The property insurance market in Japan is likely to survive despite losses following the 7.6 magnitude earthquake that struck the Noto Peninsula on 1 January 2024.

This is according to GlobalData, which also found that earthquake insurance accounted for an 18.2% share of the general reinsurance ceded premiums in the year ending 31 March 2023 in Japan.

The Noto Peninsula earthquake resulted in over 240 casualties and caused widespread damage to over 4,000 properties, according to Japan’s Fire and Disaster Management Agency (FDMA).

Sravani Ampabathina, insurance analyst at GlobalData, commented: “Japanese property insurers have been able to maintain stable operations despite the recurring earthquakes, as majority of the residential insured losses are borne by the government. Also, insurers carry minimal net retention on corporate earthquake policies and cede most of the risks to reinsurers, which help in keeping a check on their profitability.”

The Noto Peninsula earthquake is estimated to result in economic losses of around JPY1.1–2.6trn ($8.6–$20.3bn) and insured loss of around JPY792bn ($6bn).

However, the government through the Japan Earthquake Reinsurance Company (JER) is likely to bear around 98% of insured residential earthquake claims, with a cap of JPY11.8trn ($91.7bn) per earthquake.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAmpabathina continues: “In addition to receiving support from the JER, property insurers’ profitability is expected to remain resilient due to frequent increases in premium rates of fire and natural hazard insurance policies, which accounts for around 85% of the property insurance GWP.”

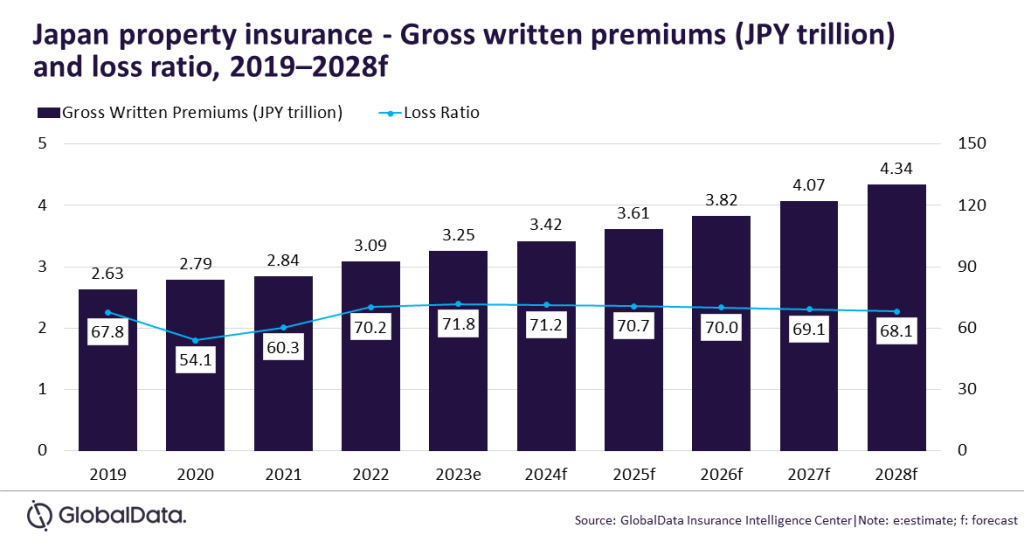

GlobalData forecasts the Japanese property insurance industry to grow at a compound annual growth rate (CAGR) of 6.1% from JPY3.4trn ($26.7bn) in 2024 to JPY4.3trn ($38.8bn) in 2028, in terms of gross written premiums (GWP).