Emerging technologies such as NFTs and the metaverse could be areas of growth for insurers, according to experts in a GlobalData poll. Both technologies are in a nascent stage and have little presence in the insurance market, but they both involve high-value assets, which could lead to opportunities for the industry.

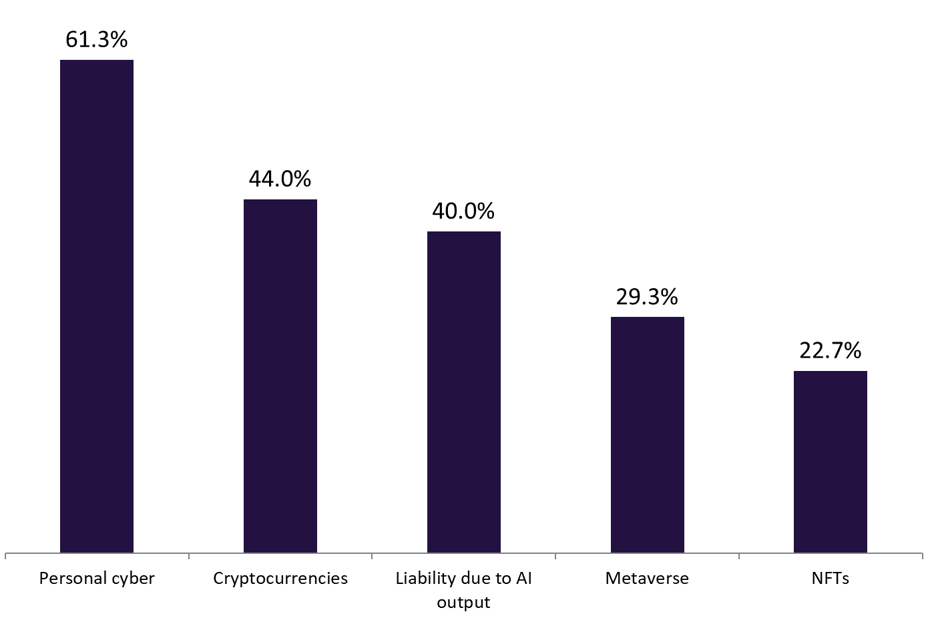

GlobalData asked readers of Life Insurance International what areas they would potentially be interested in buying insurance from in Q1 and Q2 2024. They selected personal cyber as the leading product, but NFTs and the metaverse received 52.0% combined. This suggests there is a level of excitement in the emerging areas among insurance insiders. GlobalData forecasts the metaverse will be worth $627bn globally by 2030, which highlights the size of the opportunity.

Insurance products offered in this area are currently few and far between and certainly not offered by leading traditional insurers. YuLife is one insurer that has embraced it and even created its own ‘Yuniverse’ to promote its health insurance offering. The opportunity is in insuring against NFT wallets being hacked or protecting digital assets within a metaverse. Any metaverse policy is likely to be linked to a personal cyber policy—the most popular response in GlobalData’s poll—and potentially as an add-on at first. Users can purchase a range of expensive assets within a metaverse, which if stolen would be costly. The risk for insurers is how unknown both technologies are. GlobalData has already seen NFTs soar and then plummet in price in recent years (its total value of transactions fell from its peak of $12.6bn in 2022 to $4.7bn in 2023, according to Knight Frank). Furthermore, there is no historic insurance data to rely on.

Entering new digital markets will undoubtedly be risky for insurers. For this reason, we are likely to see innovation in speciality areas such as NFTs and the metaverse led by insurtechs and experts in the field. It is likely that leading insurers will be watching closely though, and as these technologies continue to grow, significant insurance opportunities can arise.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData