This is likely to have been caused by improving savings rates as a result of continual Bank of England rate rises, not a great desire to add to pension contributions.

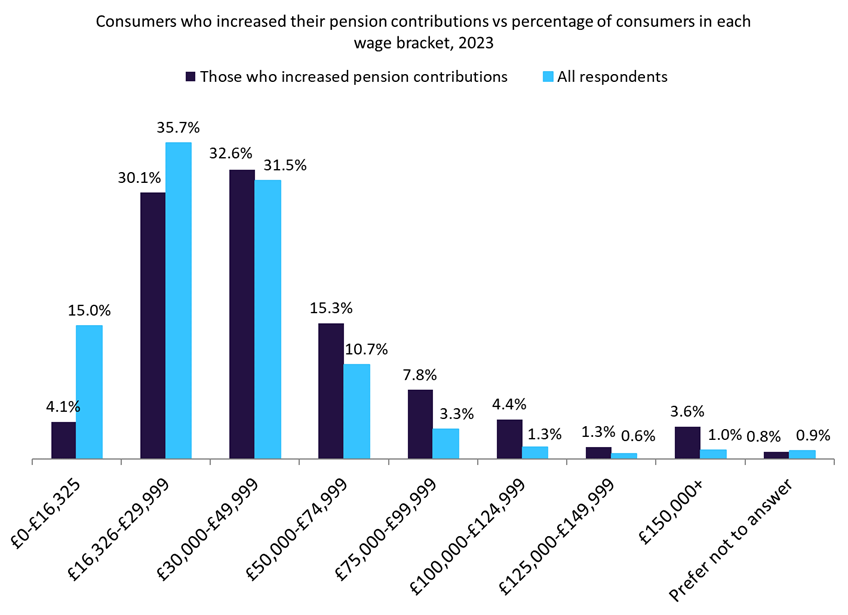

GlobalData’s 2023 UK Life and Pensions Survey found that 18.2% of consumers increased their pension contributions over the previous 12 months, compared to just 3.3% who reduced them. A disproportionate proportion of those who earn in excess of GBP50,000 per year increased their contribution compared to the overall proportion of consumers who earn that much.

It might have been expected that people would have reduced their contributions in a bid to cut household bills during the cost-of-living crisis driven by high inflation.

However, for those who can afford it, over the last 12 months savings rates have been at their most appealing levels in a decade. The Bank of England raised the central bank rate for the 13th successive time to 5.0% in June 2023. This translates to more attractive rates for savings accounts and pensions funds. Yet this is not all good news for savers, as the central bank rate remains considerably lower than the latest inflation figure of 8.7%.

Therefore, even if their pension pots are growing, savers are losing money against current prices. Furthermore, pensions are not simply savings accounts, and some funds will be pushed towards more risky investments by inflation levels.

Our data shows that people who can afford to spare any money have been utilizing the improved rates pensions funds have been offering. Although only 16.9% of consumers earn in excess of GBP50,000 per year, 32.4.% of those who increased their contributions in the past 12 months fall into that wage bracket. Similarly, 42.9% of the 3.3% of consumers who reduced their contribution were in the GBP16,000–29,999 per year wage bracket.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAs the saving environment continues to improve and inflation is expected to fall later in 2023, pension funds should continue to see increases in contributions from wealthier clients.