A study from Gallagher has found that UK businesses are concerned about the litigation risks associated with their environmental, social, and governance (ESG) targets. Meanwhile, GlobalData surveying has found that legislation and pressure from the government are the leading reasons why a company should set an ESG performance plan.

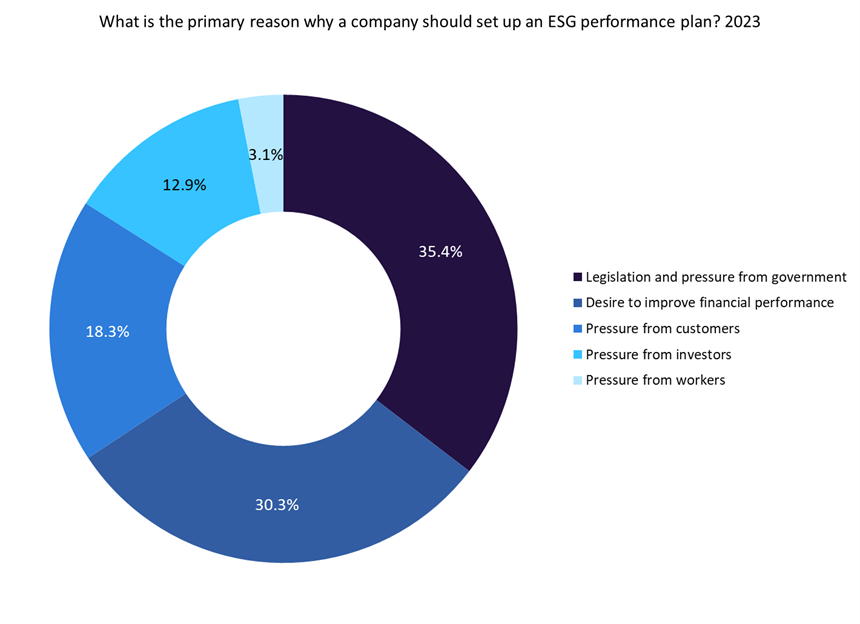

As per GlobalData’s ESG Sentiment Poll conducted in Q4 2023, 35.4% of respondents believe the primary reason a company should set an ESG performance plan is because of legislation and pressure from the government. Other leading reasons include a desire to improve financial performance (30.3%), pressure from customers (18.3%), and pressure from investors (12.9%).

A study by Gallagher, which was conducted in 2024, revealed that 62% of senior leaders at major UK corporations express worry regarding the litigation risks linked to their ESG targets. This concern is compounded by 72% admitting to feeling pressured to establish these targets without a clear plan for attainment. Additionally, 54% perceive a substantial rise in the likelihood of legal action over missed ESG targets compared to a decade ago. Regarding the repercussions of failing to meet ESG targets, 24% highlighted investor withdrawal as a primary concern, followed by litigation (21%) and shareholder activism (14%).

Insurers often offer specialised insurance products to help businesses manage risks related to ESG factors. These products may include coverage for legal expenses arising from lawsuits related to ESG issues, such as environmental damage or social responsibility claims. Additionally, insurers may collaborate with businesses to develop risk management strategies tailored to their specific ESG goals and challenges. For example, in September 2023, Zurich Insurance Group’s commercial risk advisory and services unit announced a strategic collaboration, offering advisory services aimed at addressing physical and transition climate-related risks. The offering aims to provide companies with a holistic approach to climate risks, which include transition-related risks such as policy changes, reputational impacts, and shifts in market preferences, as well as physical risks such as those caused by the increasing number of extreme weather events.

By offering these products and services, insurers play a crucial role in helping businesses mitigate potential risks and protect their financial and reputational interests in today’s increasingly ESG-conscious business environment.

Overall, by partnering with insurers, businesses can effectively manage ESG risks, demonstrate their commitment to sustainability, and build resilience in an evolving business environment. Through collaboration with insurers, businesses can proactively address ESG concerns, enhance their corporate reputation, and position themselves as leaders in sustainable business practices.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData