All articles by GlobalData Financial

GlobalData Financial

UK election manifestos unlikely to alter demand for PMI

Private healthcare is becoming more expensive, and insurers have passed on costs to policyholders.

Allianz and Income Insurance will boost competition in Singapore

The synergies between Income and Allianz could establish them as a significant player in the Singapore insurance market.

NFTs and the metaverse will bring new opportunities for insurers

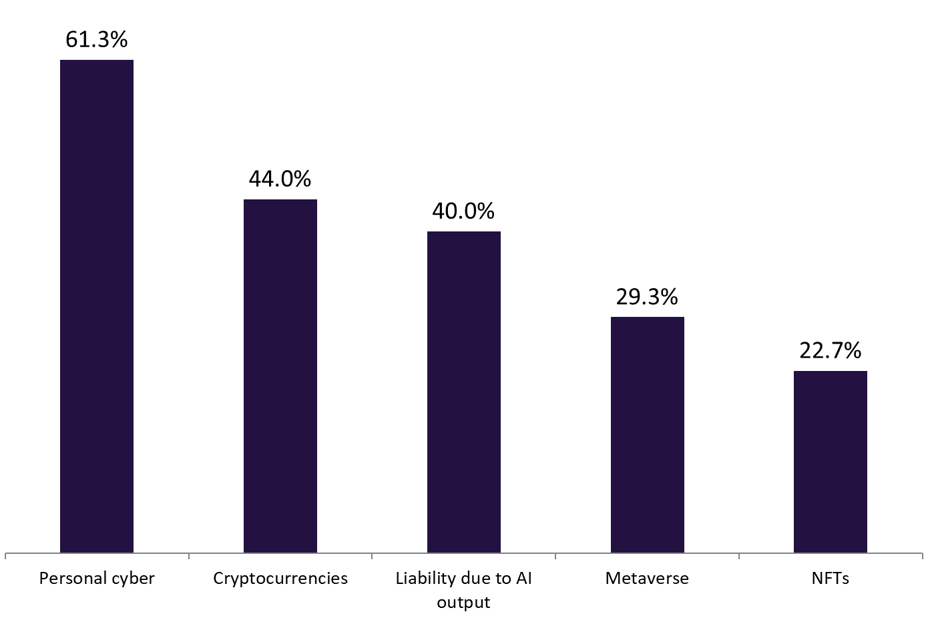

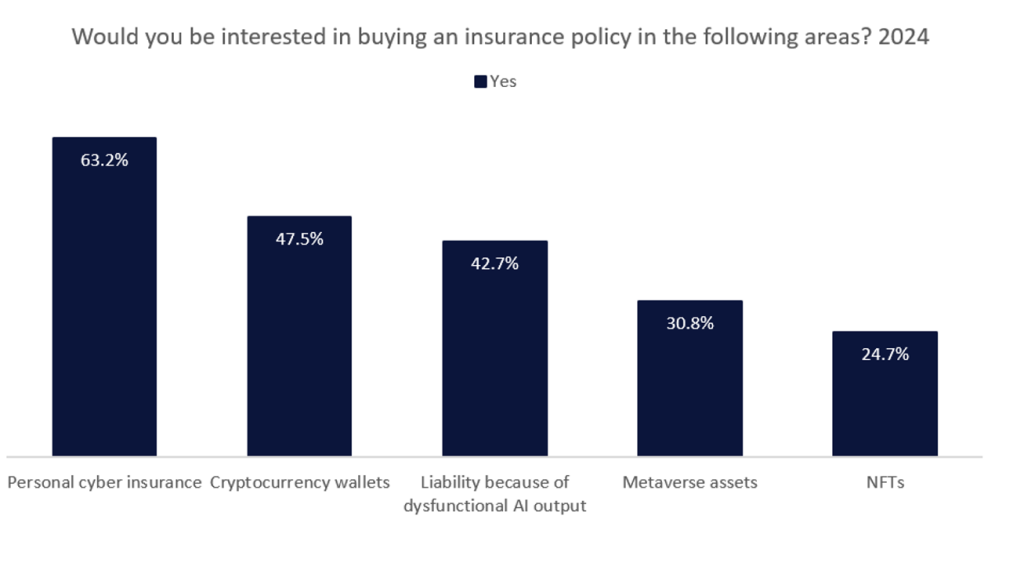

The poll revealed that Life Insurance International readers would be most interested in buying insurance for personal cyber, but NFTs and the metaverse received a combined 52.0% of the poll.

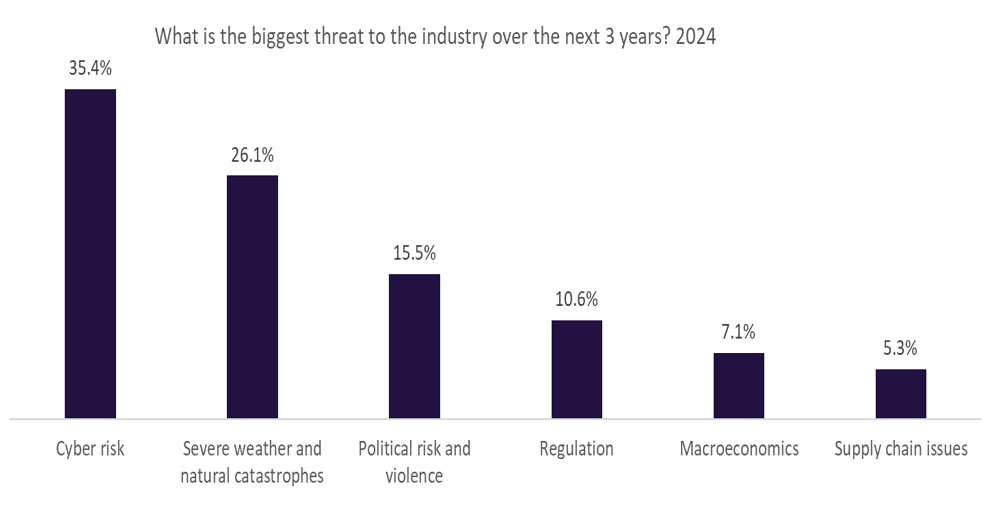

UK brokers are increasingly focusing on developing cyber insurance products

According to GlobalData, 25% of UK commercial brokers are interested in developing cyber insurance products for their existing clients in 2024, up from 18.2% in 2023.

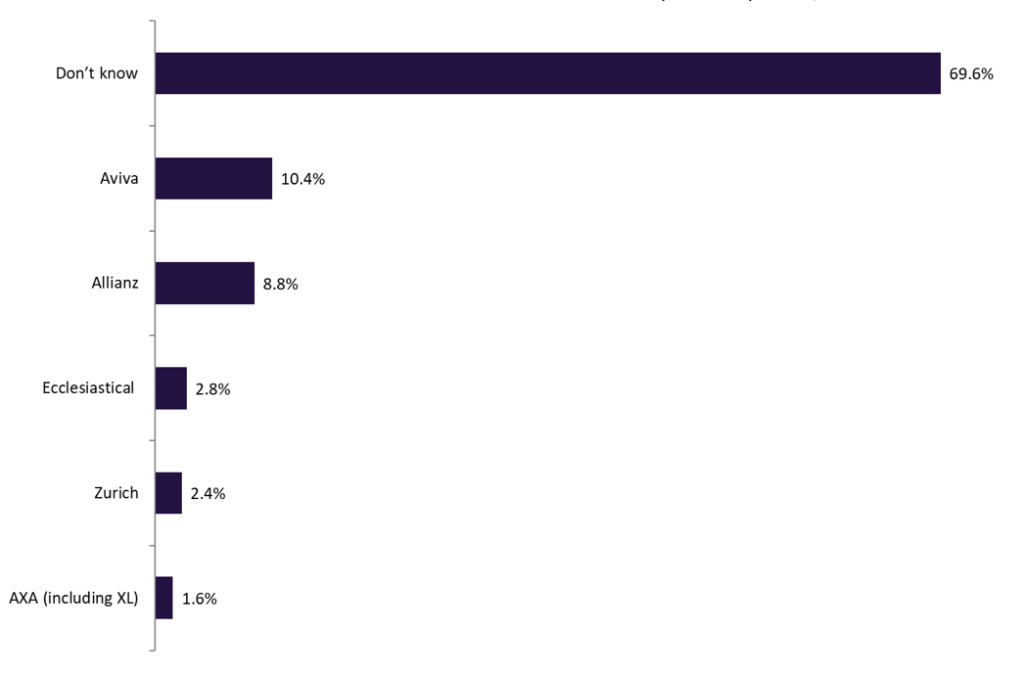

UK insurers must highlight ESG commitments to attract brokers

It is imperative for brokers to not only concentrate on ESG factors but also to be well-informed about the insurers that are leading the way in these areas.

Personal cyber insurance is the most desirable emerging product

As remote and hybrid working have become more common around the globe, the frequency and severity of cyberattacks have increased.

Cyber risk the standout global challenge for the insurance industry

With companies around the world holding more and more personal data, most businesses are vulnerable to attacks.

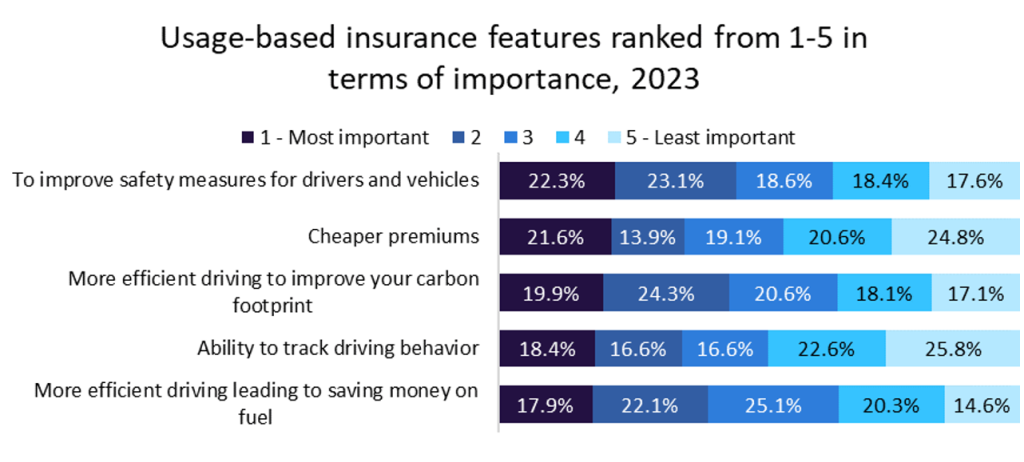

Telematic policies can not only boost driver safety but reduce premiums for UK SMEs

According to GlobalData’s 2023 UK SME Insurance Survey, 32.6% of SMEs have a usage-based policy for their vehicles.

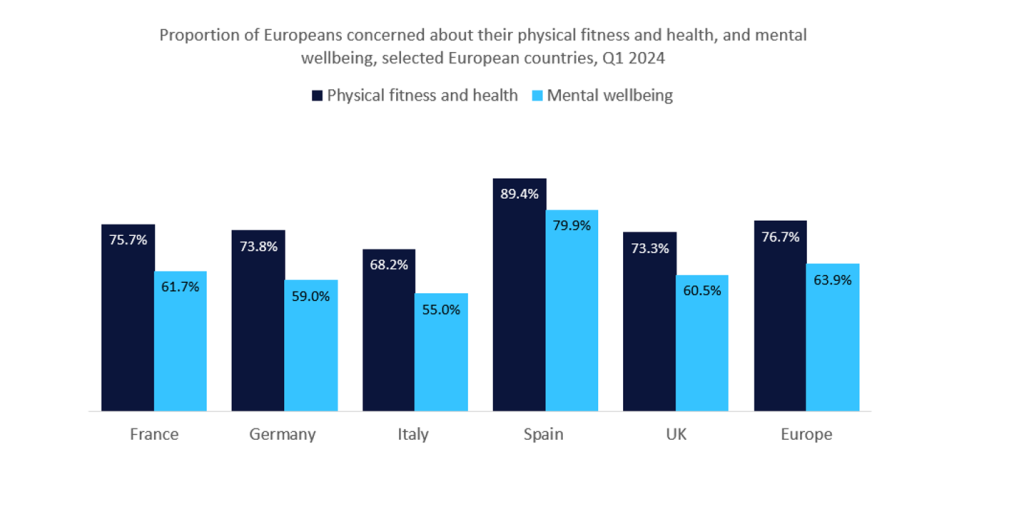

European Mental Health Week: Insurers must improve access to mental health services

Demand for mental health support is bound to increase due to the prolonged financial stress.

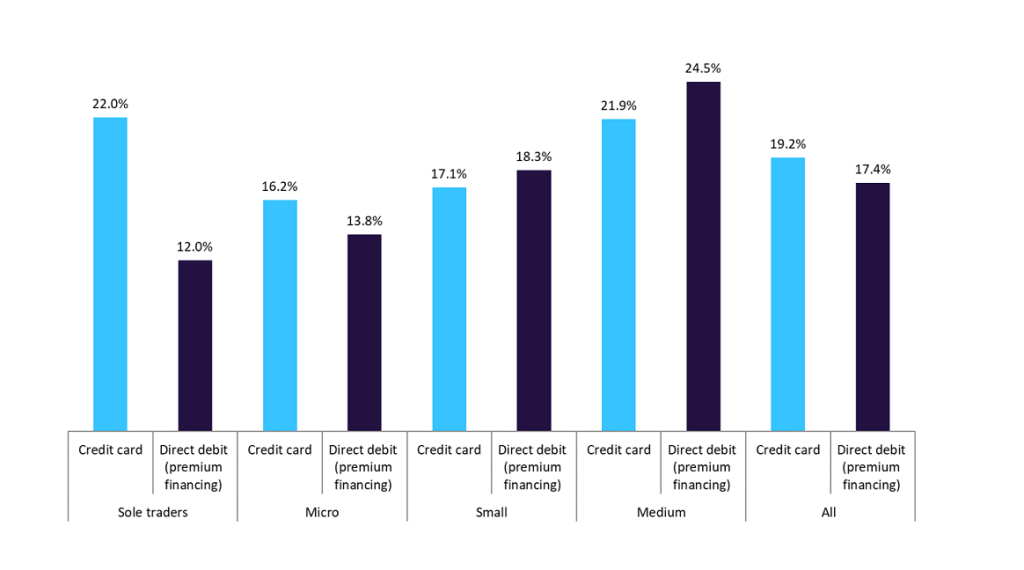

Larger-sized SMEs are more inclined to leverage credit for insurance purchases

GlobalData’s 2023 UK SME Insurance Survey has found that medium-sized SMEs are more likely to utilise credit to manage their insurance expenses.