Blink Parametric and Zurich have partnered to offer a flight delay insurance solution in Asia-Pacific. Meanwhile, GlobalData surveying suggests consumers are less willing to pay more for a travel insurance policy that pays out in the event of a flight delay/cancellation.

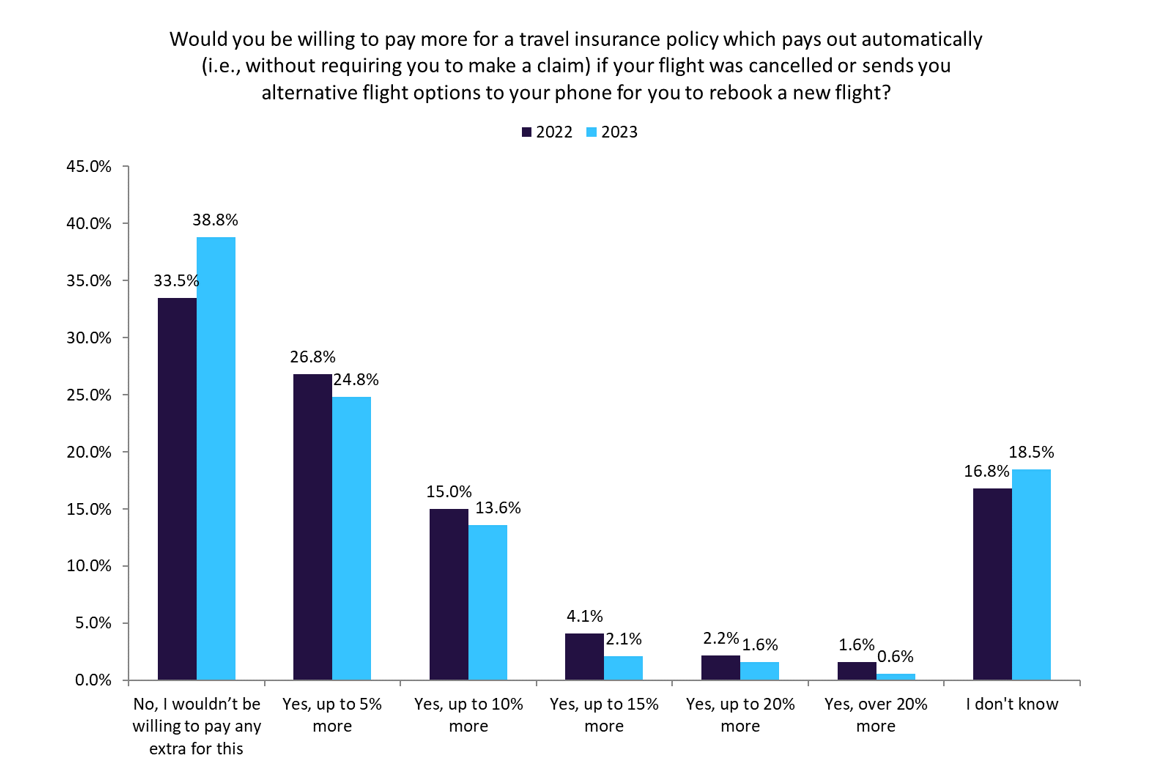

As per GlobalData’s 2023 UK Insurance Consumer Survey, 38.8% of consumers would not be willing to pay more for a travel insurance policy that pays out in the event of a flight delay/cancellation. This represents a 5.3 percentage-point increase when compared to the prior year. Additionally, the proportion of consumers who are willing to pay more for this type of policy has decreased from 2022 to 2023. This trend suggests a growing scepticism or reluctance among consumers towards the perceived value of these policies, possibly influenced by factors such as concerns about whether existing insurance coverage adequately meets their needs as well as worries about the affordability of higher premiums. Moreover, as travel gradually returns to normal following Covid-19, some individuals may no longer prioritise coverage for cancellations or delays as they did during the peak of the pandemic.

Meanwhile, Blink Parametric and Zurich Insurance in Asia-Pacific have integrated Blink’s flight delay and assistance solution into the Zurich Edge platform. Under the partnership, Zurich will offer real-time assistance to eligible policyholders who experience flight delays with complimentary access to a VIP airport lounge. The first market to go live with this Zurich and Blink move is Singapore. This added convenience and assistance may make Zurich’s policies more attractive to consumers, potentially influencing their willingness to purchase travel insurance policies that provide similar benefits, albeit at a higher premium.

In response to this scepticism highlighted in GlobalData’s consumer survey, insurers may need to re-evaluate their product offerings to better align with evolving consumer preferences. This could involve adjusting pricing structures, enhancing policy features, or improving communication strategies to effectively convey the benefits of their insurance products. By addressing these concerns and adapting to shifting consumer preferences, insurers can better position themselves to meet the evolving needs of their target audience and maintain competitiveness in the industry.

To overcome consumer reluctance, Zurich should employ clear and persuasive communication strategies to convey the advantages of its policies, reassuring consumers of the added security and peace of mind they provide while travelling. Additionally, by focusing on affordability and emphasising the tangible benefits of its policies, Zurich can successfully address consumer scepticism and enhance its competitiveness in the travel insurance market.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

Zurich Insurance Group Ltd