The protection insurance sector must ensure individuals have access to the mental health counselling services they offer and work towards destigmatising mental health discussions. Events such as European Mental Health Week 2024 (13–19 May) bring an opportunity for insurers to reignite client conversations and work towards mental illness prevention.

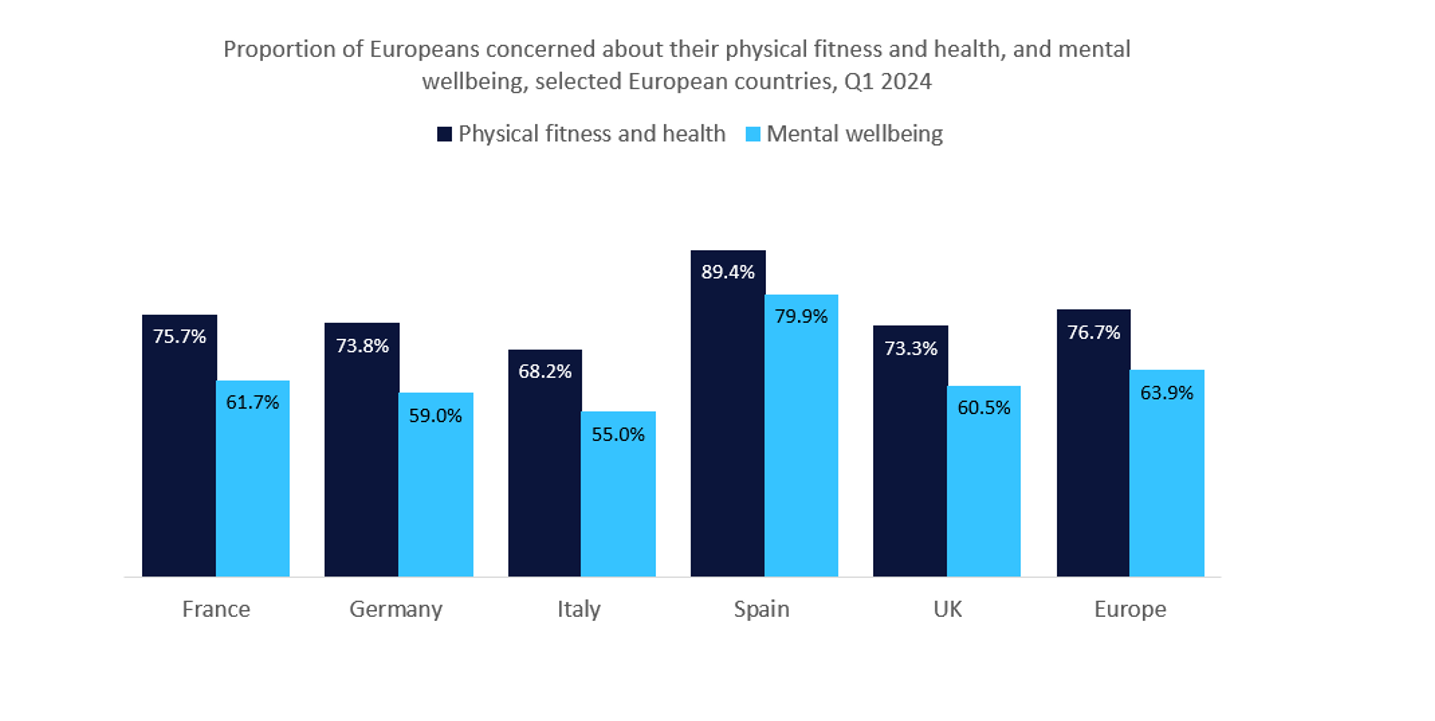

Demand for mental health support is bound to increase due to the prolonged financial stress that individuals continue to experience as a result of the ongoing cost-of-living crisis. According to GlobalData’s 2024 Q1 Consumer Survey, 63.9% of Europeans are concerned to some extent about their mental well-being, with this figure rising to 76.7% for physical fitness and health. Across Europe, the proportion of those voicing concern remains unanimously higher for physical than mental health. Yet mental illnesses remain underreported due to stigmatisation even though more people are now willing to openly discuss their mental health following the Covid-19 pandemic.

While the majority of the industry provides mental health support, there is still scope to improve outreach. Soft support services, such as Employee Assistance Programs (EAPs)—which are generally equipped with mental health counsellors—and digital wellness tools, are typically provided by insurers to support the mental and emotional well-being of employees. Taking the UK as an example, 32.9% of SMEs offered EAPs to employees in 2023, up from 30.9% a year prior, as per GlobalData’s 2022–23 UK SME Insurance Surveys. Additionally, the proportion of SMEs offering a wellbeing app or platform increased from 34.1% in 2022 to 36.9% in 2023. The relatively low penetration of these services suggests a potential disconnect in their perceived value or a lack of awareness among businesses.

Mental health conditions such as depression, stress, and anxiety should be of particular concern. Such conditions are often stigmatized, leading to barriers in open discussions that can lead to underreporting or even result in aggravating an existing illness. Insurers must continue to highlight the importance of mental health support that is available to individuals directly or through their employers. Early access to soft support services will ultimately reduce the frequency and severity of mental health claims.

Despite the prevalence of mental health challenges, insurance coverage and support for mental well-being have historically fallen behind physical health services. Insurers still have some way to go in destigmatising mental health discussions, working towards solving underwriting complexities, improving access to coverage, and adopting a more holistic approach to promoting mental health and well-being.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData