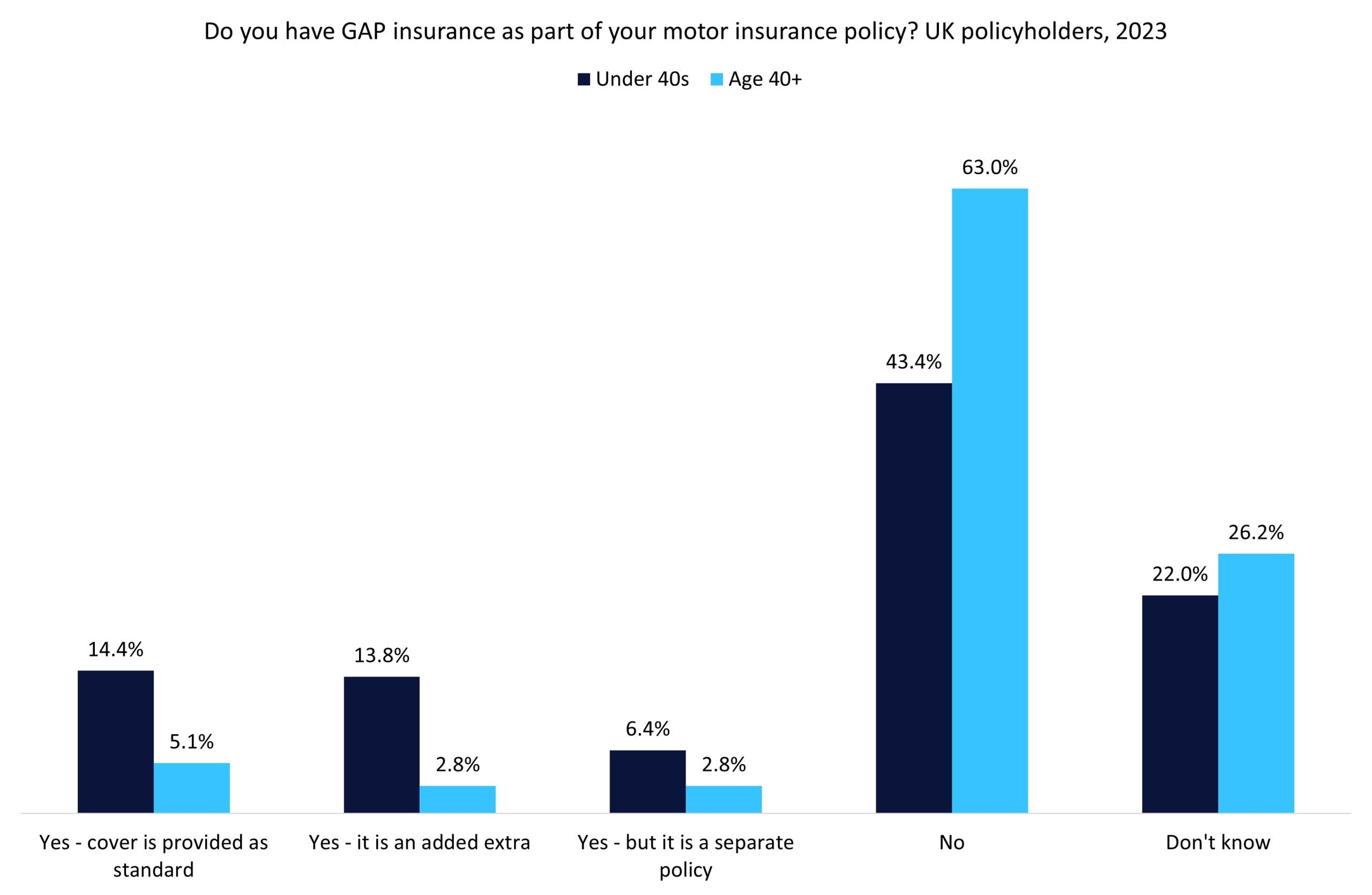

GlobalData’s 2023 UK Insurance Consumer Survey indicates that more than one-third of under-40s with a car insurance policy also have guaranteed asset protection (GAP) insurance. Insurers that deliver improvements to the product, recommended by the Financial Conduct Authority (FCA), can reap benefits including lower acquisition costs and greater customer satisfaction.

According to GlobalData’s 2023 UK Insurance Consumer Survey, just 10.7% of motor insurance policyholders aged 40 and older have a GAP insurance policy. This is compared to 34.6% of policyholders aged under 40. While younger consumers are more likely to own a vehicle on finance (and hence need GAP cover), the relative difference is not as significant as the difference in GAP penetration. Research from Admiral before the pandemic suggests that 64% of millennials took out finance to buy their car compared to 38% of Generation X consumers. Younger generations’ lower financial literacy and their inability to cover potential losses themselves has left these consumers more vulnerable to the downsides of GAP insurance.

Following the raft of consumer duty measures introduced by the FCA in July 2023, a focus within the insurance sector has been on value for money from products—a facet that is especially crucial amid the UK’s cost-of-living crisis and economic recession. Having found that only 6% of premiums paid to insurers for GAP insurance are paid out in claims, the FCA has a very strong case that these products fall short in this regard. Insurers that can offer this cover at a fairer price are likely to see a growth in satisfaction from customers, given the squeeze on incomes seen over the past few years.

Furthermore, the FCA found that, in some cases, around 70% of premium income was allocated to commission payments. Insurers must be more proactive in plugging the areas from which premium income is leaking, given the challenges facing underwriting and operating costs in the post-pandemic era. The motor line has seen its expense ratio grow from 29.5% in 2019 to 35.7% in 2022 (it was just 18.2% in 2010). Insurers must evaluate their entire product suite and distribution model and assess areas that are causing considerable premium losses. Providers must start getting serious in their attempts to slimline customer acquisition or cost management expenses, otherwise more modern businesses will usurp them in profitability and customer numbers.

While the action taken by insurers to pause and rework their GAP insurance offerings shows commitment to consumer duty, players must go further. Those that can start showing genuine dedication to providing fair value to consumers, while getting serious with their attempts to manage unnecessary outflows of income, will be in the best position for growth over the coming years.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData