Individuals continue to work from home far more regularly today than before the onset of the COVID-19 pandemic, meaning the idea of car usage returning to pre-pandemic levels is becoming increasingly distant. This means that usage-based insurance (UBI) policies have become more relevant to the motor insurance industry, but a lack of awareness of these policies among motorists may limit uptake.

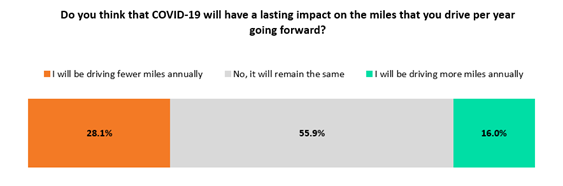

GlobalData’s 2021 UK Insurance Consumer Survey found that 28.1% of motor insurance policyholders expect to drive fewer miles as a result of the pandemic, significantly higher than the 16.0% who think their mileage will increase. UBI policies have commonly been marketed for motorists driving fewer than 7,000 miles per annum, at which point holding this type of cover can work cheaper than holding a traditional insurance policy. According to our survey, just over half of policyholders (52.6%) expect to drive fewer than 7,000 miles in 2022.

Beyond the pandemic changing consumer behaviour, spiralling inflation will force many consumers to cut unnecessary expenses. With fuel prices also skyrocketing, some may even be forced to think twice about when they will use their car for leisure. While UBI policies may become more suitable for some customers, a lack of communication among providers offering such policies means that not all consumers will opt for what is financially sound for them.

UBI policies are powered by telematics, typically a black box that measures driving behaviour such as how quickly someone breaks as well as miles driven. A survey conducted by manufacturer Redtail Telematics found that just 4% of customers had received information from their insurance provider about how telematics policies can reduce premiums for infrequent or casual drivers. Meanwhile, the popularity of price comparison websites for purchasing motor insurance policies adds another layer of complexity in passing the message to the consumer.

Price comparison sites are often regarded as lacking transparency when it comes to disclosing policy details.

However, a prolonged change in driving levels will foster demand for more flexible motor insurance products.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAnd, naturally, UBI policies will become increasingly more appealing to drivers as awareness of these policies improves and consumers better understand the benefits they offer to infrequent drivers. Providers who start communicating about the benefits of UBI sooner rather than later are more likely to retain customers, while reduced premiums will make them happier.