A significant proportion of UK consumers would be willing to pay higher premiums to insurers with good records on sustainability. GlobalData’s 2022 UK Insurance Consumer Survey shows that sustainability is becoming increasingly important to consumers, meaning insurers that prioritize the issue can benefit – even if it means they have to charge higher premiums as a result. This comes amid the COP27 conference, with leaders from all industries meeting to discuss the climate. Clearly, action from leading businesses and insurers will be supported by consumers.

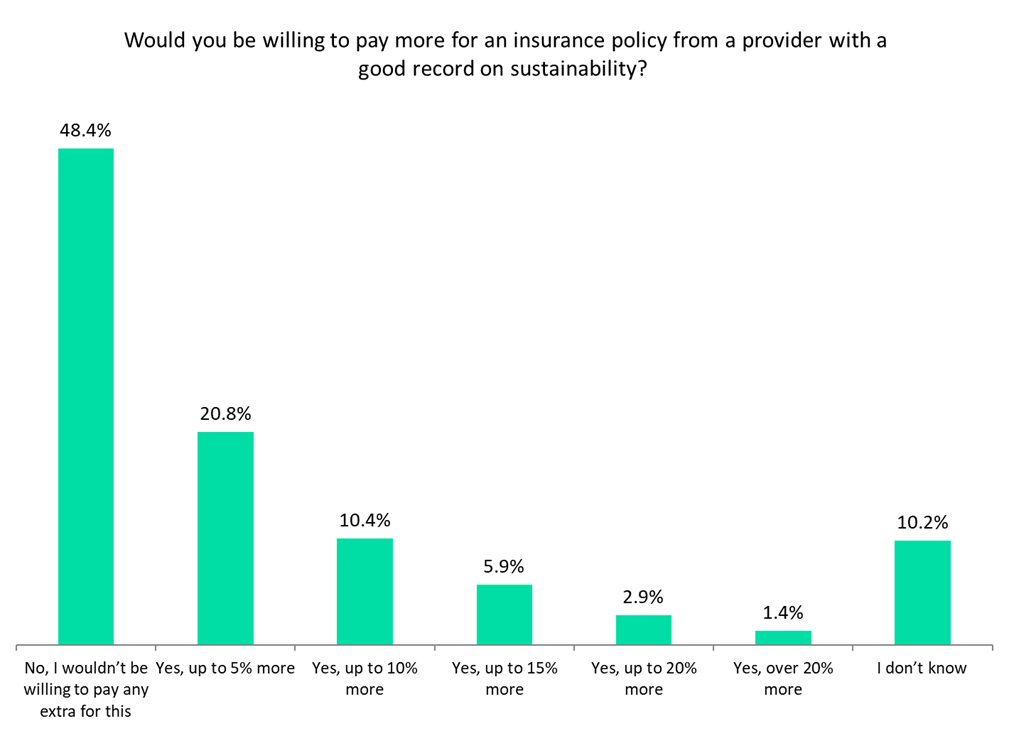

GlobalData’s 2022 UK Insurance Consumer Survey found that 41.4% of consumers are willing to pay more (to various degrees) for an insurance policy from a provider with a good record on sustainability. In addition, 10.2% stated that they “didn’t know” whether they were willing or not, indicating they could be open to paying more but may need some convincing from insurers.

In the past, both consumers and businesses have expressed concerns about sustainability, but when it comes down to actually paying more are hesitant to do so. This was reflected in GlobalData’s 2022 UK SME Insurance Survey, which found that SMEs say sustainability is very important to them, while ranking it towards the bottom of factors when purchasing an insurance policy. However, our latest consumer data represents a shift from that trend, as a sizable proportion of respondents are putting sustainability above price. This may become harder for many consumers in 2023 as the economic downturn really hits, but it shows that consumers feel strongly about the issue and have certain expectations of the businesses they give their money to.

The main way insurers can show they are taking action on sustainability is by cutting ties with polluting industries such as coal, gas, and oil. Such action is becoming more common as pressure on them increases. All leading insurers have targets for when they will stop working with these industries, but we are also seeing companies walking away from potential contracts now. This was seen recently with Marsh McLennan and Lockton walking away from Adani Enterprise’s Carmichael coal mine in Australia. Insurers can also be more proactive; examples include Zixty and Lemonade planting trees based on miles driven by motor insurance customers, or Aviva committing to running its office in Perth, Scotland entirely on renewable energy.

It is undeniable that sustainability should now be a core element of any insurer’s strategy, with GlobalData findings highlighting that it is something a significant proportion of potential customers will judge them on.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

Aviva Plc

Lockton, Inc