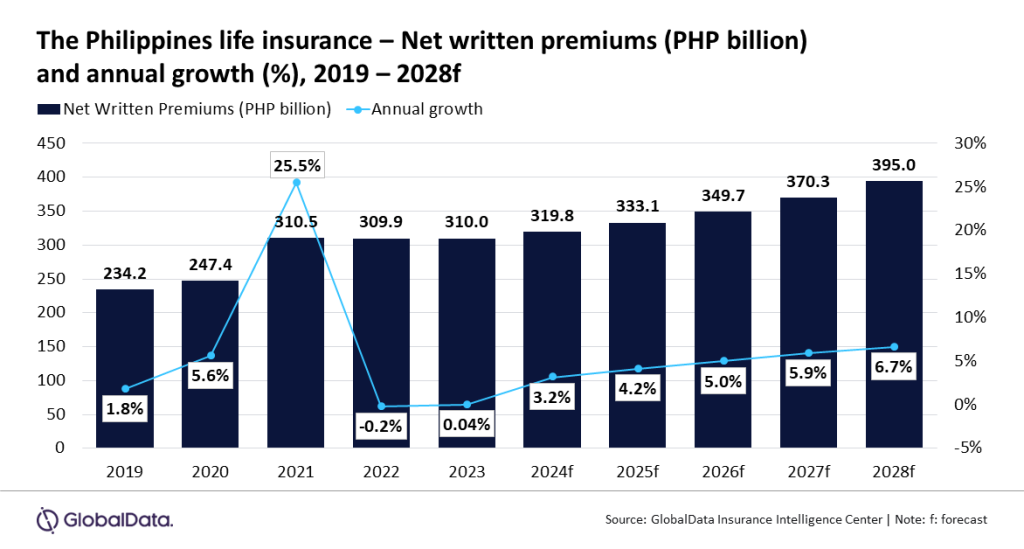

The life insurance industry in the Philippines is predicted to grow at a compound annual growth rate (CAGR) of 5.4% from PHP319.8bn ($5.8bn) in 2024 to PHP395bn ($7.1bn) in 2028, in terms of net written premiums (NWP).

This is according to GlobalData which also forecast that the life insurance sector in the Philippines is expected to record an annual growth rate of 3% in 2024.

In addition, this will be driven by economic recovery and the country’s demographic trend of an aging population that are gaining a growing life expectancy.

Prasanth Katam, insurance analyst at GlobalData, said: “The real GDP in the Philippines grew by 5.6% in 2023, driven by robust consumer spending, a strong labor market, and a recovery in tourism and financial services activities. The GDP is further expected to grow by 6.1% in 2024 and 6.3% in 2025, which will support the growth of life insurance.”

Furthermore, the country’s aging population with a growing life expectancy will also lead to an increase in the demand for various life insurance and pension products. GlobalData has forecast that the share of the population aged 65 and above is set to increase to 6.1% in 2028 from 5.4% in 2023.

The growth of the life insurance sector in the Philippines can also be attributed to favorable regulatory developments and government support.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn April 2024, the Cebu provincial government approved the Sugbo Segurado plan, an accident and life insurance plan designed to cover a wide range of government officials and workers. The plan aims to provide financial security to provincial government employees in Cebu province and promote insurance penetration.

Katam continued: “Digital transformation is also propelling the expansion of the life insurance industry in the Philippines. Insurers are investing heavily in technology to streamline operations, enhance customer experience, and improve policy distribution.”