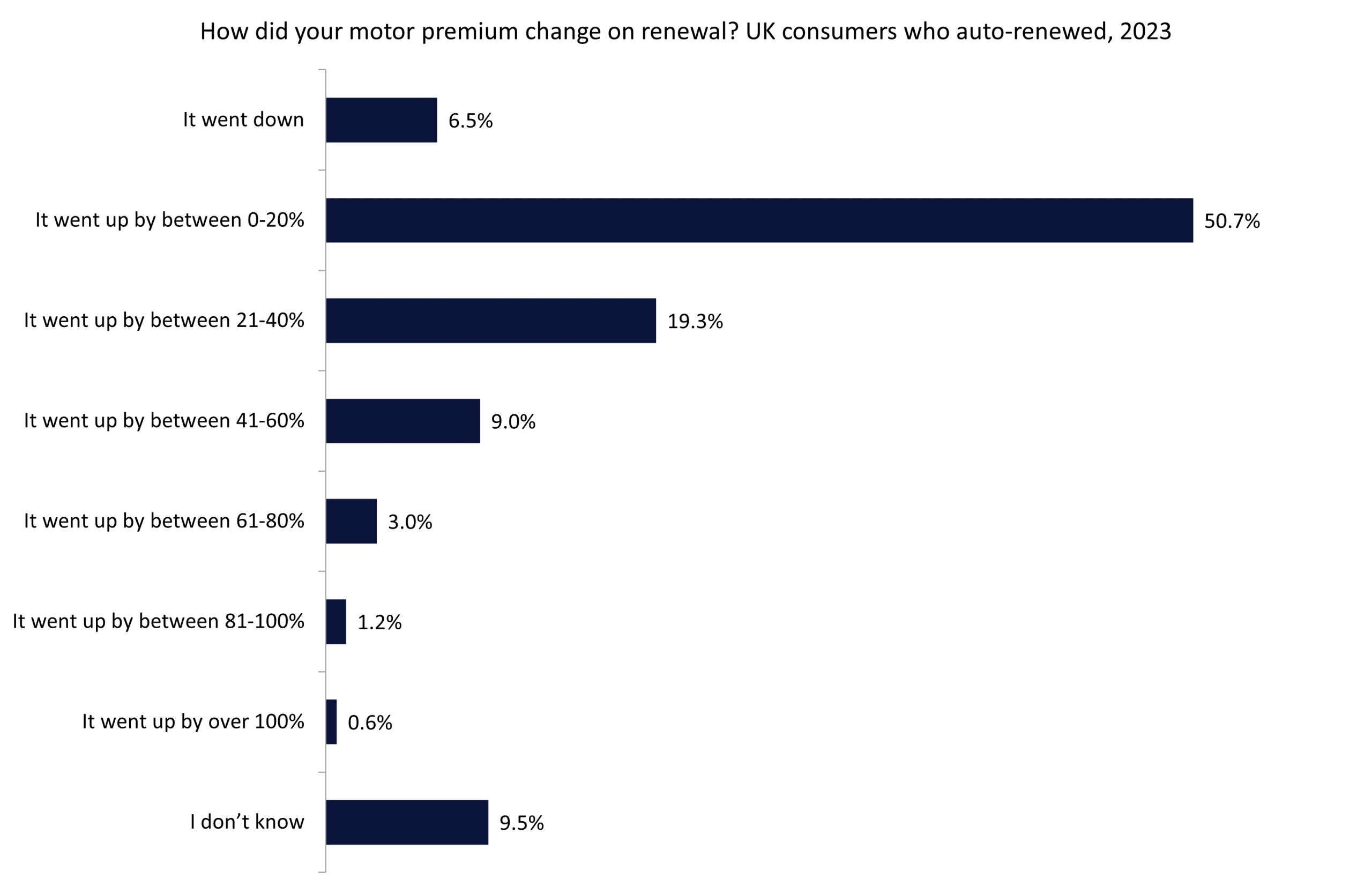

Our 2023 UK Insurance Consumer Survey found that just over half of motor insurance customers saw their premiums increase by 0%–20% in 2023. Additionally, 33.1% of respondents stated that their premiums increased by 21% or above, including 0.6% whose premiums more than doubled in 2023. According to the Association of British Insurers, the UK motor line recorded a combined operating ratio of 110.5% in 2022, with EY forecasting even more significant losses in 2023. Insurers are thus met with the challenge of raising premiums in line with claims costs without driving too many consumers from the market.

The rising costs of car ownership and operation are pushing a growing number of consumers to consider abandoning driving altogether. With growing repair costs (including for services such as MOTs), high fuel prices, and increasing insurance premiums, many consumers are finding that the costs of owning a vehicle no longer outweigh the benefits. Although petrol and diesel prices have fallen since their 2022 high (of 191p per litre for petrol and 199p per litre for diesel), both fuels remain above their pre-pandemic pricing. The Russia/Ukraine conflict and continual OPEC+ supply restrictions are exacerbating the issue.

Meanwhile, supply chain problems (including the residual semiconductor shortage from the Covid-19 years) continue to blight car repair networks, especially as electric vehicles (EVs) and connected cars make up more of the national parc. While insurance costs will naturally rise with these movements, alongside the increase in driving from spring 2021 following periods of Covid-related lockdowns, consumers are now finding these costs are unmanageable.

Research conducted by insurtech The Green Insurer in December 2023 indicates that around 15% of motorists are considering forgoing their car due to rising ownership costs. The study also reports that 51% of car owners are concerned about rising insurance premiums. Given the strain on consumer finances in 2024, continual premium increases will surely drive more consumers out of the market.

Insurers should therefore prioritise claims management and minimisation. Telematics-oriented products can deliver some of these benefits, although despite many years of talk they are yet to fully deliver on their promise. Establishing strong repair networks with reliable supply chains—crucial as EVs become more popular—will help eliminate long lead times and unforeseen price shocks. In a challenging market, players who can manage the short term while future-proofing their long-term networks will be in positions to lead the way as the auto markets enter their next generation.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData