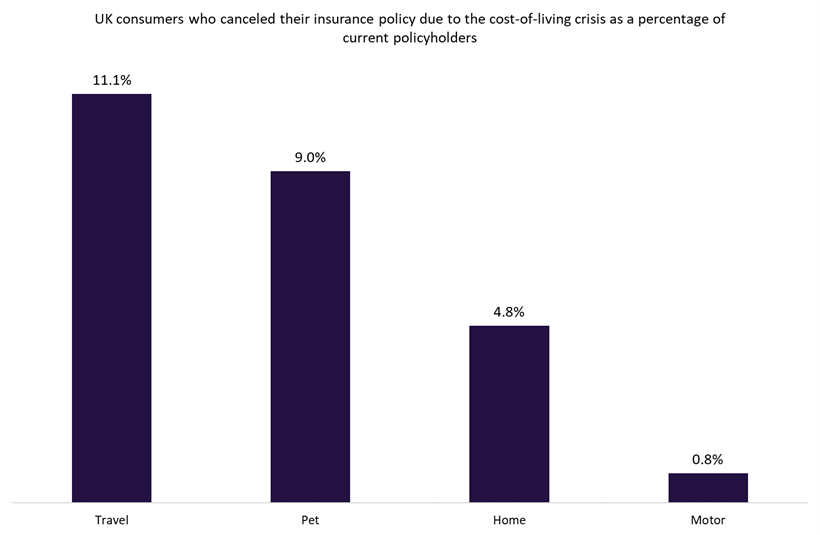

11.1% of travel insurance customers cancelled their policy over the past 12 months as a cost-saving measure amid the UK’s cost-of-living crisis, according to insight from GlobalData’s 2022 UK Insurance Consumer Survey. Meanwhile, 9.0% of pet insurance customers took the same action.

The squeeze on living standards in the UK is forcing many consumers to alter their spending habits as the cost-of-living crisis continues to bite. Turning first to travel insurance, GlobalData’s 2022 UK Insurance Consumer Survey highlights that 41.5% of consumers who cancelled their travel policy did so as a cost-saving measure. In addition, 29.0% cancelled as they say they are traveling less frequently than before. This suggests insurers could look to more actively target some of these consumers with single-trip policies for the few trips they do make rather than one all-encompassing annual policy. This would be best achieved by offering it at the point of sale in collaboration with travel providers, which is slowly becoming a more frequently used method of purchase.

Regarding pet insurance, 50% of consumers who cancelled their policy did so to reduce their costs. The cost of pet insurance has risen quite steeply in recent years, so these results are unsurprising. Co-insurance policies – whereby the costs and risks of insurance are more equally shared among insurer and insured – could be a solution for insurers to solve this issue.

For home insurance cancellations, the most frequently cited reason was again to cut costs, with 44.4% of respondents giving this reason. As home working has remained a significant trend since the onset of the COVID-19 pandemic, some consumers are cancelling home insurance policies in response to spending more time at home. 17.9% of respondents who canceled gave this factor as a reason for the decision.

Offering customers the opportunity to tailor their policies for more personalised (and cheaper) coverage could increase business retention. Some consumers stated that their provider has not offered payment breaks to support them through the cost-of-living crisis. This drove cancellations across all four products: 11.6% for travel, 13.5% for pet, 17.2% for home, and 16.0% for motor. Offering payment breaks or credit finance methods will help alleviate payment concerns for consumers and retain business for insurers. Although not a simple task, supporting consumers through the cost-of-living crisis can help insurers maintain loyalty going forward, increasing business in the long run.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData