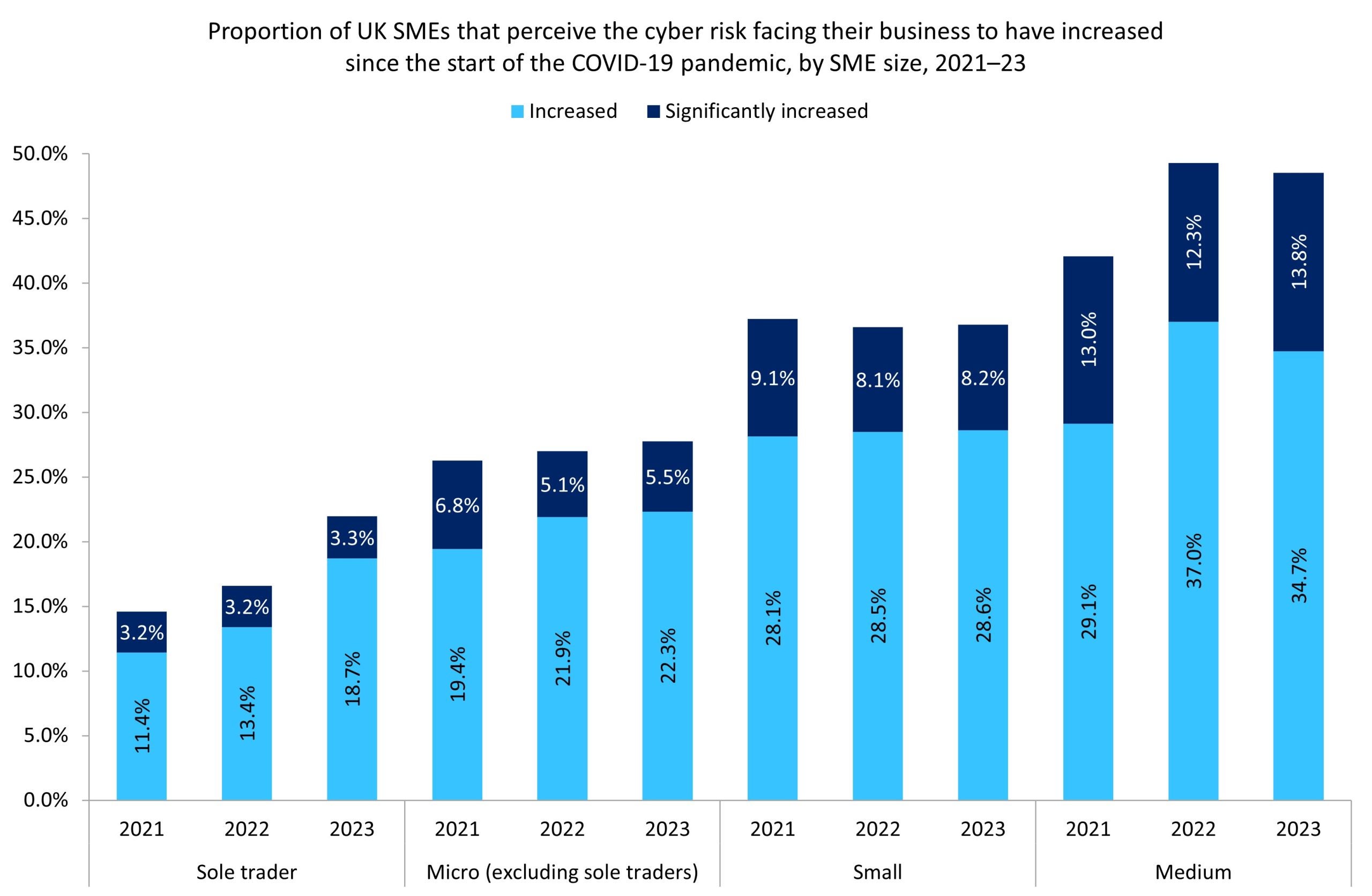

GlobalData’s 2021–23 UK SME Insurance Surveys indicate that less than half of UK SMEs, of all sizes, believe that the cyber risk facing their business has increased since the start of the Covid-19 pandemic. In its Risk Barometer 2024 report, Allianz identifies cyber incidents as the most important business risk in 2024. Conveying cyber risk to clients continues to gain importance as geopolitical tensions and cybercriminal sophistication grow.

As per our 2021–23 UK SME Insurance Surveys, the cyber risk perceived to be facing a business is affected by the size of the company. Larger SMEs are considerably more aware of the growing cyber risk they face than sole traders. For sole traders, the perceived risk has grown steadily since 2021, with a 7.4 percentage-point increase in the share of sole traders saying that their cyber risks have increased since the pandemic. For microenterprises and small businesses, the figure is relatively unchanged year on year. Just over a quarter of microenterprises and just over a third of small companies believe the cyber risk they face has increased since the start of the pandemic. Medium companies are most likely to perceive that their cyber risk has increased, with a large increase in 2022 possibly linked to cyberattacks associated with Russia’s invasion of Ukraine. Still, less than 50% of medium-sized companies believe their cyber risk has increased since 2019, suggesting that more can be done to inform businesses more fully of cyber risks in the current age.

Allianz’s Risk Barometer 2024 finds that 36% of companies rank cyber risk as their top concern in 2024. The top concerns surrounding cyber risk are data breaches, cyber incidents involving critical infrastructure, and ransomware attacks. The emergence of generative AI is a key challenge for cybersecurity providers and insurers, enabling bad actors to produce more compelling threats as well as generate new strains of viruses at greater speeds. The emergence of highly believable deepfakes is also becoming a key challenge in the space.

Cyber risk is certainly one of the most pressing for businesses and insurers in 2024. GlobalData’s 2024 UK SME Insurance Survey reports that 54.4% of UK SMEs are concerned, to some extent, about cyber risk. Brokers and insurers must work to increase this figure as the trend of growing sophistication, speed, and adaptability of cybercriminals (state-sponsored or otherwise) looks set to continue, empowered by technological progress.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

Allianz SE