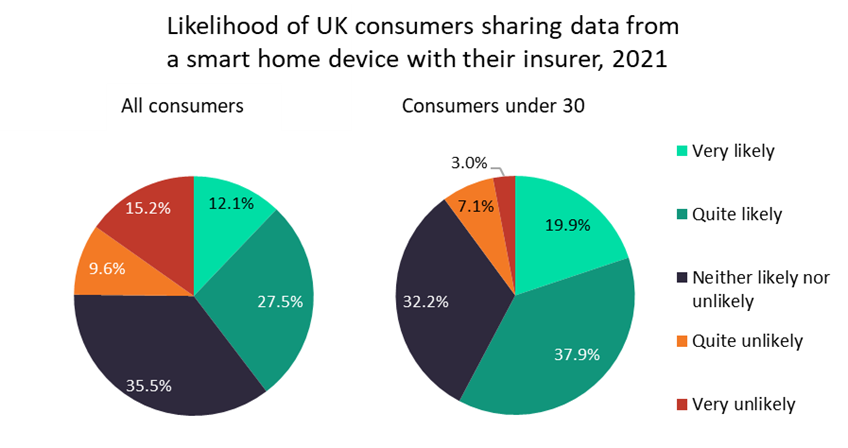

Smart home devices are alleviating pressure on claims within the home insurance line. GlobalData’s 2021 UK Insurance Consumer Survey indicates that younger consumers are over 20 percentage points more willing than the average of all consumers to share data gathered by these devices with their insurer. This will create a growing number of opportunities for insurers to target this demographic with smart device-oriented policies.

Smart and connected devices in the home can reduce both the impact and frequency of certain claim types within home insurance. This benefits both the insurer (via less regular and expensive claims payouts) and consumers (by preventing or reducing loss and damage from theft, fire, and escape of water).

According to GlobalData’s 2021 UK Insurance Consumer Survey, 39.6% of consumers are willing (to some extent) to share data from a smart home device with an insurer. This proportion increases to 59.8% when considering only consumers under the age of 30. The same survey found that 65.1% of consumers are willing to share smart home data with their insurer in return for financial savings. With insurers deriving considerable benefits from consumers using smart devices within their home, targeting this younger demographic with smart device-based home insurance policies is a good way of increasing uptake of these devices.

Source: GlobalData’s 2021 UK Insurance Consumer Survey

Claims-mitigating smart devices include smart security cameras, water leak detection devices, and smart smoke alarms. To increase uptake, insurers must offer adequate and appropriate incentives to consumers. These incentives should include both discounted (or even free) smart devices as well as reduced home insurance premiums upon correct installation. This double incentive strategy is utilised by many insurers in the US (the leading smart home device market), including American Family, Nationwide, and State Farm.

As younger generations increasingly migrate towards home ownership, the potential of the smart home insurance market is sure to grow. Insurers that can offer a robust and fairly priced policy to homeowners in order to actively manage claims risk with smart devices will be best positioned to take advantage of such growth.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData