UK-based insurtech Stubben Edge Group has secured an additional £5.6m in investment despite GlobalData findings showing that total investment into insurtechs has fallen significantly in 2022 due to tough economic conditions.

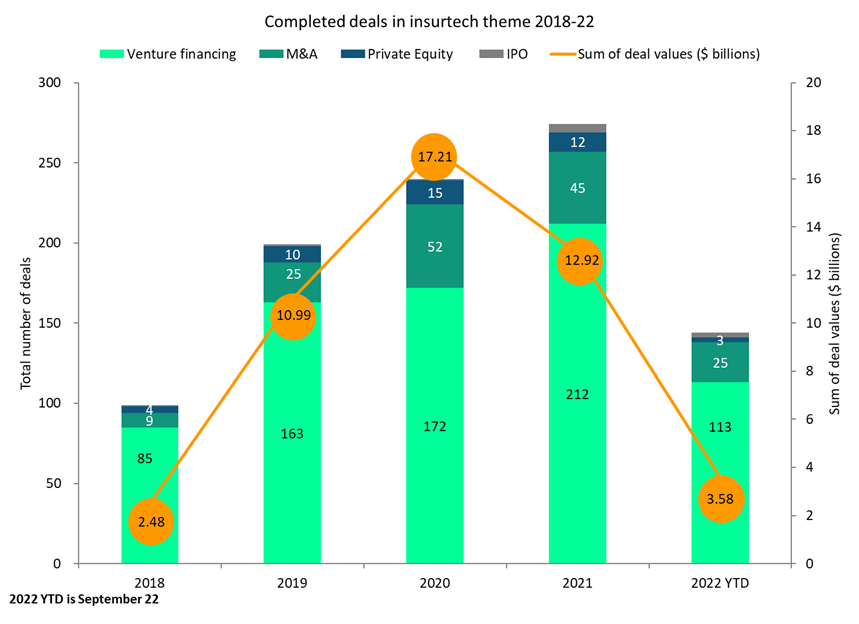

GlobalData’s Deals Database shows in 2021 the total number of deals falling by 11.5% and the sum of deal values falling by 24.9%, and current trends suggest growth is unlikely in 2022. The insurtech industry has recorded only 144 deals with a total value of $3.58bn so far in 2022, representing respective 47.1% and 72.3% declines from 2021 figures, despite being towards the end of Q3 2022.

This is likely due to a combination of factors; macroeconomic conditions and economic policy are driving investments to more traditional sources of investment, as investors hope to find a ‘safe haven’ in the face of extreme economic uncertainty and rising inflation.

In the context of declining confidence in the insurtech sector and the current economic climate, it is impressive how Stubben Edge Group has raised additional funds, at a higher valuation, following an oversubscribed £10 million round in September 2021. Funding rounds are essential to keep insurtechs up and running during the early stages of their life cycle. Cornerstone investors for this latest round include several names from Lloyd’s, Dowgate Wealth, Nigel Wray, institutional investors, and other high-net-worth investors.

Stubben Edge Group is revolutionizing insurance distribution, providing a digital platform where brokers, distributors, and financial advisors can start and grow their business. Its technology enables users to find and sell better insurance products faster and cheaper to a growing number of people, while also supplying finance, compliance, administration, and marketing services.

Its latest round of funding follows a consistent flow of stories of insurtechs struggling in 2022. For example, Nova Benefits cut its headcount by 30% in June 2022, and reverse insurance comparison site Honcho went bust a month later, despite appearing to be one of the most promising UK insurtechs. Stubben Edge Group has also stated that it plans to make further M&A announcements soon.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataOverall, it is a testament to the strength of the business that Stubben Edge Group was able to raise additional funding despite the economic climate. Investments so far indicate that Stubben Edge is well placed for future growth and is set to become an important insurtech within the industry.