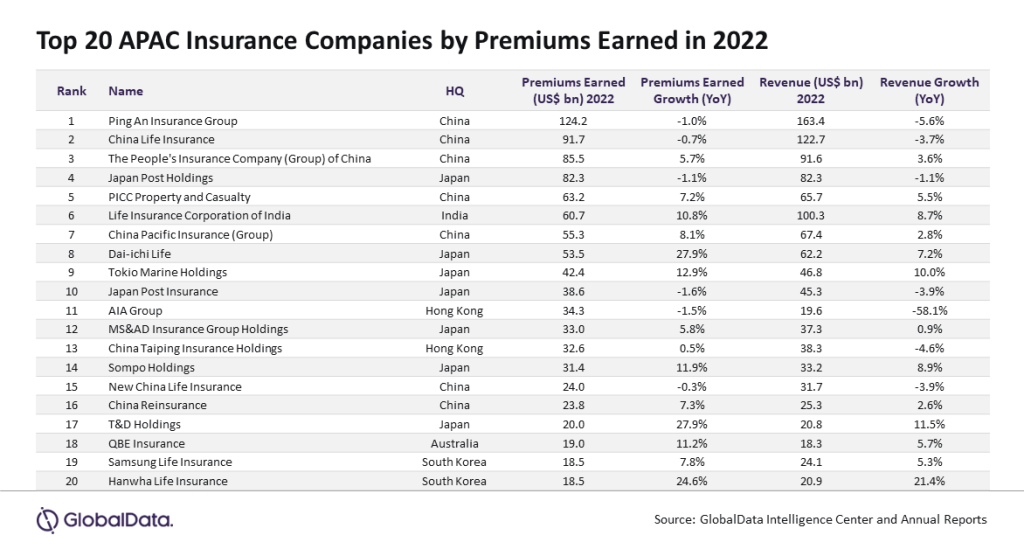

As a result, the average premium earned by these APAC insurance firms grew by 8.2% with an additional 0.7% increase in total revenue.

Of the top 20, 15 of them reported year-on-year growth in premiums earned in 2022, according to GlobalData.

Notable performers were Dai-ichi Life, T&D Holdings, and Hanwha Life Insurance.

A 17.6% growth in premium earnings for Dai-ichi Life can be attributed to the rise in policy reserve reversals resulting from reinsurance transactions targeted at reducing market risks.

Furthermore, increased income from insurance premiums Taiyo Life, Daido Life, and T&D Financial by 7.6%, 0.3%, and 94.7% respectively, couple with positive investment income pushed T&D Holdings’ revenue by 11.5%.

In addition, Hanwha Life revenue increased by 21.4% due to a 26.3% growth in premium income, driven by an increase in general protection premiums and a favourable investment yield.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataMurthy Grandhi, company profiles analyst at GlobalData, said: “In 2022, roadblocks for insurers came in the form of IFRS 9 implementation and risk-based capital regulations, the translation of ESG/net-zero factors into investment approaches, and the establishment of viable hedging strategies in the face of elevated expenses and restricted access to hedging instruments. But they sailed through commendably.”

APAC insurance losers

Not everyone has had an easy time. Japan Post Insurance and AIA Group saw slight drops in earned premiums, experiencing declines of 1.6% and 1.5% respectively. These falls have also led to an overall reduction in revenue.

Grandhi concludes: “Post-COVID-19, customers seek enhanced healthcare coverage and expect more from insurers in the APAC region. In response, insurers are shifting focus to protection-oriented offerings, investing in healthcare, clinics, hospitals, and third-party administrators. Building comprehensive healthcare ecosystems and partnerships is crucial for future success.

“Concurrently, insurers are focusing on digital transformation, allocating resources to enhance digital capabilities in distribution channels and streamline backend operations through automation. This strategic shift addresses customers’ rising expectations for faster and accessible services, akin to digitally advanced services in other sectors.

“Nonetheless, addressing the effects of the current interest rate environment on capital markets is crucial. After a prolonged period of low rates, insurers now face potential impacts of rate hikes and macroeconomic uncertainties. These considerations affect product design and capital allocation. The first half of 2022 saw unexpected challenges, with negative returns in equity and fixed income markets, and significant currency depreciation against the US Dollar. Despite these issues, the Asia-Pacific insurance market remains attractive globally.”