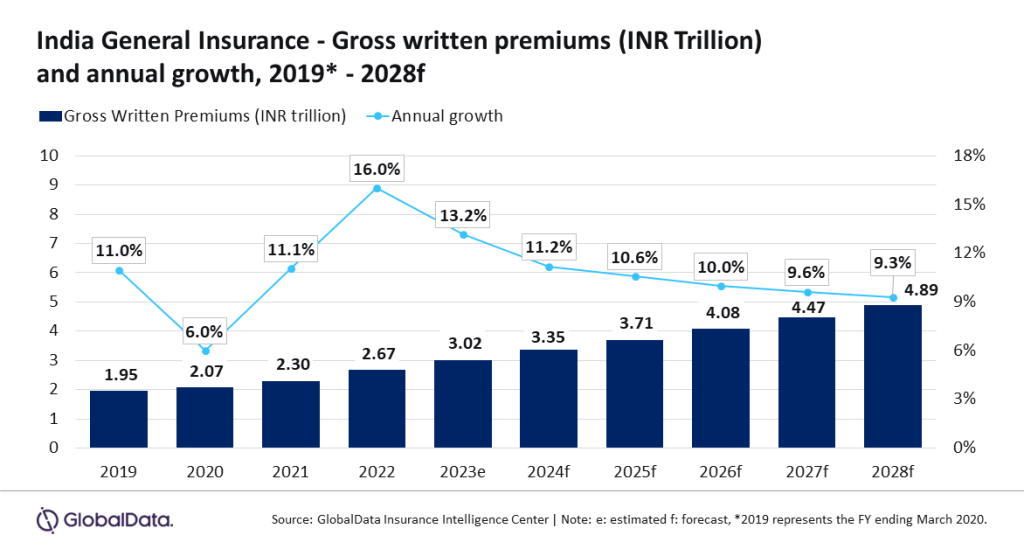

The general insurance industry in India is set to grow at a CAGR of 9.9% from INR3.35trn ($40.36bn) in 2024 to INR4.89trn ($57.3bn) in 2028, in terms of gross written premiums (GWP).

This is according to GlobalData, which also predicted that general insurance in India will grow by 11.2% in 2024. The rise will be driven by personal accident and health (PA&H), motor, and property insurance lines which totalled 93% of general insurance premiums in 2023.

Swetansha Chauhan, insurance analyst at GlobalData, said: “The general insurance industry in India continued its high growth trend and grew by 13.2% in 2023, driven by economic growth and rising disposable income. Rising consumer awareness of health and other general insurance products and robust regulatory reforms also supported India’s general insurance industry growth. The trend is expected to continue in 2024 and 2025.”

PA&H insurance is huge in India, accounting for 39.5% of the sector in 2024. It is also expected to grow by 14.5% in 2024, driven by increased health awareness following the Covid-19 pandemic and rising medical inflation.

Motor insurance is the second largest line in general insurance as GlobalData estimates it takes 31.1% of the industry.

Furthermore, it is expected to grow by 10.4% in 2024 due to rising vehicle sales.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataChauhan added: “The growth in vehicle sales was also fueled by the government’s vehicle scrapping policy, which came into effect on April 1, 2023. The policy requires private vehicles older than 20 years and commercial vehicles older than fifteen years to be scrapped. Motor insurance is expected to grow at a CAGR of 7.9% during 2024-28.”

Chauhan continued: “Recovery in the economy and rising disposable income will continue to support the growth of India’s general insurance industry during the next five years. Initiatives from the government and favorable regulatory reforms will help in increasing the insurance penetration rate in India (0.98%), which was lower as compared to other Asian markets such as Japan (1.75%), South Korea (1.46%), Hong Kong (1.65%) and China (1.26%) in 2023.”