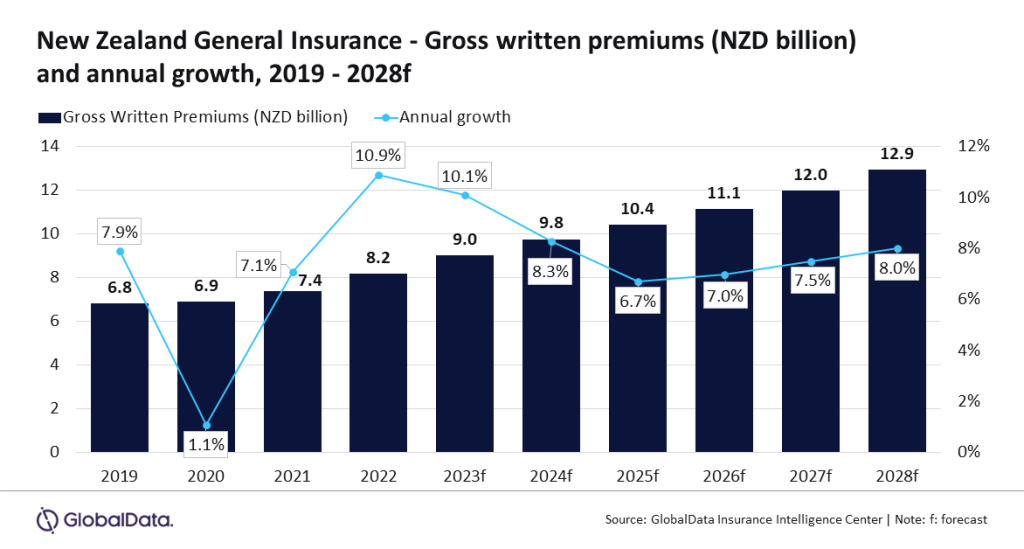

The New Zealand general insurance sector is expected to grow at a CAGR of 7.3% from NZD9.7bn ($5.8bn) in 2024 to NZD12.9bn ($7.6bn) in 2028 in terms of gross written premiums.

This is according to GlobalData which also predicted that the general insurance industry in New Zealand will grow by 8.3% in 2024. The property and motor insurance lines will greatly support this as they make up 75% of general insurance in 2023.

Sneha Verma, insurance analyst at GlobalData, said: “New Zealand’s general insurance industry is expected to witness a growth of 10.1% in 2023 after growing by 10.9% in 2022. The growth is supported by a rise in the demand for natural catastrophic (nat-cat) insurance policies due to an increase in the frequency of extreme weather events and an increase in premium prices across most of the insurance lines driven by inflation.”

Property insurance is the leading line of business in the New Zealand general insurance industry, accounting for a 41.7% share of the general insurance GWP in 2023. It grew by 9.8% in 2023, driven by the rise in demand for nat-cat insurance policies due to the country’s susceptibility to extreme weather events.

Furthermore, motor insurance is the second largest line of business, accounting for a 32.9% share of the general insurance GWP in 2023. Motor insurance premiums grew by 9.4% in 2023, primarily due to premium rate increases driven by inflation and high claim payouts following Cyclone Gabrielle.

In addition, car insurance costs in New Zealand in 2023 have seen a huge increase as compared to last year.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAs per the New Zealand Parliament’s Monthly Economic Review in February 2024, annual car insurance premiums increased by 30% on an average and reached $1,190 in the third quarter of 2023, as compared to $914 in 2022. The trend is expected to continue in 2024 and motor insurance is expected to grow at a CAGR of 6.3% during 2024-28.

Verma added: “High inflation has also played a major role in an increase in property insurance prices. The annual inflation in New Zealand stood at 4.7% in 2023, much higher than the target band of 1% to 3% set by the Reserve Bank of New Zealand. Property insurance is expected to grow at a CAGR of 7.9% during 2024-2028.”