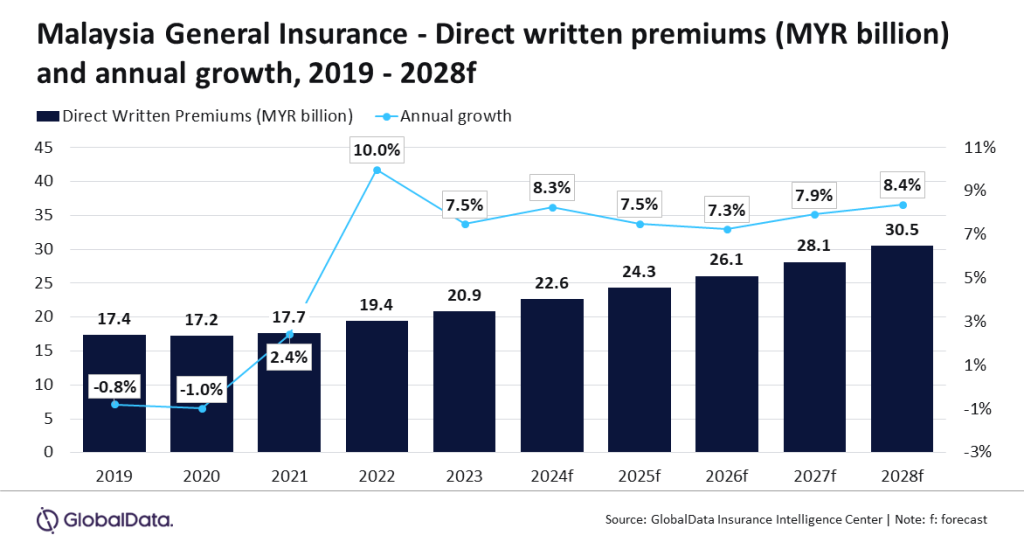

The general insurance industry in Malaysia is predicted to grow at a CAGR of 7.8% from MYR22.6bn ($5bn) in 2024 to MYR30.5bn ($6.8bn) in 2028 in terms of direct written premiums.

This is according to GlobalData and its insurance database which also expects the general insurance industry in Malaysia to increase by 8.3% in 2024. Motor and property insurance are supposed to be the lines that account for 73% of the industry in 2024.

Sneha Verma, insurance analyst at GlobalData, said: “Malaysian general insurance industry witnessed slower growth of 7.5% in 2023 as compared to 10.0% growth in 2022, due to slower economic growth and tight monetary policy. The growth momentum is expected to rebound in 2024, supported by an increase in premium rates across general insurance lines driven by rising claims and high inflation, as well as heightened demand for natural catastrophe (nat-cat) insurance policies due to an increase in the frequency of extreme weather events.”

Motor insurance is the main line of business in general insurance in Malaysia, accounting for 46.9% of direct written premiums in 2024. The sector is also expected to grow by 8.9% in 2024, attributed to an increase in vehicle sales.

Verma added: “Rising claims due to the increasing number of road accidents will prompt insurers to reassess their risk exposure and increase premium rates in 2024, which will support motor insurance growth.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData