Although there are still obstacles to their integration, connected technologies and artificial intelligence (AI) are having an increasing impact on the insurance value chain. Consumer uncertainty is evident from GlobalData’s 2023 UK Insurance Consumer Survey, which found that 31.4% of respondents are comfortable using an AI-powered chatbot to resolve a problem with their policy, compared to 45.3% who are not. This implies many individuals are sceptical of a chatbot’s capacity to correctly assess their needs.

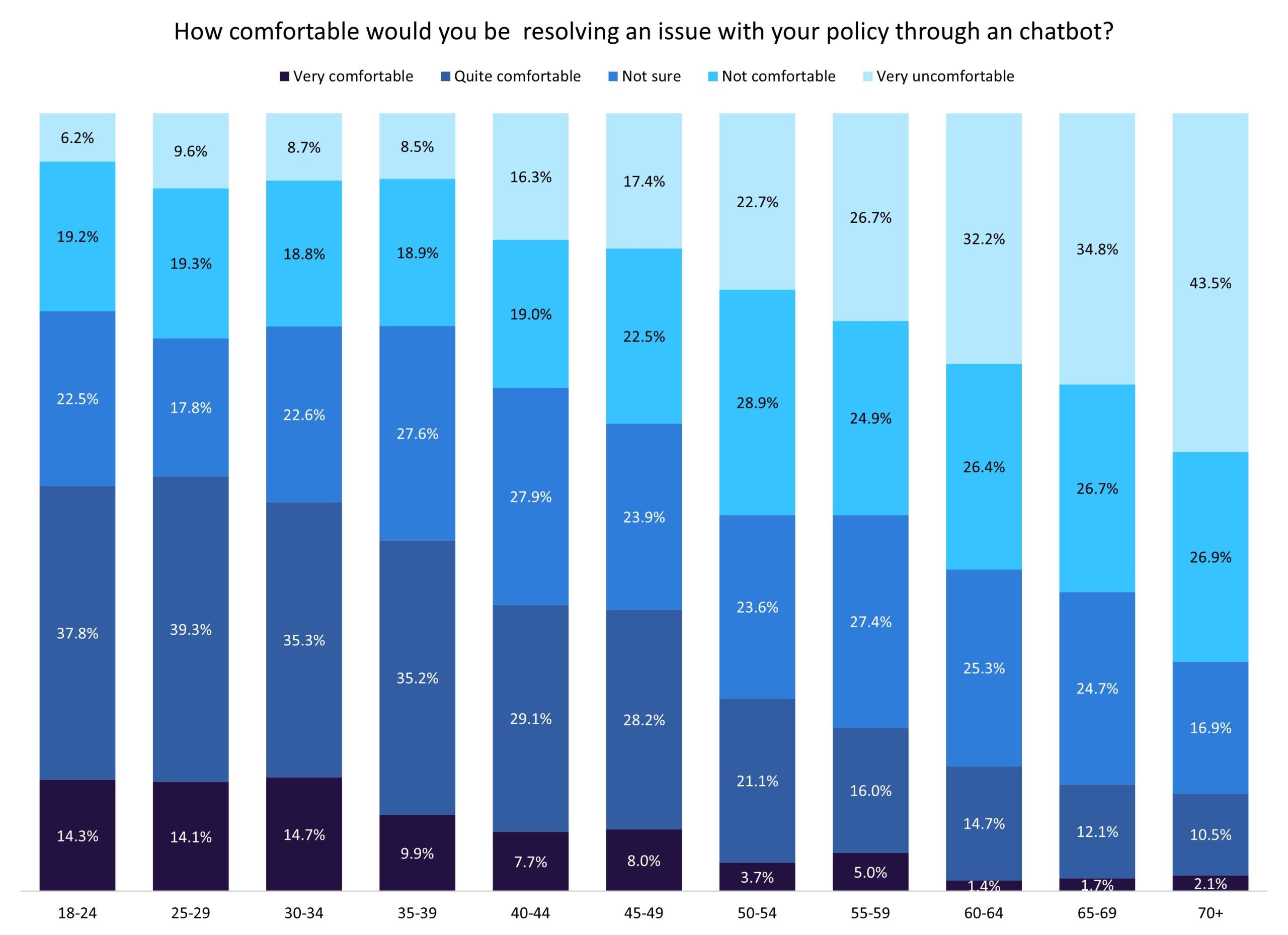

Further examination of this data reveals that younger consumers are more receptive to AI, with 52.1% of those in the 18 to 24 age group expressing comfort with the concept compared to only 12.6% of those in the 70+ year age group. The chart below demonstrates the level of comfort among different age groups, highlighting a decreasing trend in comfort among older generations. The need to better inform and persuade older consumers to embrace AI-powered chatbots to resolve policy issues is highlighted by this generational divide.

Research conducted by INSTANDA highlights the growing need for a more individualised and seamless customer experience in the insurance sector. For instance, 26% of respondents want straightforward claim procedures, 23% want independence in changing policies, and 21% want personalised products. This emphasises how crucial it is for insurers to modify their products to satisfy consumers’ changing demands.

Insurance companies should take advantage of the opportunity to broaden their AI capabilities to satisfy customer demands. Benefits from implementing AI-powered chatbots include lower operating costs, more seamless customer experiences, and shorter wait times. There are, however, some potential disadvantages to take into account, such as the potential to not deliver exactly what the consumer is asking while the technology is in its nascency, as well as the need to address older generations’ doubts. Notwithstanding these obstacles, AI has the power to transform the insurance sector by increasing customer satisfaction and operational effectiveness. To satisfy the changing demands of their consumers, insurers must endeavour to effectively utilise AI technologies. Although there are obstacles, adopting AI in the insurance industry has more advantages than disadvantages. Investing in AI-powered chatbots and attending to customer concerns can open up new avenues for innovation and expansion for insurance companies.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData