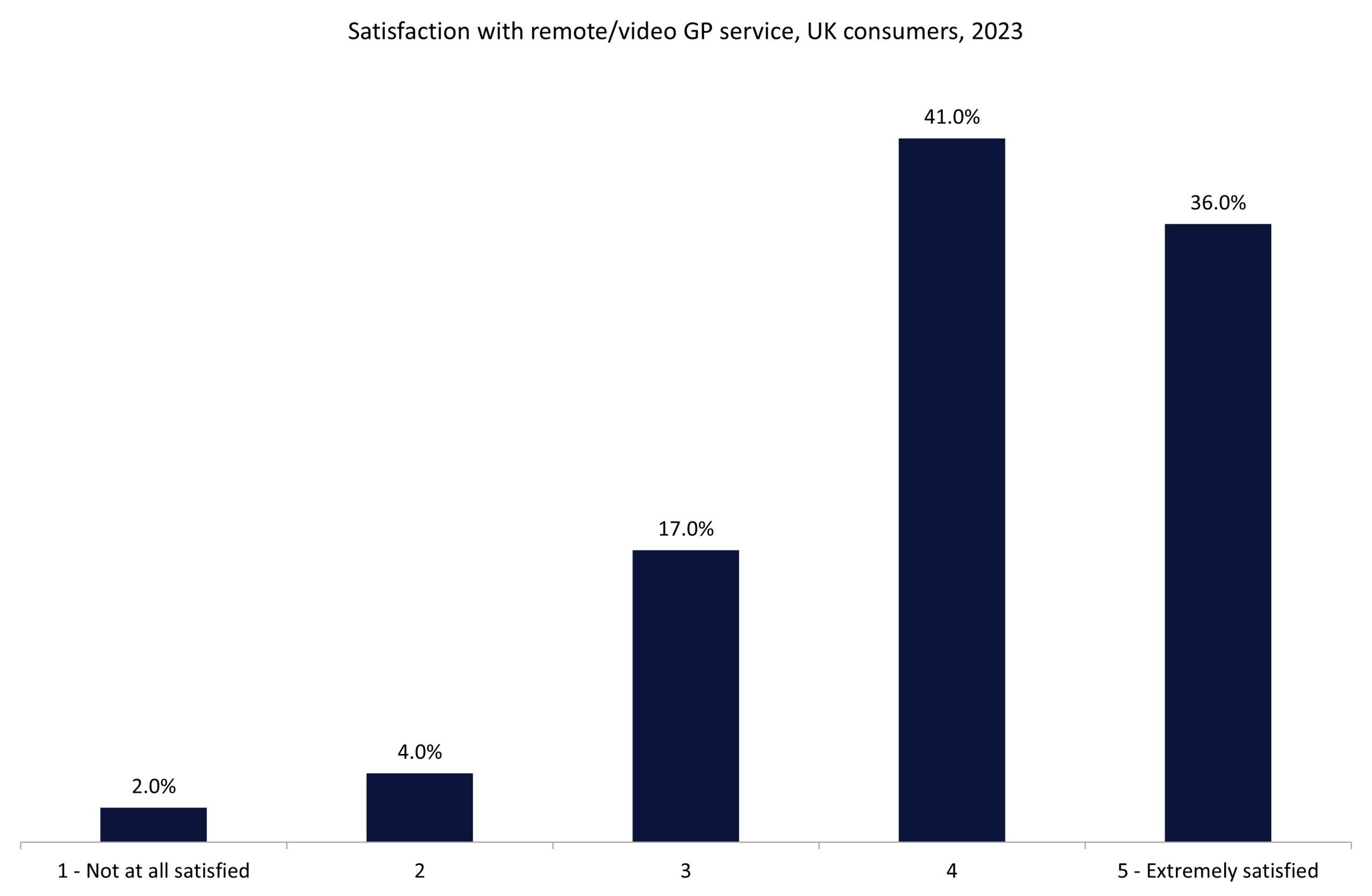

Scottish Widows recently reported a 62% increase in the use of its well-being app in 2023 compared to the year before. GlobalData surveying suggests that encouraging insurance policyholders to utilise such tools can increase customer satisfaction. GlobalData’s UK Insurance Consumer Survey indicates that 77% of consumers who use a remote GP service are satisfied with the service they receive.

Well-being apps are becoming increasingly prevalent throughout UK health and life insurance. Greater digital awareness and proficiency among insurers’ customer bases, as well as growing pressure on the NHS in the UK, is driving this uptick in usage. In particular, insurers are tapping into the prevalence of smartwatches and other devices to help consumers maintain healthy lifestyles, offer advisory services, and provide simple medical assistance. In the private medical insurance space, 25.2% of consumers indicated to GlobalData’s 2023 UK Insurance Consumer Survey that they purchased the product due to concerns over NHS waiting times or services. Remote services are often seen as a good way of helping doctors see more patients, as well as allowing for remote monitoring (freeing up hospital bed space) and increasing accessibility for less mobile patients. GlobalData’s survey further finds that, of the 35% of policyholders who used a remote/video GP service, 77% of them were satisfied with it.

Scottish Widows’ breakdown of customers who used their well-being app, Clinic in a Pocket, shows that 58% of users were aged between 26 and 45. This provides further credence to the suggestion that digitally savvy (younger) policyholders are more inclined to use such services. Scottish Widows is a top-ten provider of whole-of-life assurance in the UK (4.8% market share), according to GlobalData’s 2023 UK Insurance Consumer Survey. Making continued use of such tools, as well as its collaboration with RedArc, the nursing service provider, will help to maintain renewals over the coming period as well as provide a key point of difference in attracting new business. Insurers and customers are starting to see the benefits of integrating technology into health and life insurance services. As technology continues to improve and further capabilities (possibly driven by artificial intelligence) emerge, players should continue to implement such capabilities into their offerings. Customers evidently use and enjoy such services, helping insurers to improve policyholders’ health and lifestyles while also developing efficiencies across diagnosis, triage, and claim assessment.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

Scottish Widows Ltd