Brits are most likely to start feeling old in their 50s or 60s, according to research from AEGON.

The Aegon Financial Priorities Survey 2024 revealed that Brits feeling old in your 60s was first with 20%, followed by feeling old in your 50s at 19%.

However, 14% of Brits still felt youthful in their 70s and 9% reported that they don’t think they will ever feel old.

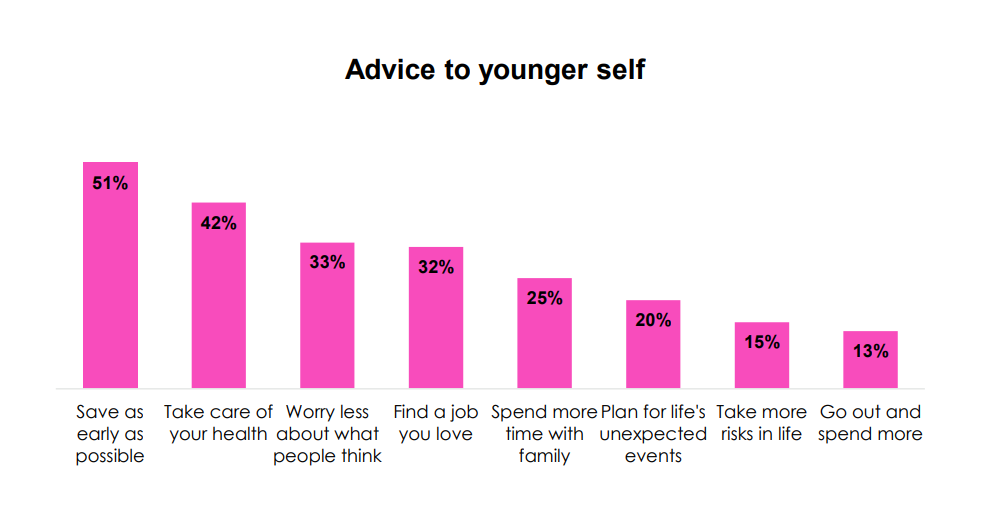

In addition, if given the chance to travel back in time and give advice to a younger self, 51% would tell themselves to start saving as early as possible.

Steven Cameron, director of pensions at Aegon, said: “While every individual is unique, many of us now live longer lives and our expectations and hopes for every stage of life, including those later years, are changing.

“Not so long ago, people tried to comfort themselves that rather than being past your best, ‘life begins at 40’. Then there was a period when you’d hear ‘50 is the new 40’ – so perhaps another way of looking at this research is that 60 is now the new 40.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“These new findings showing that over half of us wish we could have started saving earlier highlights just how important putting some money aside for the long term really is.

“Just a small increase in contributions can have a massive positive impact on the opportunities we open up for our future years.

“Regardless of how old or young you feel, it’s vital that we individually and collectively give thought towards how we plan for and navigate this phase of life. Aegon’s benchmark Second 50 report is a great starting point to guide that ongoing discussion.”

Jonathan Bland, head geek at Pension Geeks, added: “In our experience of going into workplaces and doing hundreds of live TV shows, we’ve never ever met someone who has any regret of saving too much into their pension at the time of retiring or getting near to it. So, I think it’s a great thing that the younger audience are getting informed and educated about the importance of saving for your future. I’d say it’s never too early, or late, to start saving.”