All articles by GlobalData Financial

GlobalData Financial

New cohorts of India’s population targeted as health insurance is set to grow

According to GlobalData’s 2023 Financial Services Consumer Survey, 59.4% of Indians do not hold private health insurance, with this proportion being somewhat higher among women.

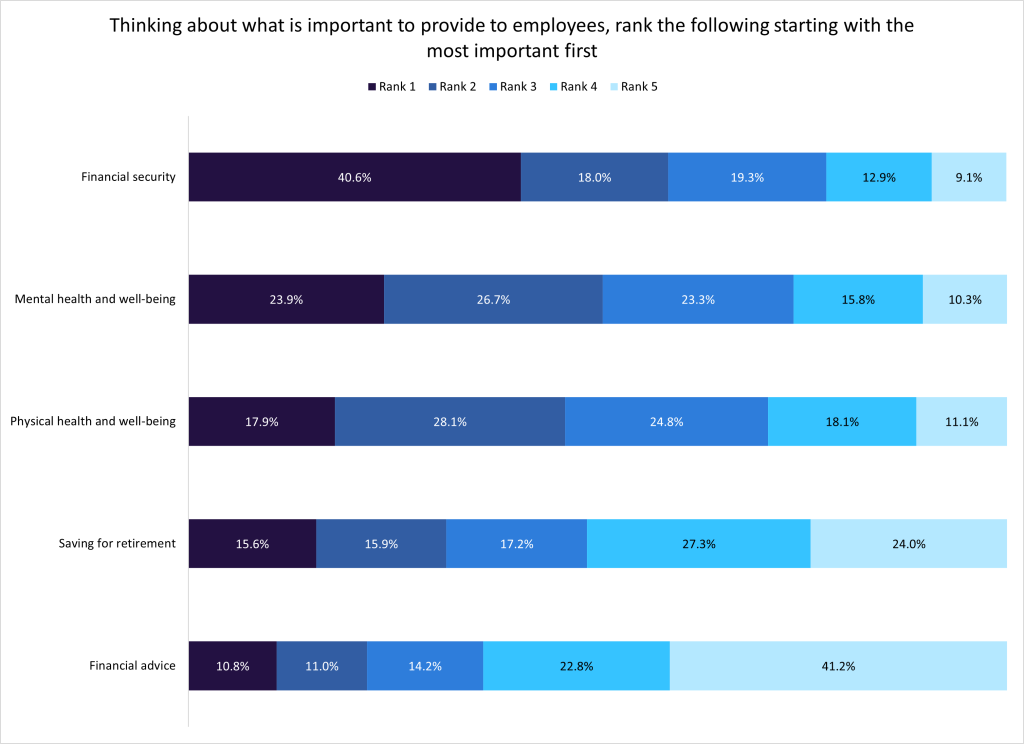

Mental and physical well-being continues to grow in importance within the workplace

The results of GlobalData’s 2022–2023 UK SME Insurance Surveys show that employers are becoming more aware of the importance of their staff’s physical and mental well-being.

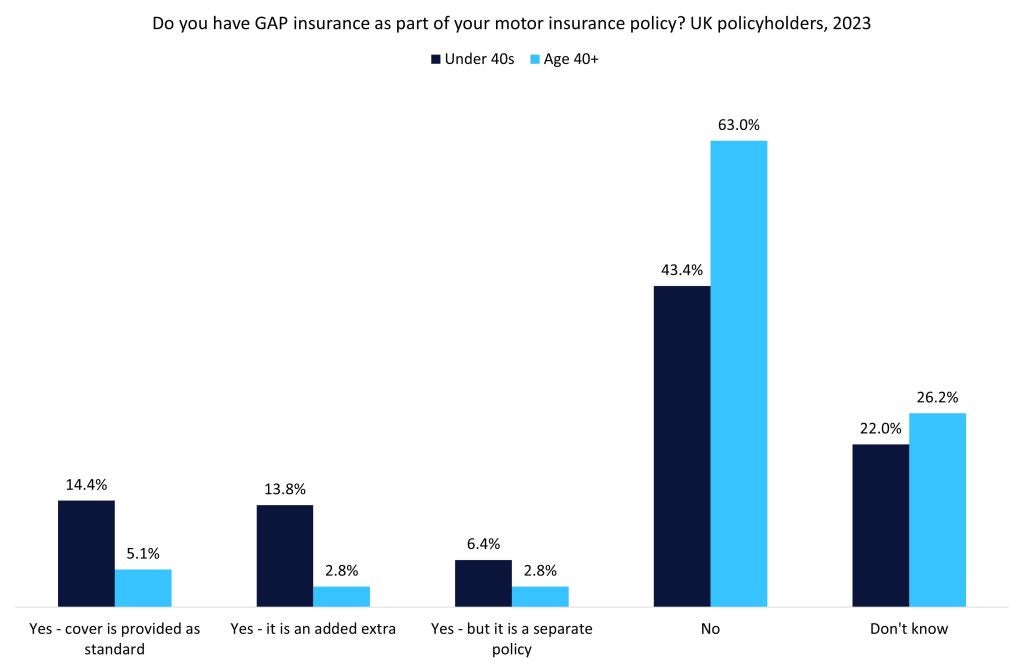

Younger consumers more significantly affected by poor-value GAP insurance policies

According to GlobalData’s 2023 UK Insurance Consumer Survey, just 10.7% of motor insurance policyholders aged 40 and older have a GAP insurance policy.

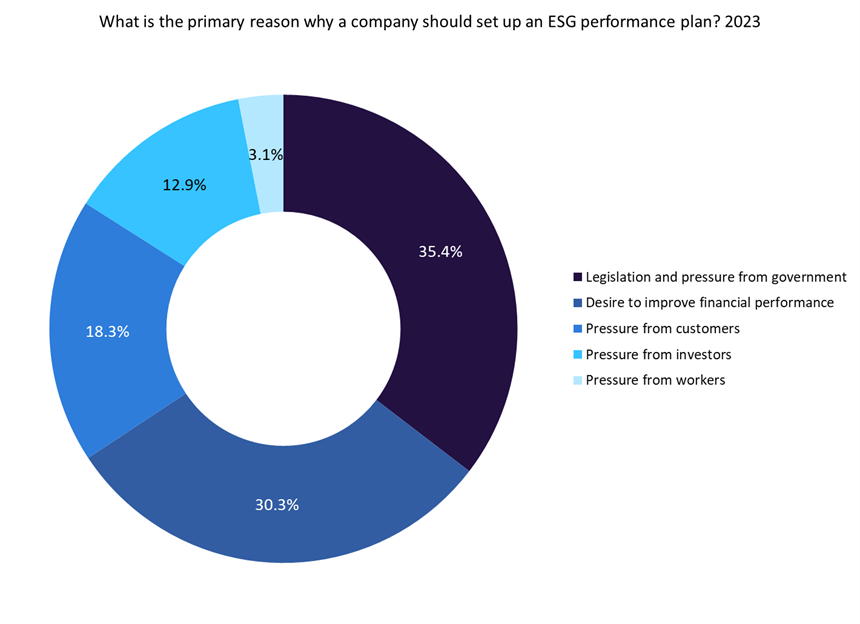

Insurers can help businesses reduce risks associated with legislated ESG targets

As per GlobalData’s ESG Sentiment Poll conducted in Q4 2023, 35.4% of respondents believe the primary reason a company should set an ESG performance plan is because of legislation and pressure from the government.

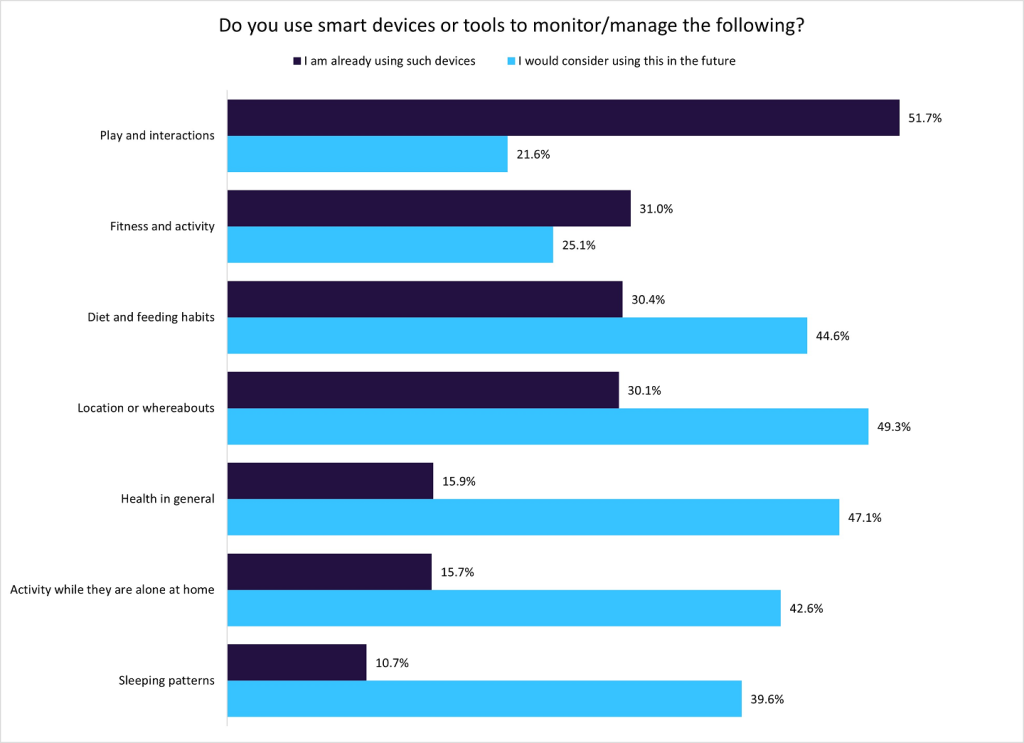

Pet wearables present an opportunity for pet insurers to reach more customers

Pet owners predominantly use smart devices to monitor play and interactions, with 51.7% utilising them for this purpose.

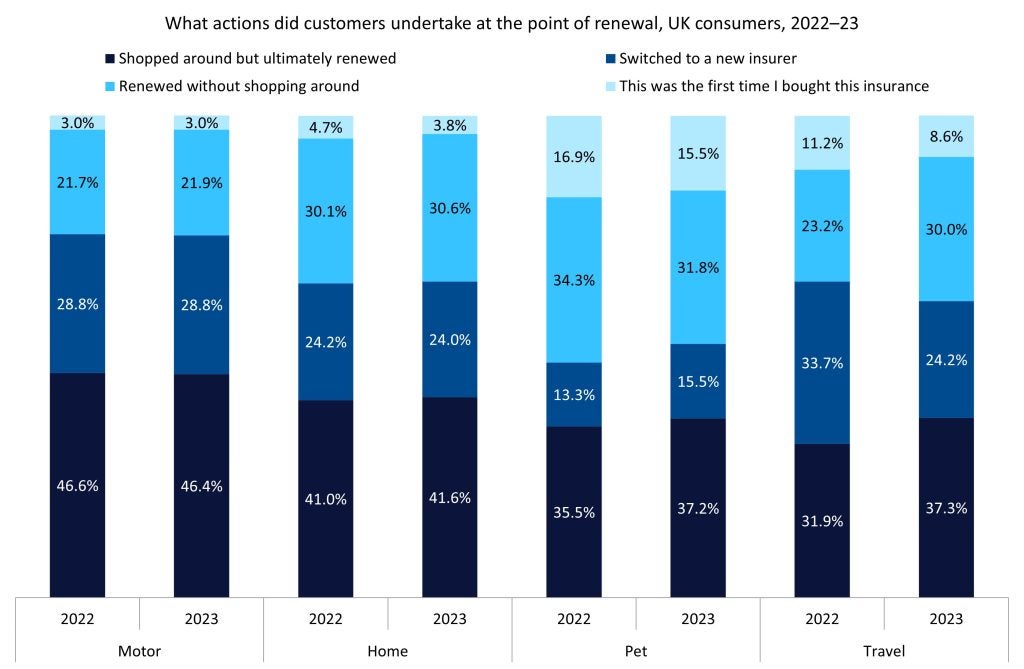

Record MoneySuperMarket revenues expose brutal landscape for personal lines insurers

Price comparison websites (PCWs) are uniquely positioned to take advantage of spiralling insurance premiums in the post-pandemic world.

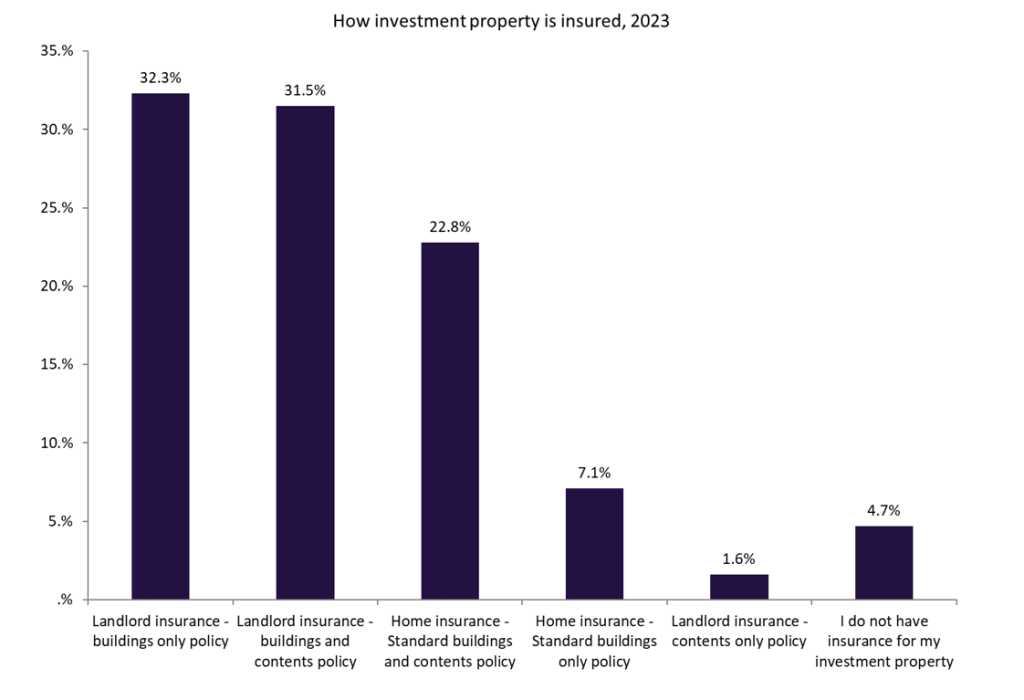

Insurers should educate landlords about investment property insurance

As per GlobalData’s 2023 UK Insurance Consumer Survey, 29.9% of landlords rely on standard home insurance policies for their investment properties.

Insurers can market telematics as green, as well as cheap

The Green Insurer’s study found that 35% of respondents were likely to consider telematics policies in the future.

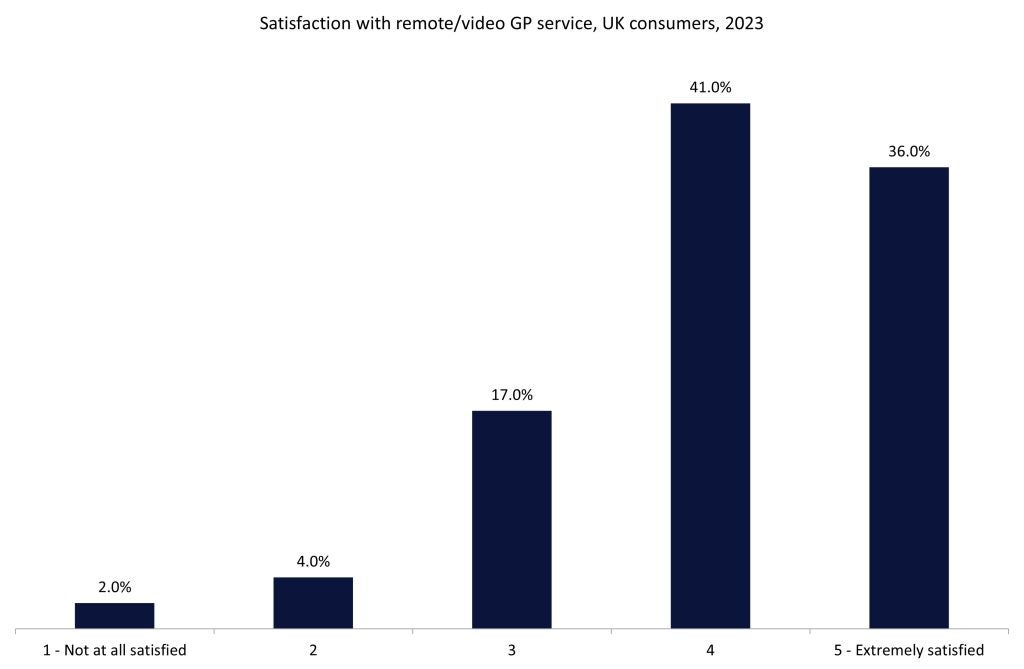

Well-being apps are showing value to health and life insurers and their customers

Scottish Widows’ breakdown of customers who used their well-being app, Clinic in a Pocket, shows that 58% of users were aged between 26 and 45.

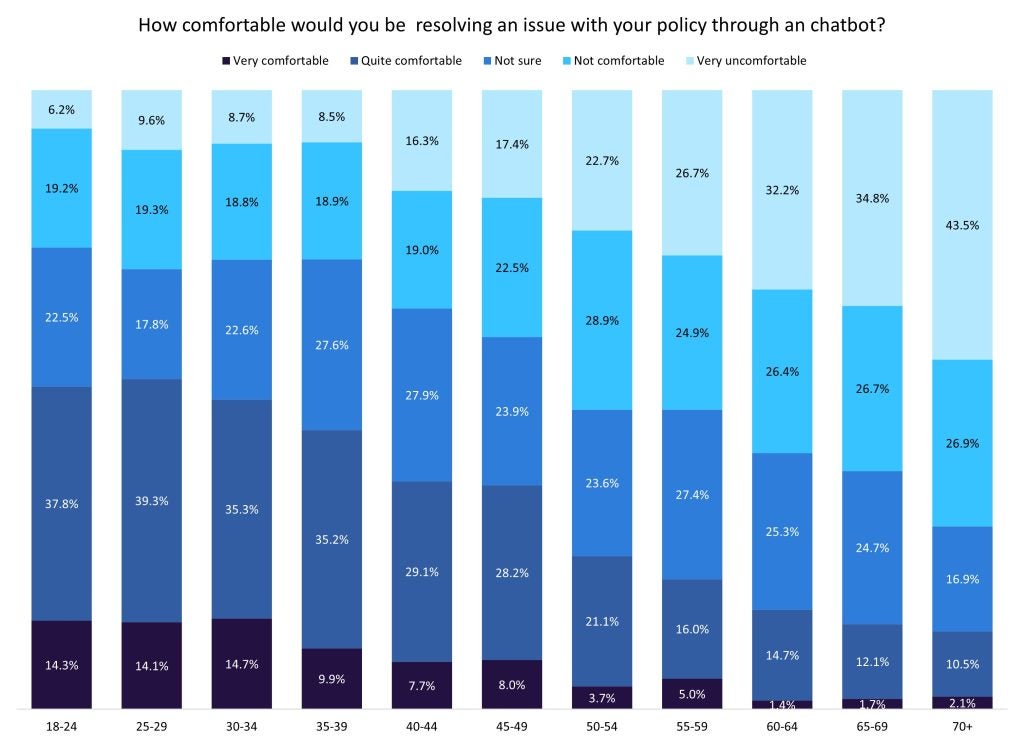

Older generations present a barrier to the integration of AI-powered chatbots

Research conducted by INSTANDA highlights the growing need for a more individualised and seamless customer experience in the insurance sector.