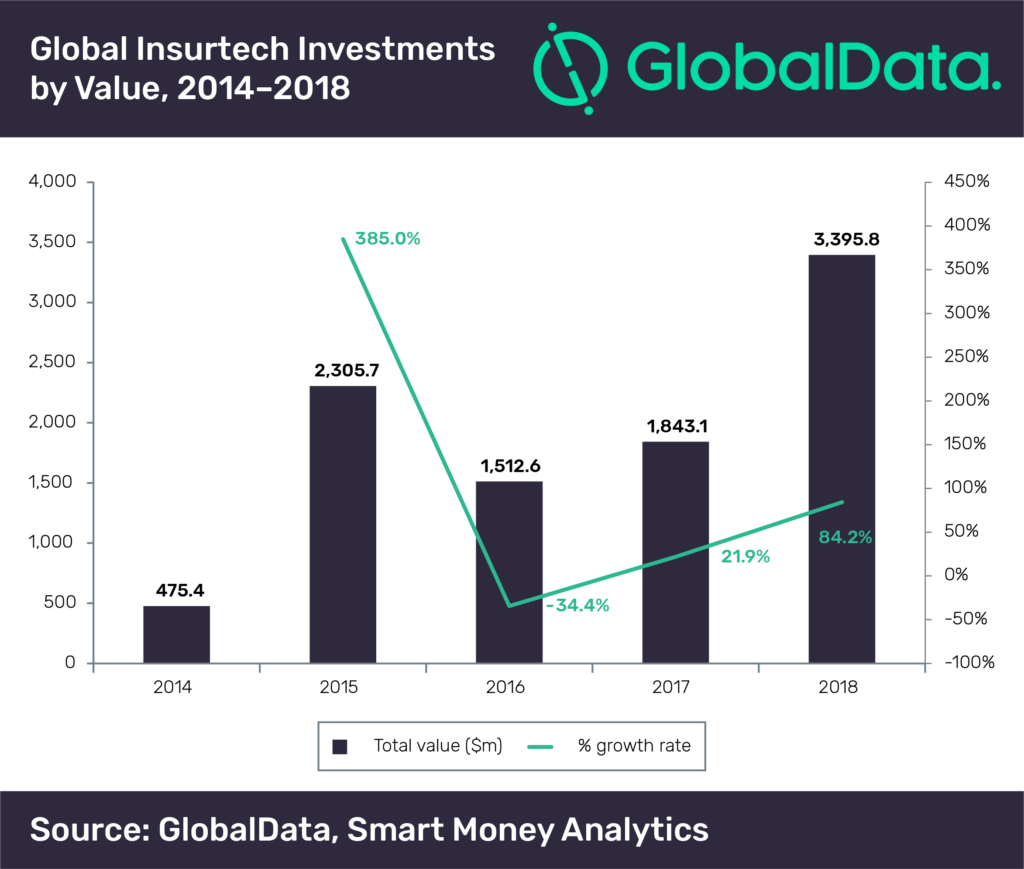

Global insurtech funding moved past the $3bn mark in 2018, a rise of 84.2% spike from 2017.

Total insurtech funding amounted to $3.39bn in 2018. Furthermore, rises have been consistent since a 34.4% drop between 2015 and 2016. From then, insurtech funding grew by 21.9% to hit $1.8bn in 2017.

In addition, 2018 saw 139 deals compared to 123 insurtech deals in the year previous. While the number of deals is rising, the rate of increase is dropping. There was only a 13% rise between 2017 and 2018, compared to the 21.8% rise between 2016 and 2017. Furthermore, 2016 saw a 44.3% rise from 2015.

This is according to GlobalData in its report, Digital Challengers in Insurance – Thematic Research.

This is according to GlobalData in its report, Digital Challengers in Insurance – Thematic Research.

It also highlights the emergence of on-demand policies and services. Customers want to be able to purchase insurance wherever they are, whenever they are.

Ben Carey-Evans, Insurance Analyst at GlobalData, said: “The digital challenge in insurance continues to grow and the scale of funding in 2018 is proof of that. It has lagged behind other sectors, given what Uber and Netflix provide in transport and entertainment, respectively. However, this type of flexible and instant service is more commonplace with a range of start-ups thriving in both personal and commercial lines. This has even prompted traditional insurers such as Aviva to respond with the release of its Aviva Plus, which allowed customers to pay monthly subscriptions and tweak cover levels during the contract.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataGlobal insurtech funding

There has been a large amount of insurtech funding in recent weeks, some with staggering amounts.

Kin raised $47m in a new funding round led by August Capital, with participation from Hudson Structured Capital Management (HSCM Bermuda).

American insurtech start-up Ethos has raised $60m in a Series C funding round led by Google’s venture capital arm GV and new participation from Goldman Sachs.

One firm that has received a massive amount of funding is Root Insurance. It completed a $350m Series E funding round led by new investors Coatue Management and DST Global.

With completion of the latest round, Root Insurance’s valuation has surged to $3.65bn. The round was also joined by the company’s existing investors.