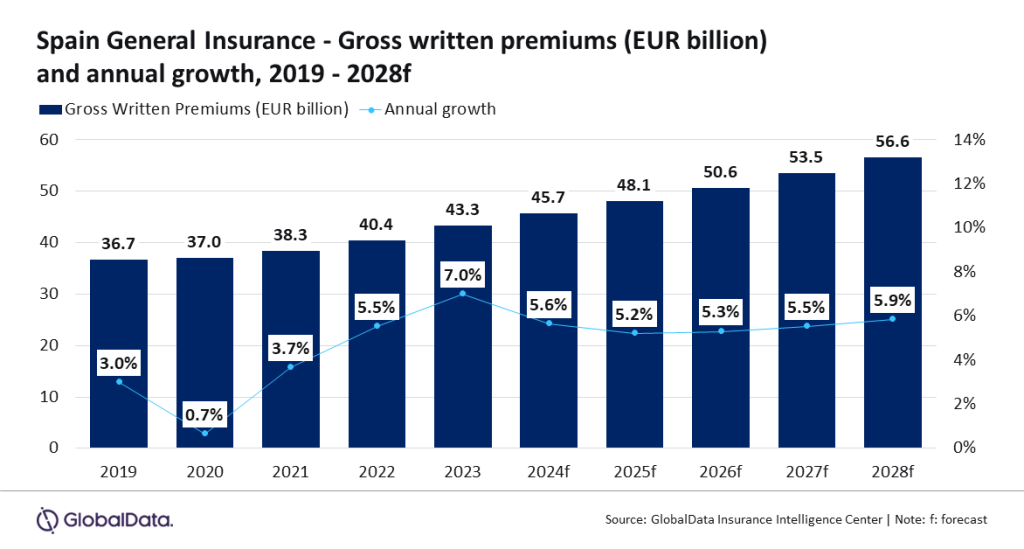

The general insurance industry in Spain is set to grow at a CAGR of 5.3% from EUR45.7bn ($48.5bn) to EUR56.6bn ($60.4bn) in 2028, in terms of GWP.

This is according to GlobalData, which also predicts that general insurance in Spain will grow by 5.6% in 2024 and 5.2% in 2025.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGrowth will be mainly backed by personal accident and health (PA&H), motor and property insurance segments, which make up around 78.4% of total general insurance GWP in Spain.

Anurag Baliarsingh, insurance analyst at GlobalData, explained: “The general insurance industry in Spain continued its growth trend for the third consecutive year and grew by 7% in 2023, its highest growth over the last five years. The growth was driven by rising demand for private health insurance, prompted by inadequate public healthcare, a recovery in vehicle sales, and increasing investments in infrastructure.

“However, with the Spanish economy expected to grow at a slower pace of 1.4% in 2024 and 1.6% in 2025, the general insurance industry will witness slower growth over the next two years.”

PA&H insurance is the leading line of business in the Spanish general insurance sector. It is expected to have a 29.8% share of general insurance GWP in 2024 and expected to grow by 5.3% in the same year. This is attributed to an increase in demand for private health insurance.

According to the Spanish Union of Insurance and Reinsurance Entities (UNESPA), around 2.3 million people opted for private health insurance in 2023.

As a result, the percentage of the population opting for private health insurance increased from 19.2% in 2022 to 30% in 2023. Factors such as doctor on demand and coverage of mental health have played a pivotal role in the demand of private health insurance. PA&H insurance is expected to grow at a CAGR of 4.9% between 2024 and 2028.

Furthermore, motor insurance is the second largest line of business, expected to account for 28.4% share of general insurance GWP in 2024. Motor insurance GWP is expected to grow by 5.2% in 2024, driven by rising vehicle sales.

According to the Spanish Association of Automobile and Truck Manufacturers (ANFAC), passenger car sales grew by 7.8% during January-April 2024 as compared to the same period over the previous year.

Baliarsingh added: “The general insurance industry in Spain is expected to witness an upward growth trend from 2025 onwards, propelled by economic recovery and increased demand of private health insurance. Rising costs due to inflation will prompt insurers to reassess their risk exposure and increase premium prices in the short term.”