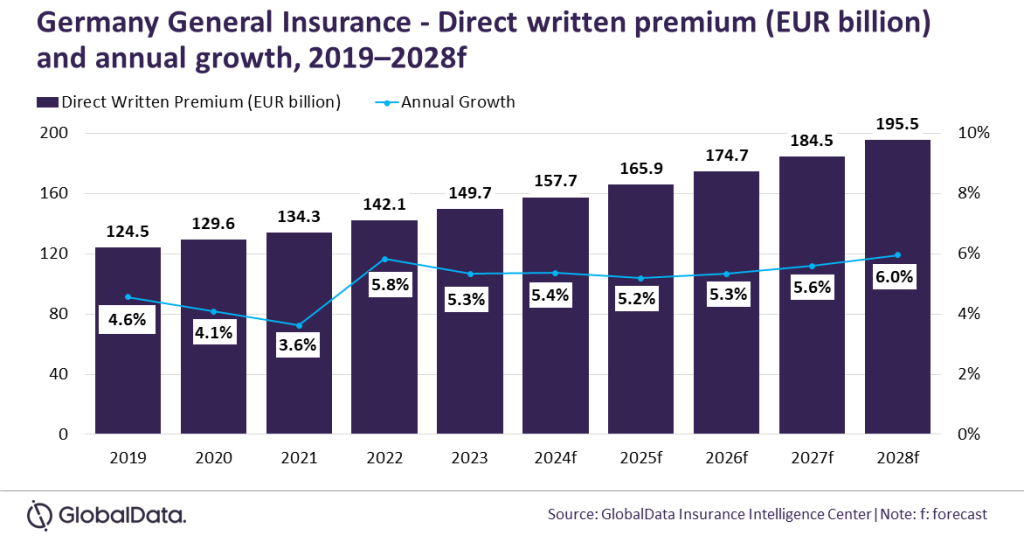

The general insurance industry in Germany is set to grow at a CAGR of 5.5% from EUR149.7bn ($152.8bn) in 2023 to EUR195.5bn ($205.2bn) in 2028.

This is according to GlobalData and its insurance database which also revealed that Germany general insurance is expected to grow by 5.4% in 2024. The growth is supported by an increase in motor vehicle sales, rising demand for natural catastrophic (nat-cat) insurance policies and an inflation-led rise in premium rates across most general insurance lines.

Sneha Verma, insurance analyst at GlobalData, commented: “The growth rate of Germany’s general insurance industry is expected to remain consistent between 5-6% during 2023-28. It will be primarily supported by health and property insurance, driven by the post-COVID-19 pandemic increase in health awareness and increasing demand for nat-cat insurance policies.”

In addition, personal accident and health insurance (PA&H) is the leading line of business, accounting of 37.7% of the general insurance market in 2023. It is also expected to grow by 3.8% in 2024 and 4.2% in 2025, boosted by an increase in health awareness after Covid-19.

According to the German Insurance Association, private health insurance premium is expected to increase by 4% to 5.5% in 2024. PA&H insurance is projected to grow at a CAGR of 4.4% during 2023-28.

Furthermore, motor insurance is the second largest line of business, accounting for a 21% share of the Germany general insurance DWP in 2023.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataMotor insurance DWP grew by 1.8% in 2023, supported by an increase in total vehicle sales. According to the Federal Motor Transport Authority, vehicle sales increased by 7.2% to 2.84 million in 2023 from 2.65 million in 2022. The trend is expected to continue in 2024.

Verma added: “In addition to vehicle sales, an increase in premium prices due to inflation will also support motor insurance growth. An extended period of high inflation has resulted in an above-average increase in spare parts and repair costs, leading to a higher cost of claims. This has impacted insurers’ profitability, leading to the combined ratio for the motor insurance industry surpassing 100% in 2022 for the first time in the last 10 years. Motor insurance is expected to grow at a CAGR of 2.2% during 2023-2028.”