GlobalData’s findings show that only 32.6% of UK SMEs currently have a usage-based commercial vehicle policy, leaving a significant opportunity for insurers to tap into the remaining two-thirds of businesses. This is an area where insurtech Flock continues to tap into with its telematics offerings.

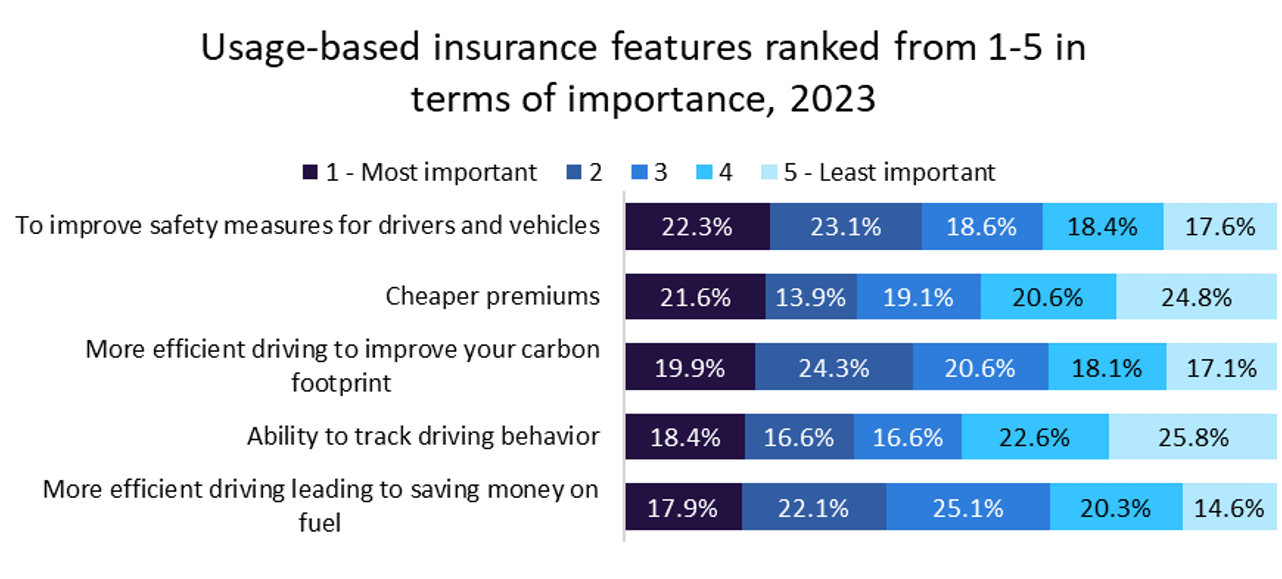

According to GlobalData’s 2023 UK SME Insurance Survey, 32.6% of SMEs have a usage-based policy for their vehicles, showing that roughly a third of all SMEs are already utilising the benefits these products provide, yet there is still an opportunity with regards to the remaining two-thirds. GlobalData’s survey looks at SMEs with usage-based commercial vehicle insurance, highlighting that improving safety measures for drivers and vehicles is the usage-based feature regarded as most important to businesses (22.3% ranked it first). This indicates a strong emphasis on prioritising the safety of drivers and the protection of vehicles. Telematics systems provide real-time feedback on driving behaviour, such as speeding, harsh braking, and acceleration, allowing SMEs to leverage the technology to monitor and analyse driving patterns. Furthermore, insurers can offer personalised feedback to drivers, helping them to improve their driving skills and reduce the risk of accidents.

Flock, an insurtech company, has partnered with The Acorn Group to launch a new UK taxi fleet insurance product that leverages vehicle telemetry data to promote safer driving practices. This innovative product targets medium-sized and large taxi fleet companies, including public hire and private hire vehicles, with the aim of tapping into the UK taxi fleet insurance landscape. By offering premium rebates as incentives for safer driving practices, the partnership focuses on enhancing fleet safety and cost-efficiency over time.

This opens the idea of the gamification of driving, such as providing drivers with scores based on their behaviour, thereby allowing insurers to incentivise safe driving practices by offering discounts or rewards to policyholders who demonstrate that they can drive responsibly. This approach not only promotes safer roads but also aligns to reduce claims and ultimately reducing premiums for businesses. This is an area that has seen increased focus given the rising motor premiums in recent years. Insurers can explore innovative pricing models that reward safe driving behaviour with lower premiums, creating a compelling value proposition for SMEs looking to protect their drivers, vehicles, and finances.

By emphasising the benefits of telematics, promoting safer driving practices through incentives, and offering innovative pricing models, insurers can attract a larger share of SMEs requiring commercial vehicle insurance. Collaborations such as the one between Flock and The Acorn Group demonstrate the potential for industry partnerships to drive safety improvements and cost savings for businesses.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData