The recent increases in cyberattacks are pushing more businesses into the spotlight, with reports of operational downtime and financial losses making headlines, yet the risks faced by consumers are not too dissimilar. Personal cyber insurance remains a niche product despite attracting significant interest as the use of digital channels is on the rise.

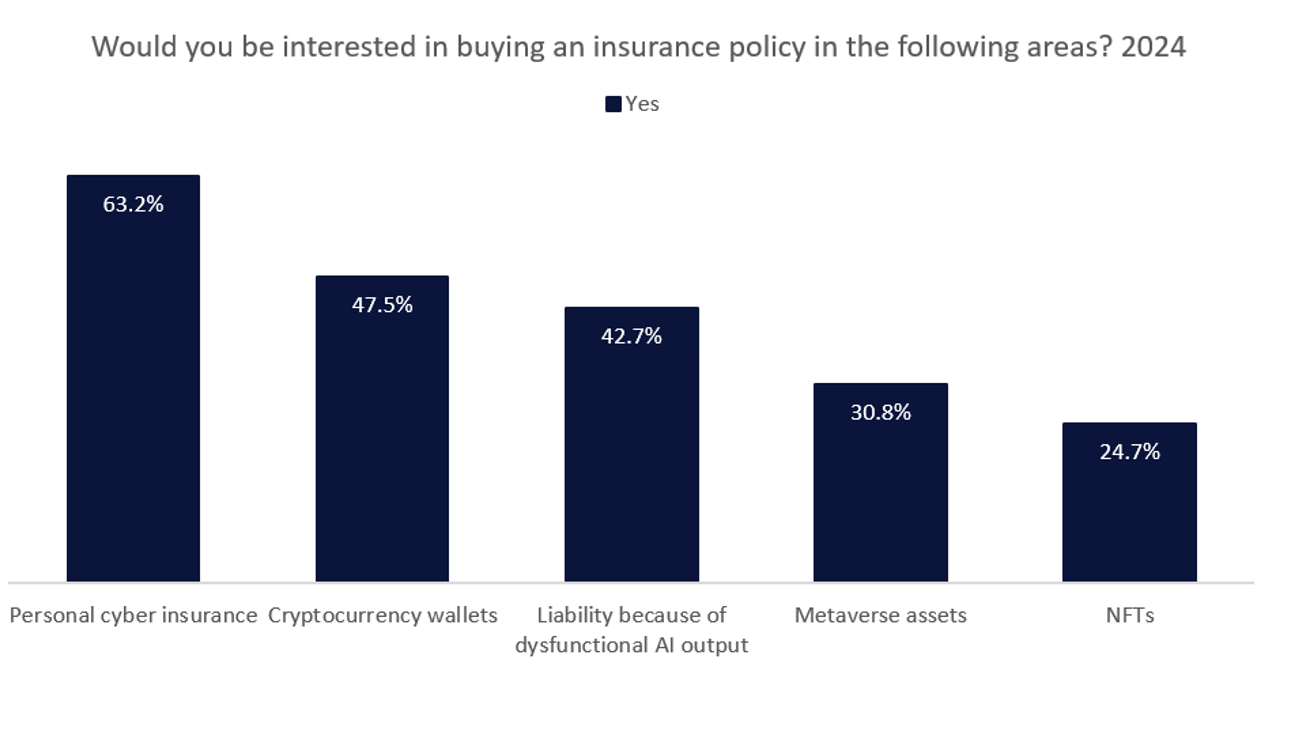

In a GlobalData poll conducted on Verdict Media sites in Q1–Q2 2024, 63.2% of insurance industry insiders worldwide indicated that they would be interested in buying personal cyber insurance, making this the most desirable emerging product. No other insurance product attracted more than 50% of respondents’ interest, with insurance for cryptocurrency wallets being the next-most acclaimed product (47.5%) but still behind by quite some margin. This signals that personal cyber insurance is at the forefront of insurance insiders’ minds, highlighting the growing importance of cybersecurity.

As remote and hybrid working have become more common around the globe, the frequency and severity of cyberattacks have increased, driving interest in cyber insurance. According to the Hiscox Cyber Readiness 2023 report, cyberattacks rose for the third year running, with 53% of firms suffering a cyberattack in 2023, up from 48% a year prior.

Yet personal cyber insurance has traditionally largely been restricted to the high-net-worth market, often being sold as an add-on to home insurance policies. With both large and small corporations making it to the news as victims of cyberattacks, more individuals will be encouraged to look for cyber insurance to protect themselves as homework retains its popularity. Some insurers have begun releasing standalone personal cyber insurance policies. In this respect, Zurich Insurance in Switzerland and cyber insurer BOXX have joined forces to launch a user-friendly protection solution targeted at individuals and families to prevent scams and digital threats. The solution is accessible through an app, with features including identity protection, a secure VPN, secure Wi-Fi, safe browsing, and a device protection password manager.

Meanwhile, competitor AXA Switzerland’s personal cyber insurance policy allows customers to gain access to prevention services by activating these through the myAXA customer app. Such services include monitoring leaked email addresses, phone numbers, and credit cards, as well as cyberbullying. These initiatives come at a time when capacity for commercial cyber insurance has remained constricted since the Covid-19 pandemic, owing to the mass move to home working, driving both a surge in cyberattacks and premium rate increases. Despite this, as the reliance on digital channels continues to proliferate throughout the daily lives of individuals, the need for individual protection online will become increasingly relevant for more people.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData