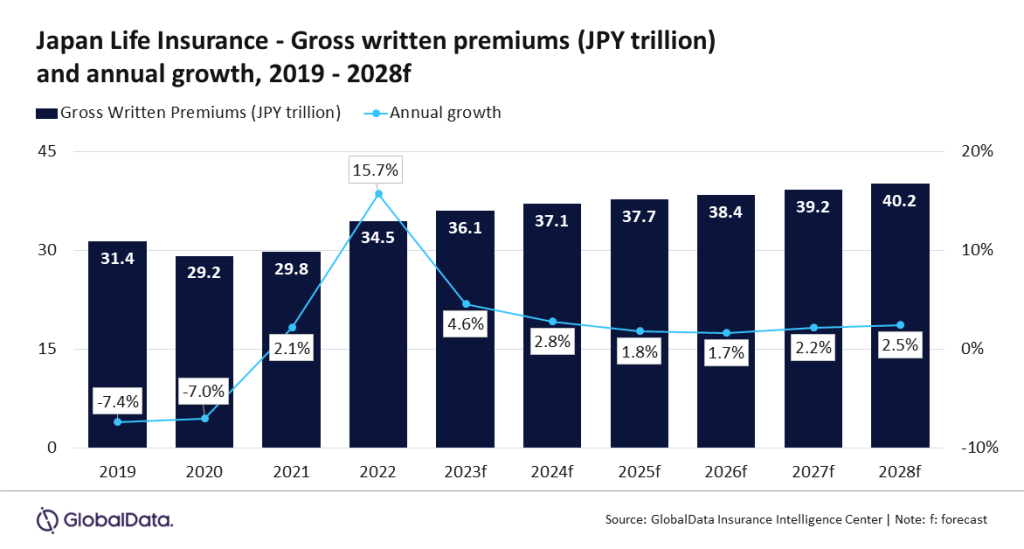

The life insurance industry in Japan is forecast to grow at a compound annual growth rate (CAGR) of 2.0% from JPY37.1trn ($289bn) in 2024 to JPY40.2trn ($359.5bn) in 2028, in terms of gross written premiums (GWP).

In addition, life insurance in Japan is expected to row by 4.6% in 2023.

This is attributed to the revival of agency distribution channels and persistent demand for single premium foreign currency-denominated insurance products.

According to GlobalData, regulatory intervention in improving agency standards and increasing competition for greater market share in short-term insurance will also support growth over 2024 to 2028.

Deblina Mitra, senior insurance analyst at GlobalData, commented: “In Japan, agencies are a prominent distribution channel for life insurance products. The channel witnessed a dip in revenue in 2020 and 2021 due to the COVID-19 outbreak that limited face-to-face interaction, leading to slower industry growth.

“The industry GWP recovered with double-digit growth in 2022, primarily after the regulator reclassified COVID-19 under the less severe Category Five infectious disease, leading to a revival in agency sales. The trend is expected to continue in 2023 and beyond, supporting industry growth.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataFurthermore, the introduction of a new review system in early 2023 for agencies by the Life Insurance Association (LIAJ) will boost customer confidence and improve transparency, thereby positively influencing the channel’s growth over the next five years.

Mitra added: “However, the Bank of Japan‘s (BoJ) anticipated tightening monetary decision in 2024, where it is projected to end negative interest rates, may cause volatility in global capital markets. Any repercussions from this decision on foreign government bond yields or interest rates can influence foreign-currency insurance demand over 2024.”