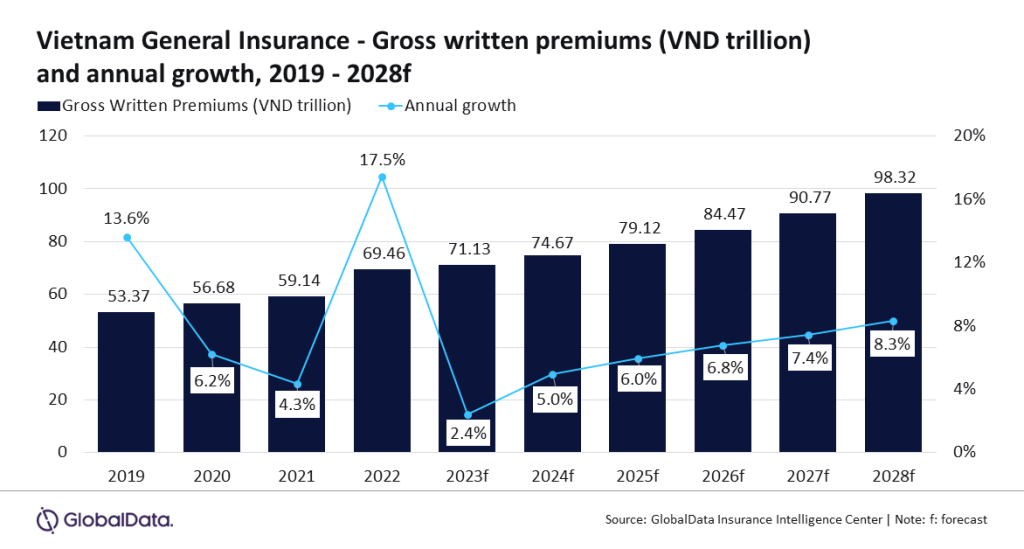

The general insurance industry in Vietnam is set to grow at a CAGR of 6.7% from VND71.1trn ($3bn) in 2023 to VND98.3trn ($3.9bn) in 2028.

This is according to GlobalData, which also predicts that the general insurance industry in Vietnam is expected to grow by 2.4% in 2023 and 5% in 2024.

GlobalData also stated that these rises are due to favourable regulatory reforms, rising demand for nat-cat insurance due to climate change, and a post-Covid-19 rise in the need for health insurance.

Swetansha Chauhan, insurance analyst at GlobalData, said: “After experiencing a significant growth of 17.5% in 2022, the general insurance industry is projected to achieve slower growth in 2023 due to a slowdown in Vietnam’s economy, which is expected to impact all major general insurance lines. However, the general insurance growth is expected to revive from 2024 onwards with a revival in the global economy and easing inflation levels.”

Personal Accident and Health (PA&H) insurance is the biggest line of business, accounting for a 35% share, in terms of GWP, in 2023. PA&H insurance grew by 3.2% in 2023, primarily driven by increasing health awareness after the pandemic and changing demographics, which include an increasing life expectancy and a rapidly aging population.

In addition, according to the United Nations Population Fund (UNFPA), as of 2023, 10% of the population in Vietnam was aged 65 years and above, which is supporting the demand for health insurance.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataChauhan added: “The increasing cost of medical treatments, driven by a high demand for quality healthcare and rising inflation, has led to an increase in the premium prices for health insurance policies. Also, concerns about declining public health infrastructure, with long waiting periods and limited coverage have led people to move towards private health insurance, which will support PA&H insurance growth. PA&H insurance is expected to grow at a CAGR of 7.5% during 2023-28.”