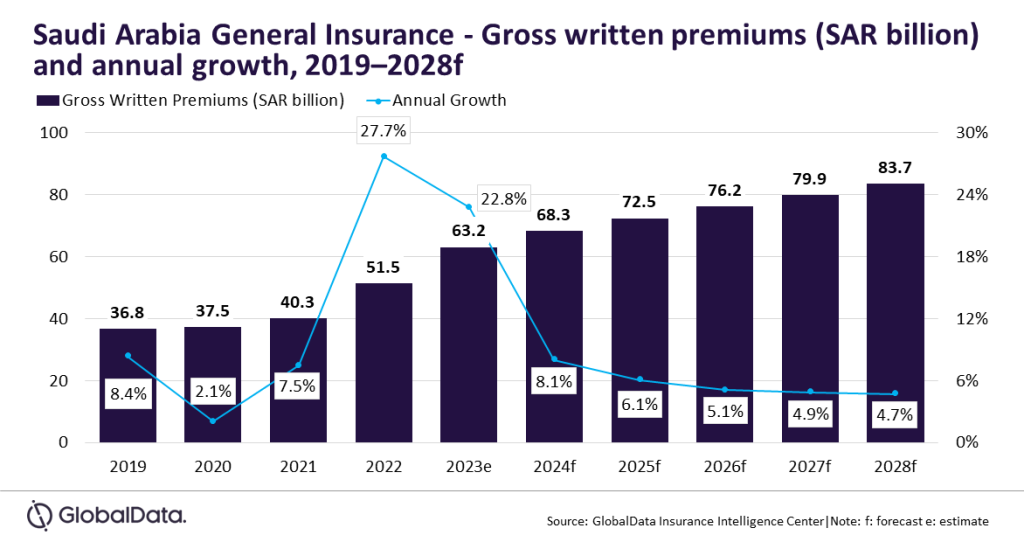

The general insurance market in Saudi Arabia is set to grow at a CAGR of 5.2% between 2024 and 2028.

This would take the general insurance industry from SAR68.3bn ($18.2bn) in 2024 to SAR83.7bn ($22.3bn) in 2028 in terms of GWP.

According to GlobalData and its insurance database, also, the general insurance industry will grow by 8.1% in 2024.

Health and motor insurance lines, accounting for 86% of the total general insurance GWP in 2023, will support this growth.

Sutirtha Dutta, insurance analyst at GlobalData, commented: “The Saudi Arabian general insurance industry witnessed high growth of 27.7% in 2022 and 22.8% in 2023. The growth was supported by favorable regulatory developments in motor and health insurance lines, rising construction activities, increasing preference for specialized healthcare, and growing motor vehicle sales.”

However, the growth is expected to stablise from 2024 in line with economic growth as the country shifts from oil to develop other sectors such as transport, logistics, technology, and metals.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Personal Accident and Health (PA&H) insurance is the leading line of business, accounting for a 63.2% share of Saudi Arabia general insurance GWP in 2023.

Furthermore, PA&H insurance grew by 25.5% in 2023, driven by a rise in health awareness and growing demand for specialised healthcare.

Motor insurance is the next biggest line of business, accounting for 23.1% of general insurance GWP in 2023. It is expected to increase by 41.4% in 2023, driven by growing vehicle sales.

Dutta added: “The expansion of the healthcare and construction industries as part of the Vision 2030 program will drive the growth of Saudi Arabia’s general insurance industry. The country’s shift from an oil-based economy will promote development in other sectors and provide growth opportunities for general insurers over the next five years.”