GlobalData’s 2022 UK SME Insurance Survey suggests that 8.9% of UK SMEs canceled their employers’ liability insurance in 2022. Similarly, RSA’s broker survey has found that an increasing number of businesses in the UK are either canceling or altering their employers’ liability coverage. Further GlobalData surveying suggests this may be attributed to the current economic climate.

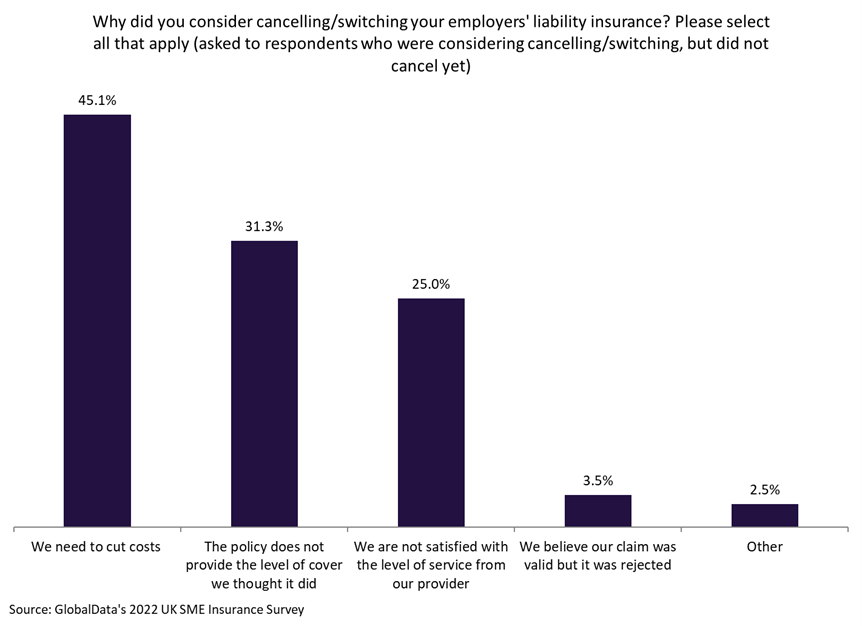

As per GlobalData’s 2022 UK SME Insurance Survey, the main reason UK SMEs are considering canceling their employers’ liability insurance is because they need to cut costs (45.1%). Additionally, 31.3% of respondents said they are considering canceling because the policy does not provide the level of cover that they thought it did, while 25% indicate that they were not satisfied with the level of service from their provider.

RSA’s broker survey found that almost 80% of brokers are experiencing alterations or cancellations to insurance policies. The survey revealed that property insurance and employers’ liability are the most altered policies. This is in line with another recent study by Smart Money People, which found that over 160,000 SMEs will lack employers’ liability insurance by the end of 2023.

Since it is a legal requirement for UK businesses to have employers’ liability insurance, you would expect that companies should never reasonably be allowed to discard it. If a business chooses not to have this coverage, they could face severe penalties and even legal action.

Additionally, GlobalData’s 2022 UK SME Insurance Survey has found that UK businesses are increasingly considering canceling other insurance policies, including property insurance, which is a reflection of the current economic climate’s severity. The survey found that 6.7% of SMEs are considering no longer holding property insurance, a 1.3 percentage-point increase when compared to the previous year.

GlobalData’s 2023 UK Commercial Insurance Broker Survey found that brokers rank economic crisis/recession as the biggest threat to their business, with 29.5% of respondents citing this factor.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAccording to RSA’s survey, 85% of brokers believe that insurers providing additional information and knowledge to understand the current macroeconomic scenario would be beneficial for them and their clients.

Overall, the costs of penalties or legal action that a business could face for failing to have employers’ liability insurance far outweigh the costs of the insurance itself. Brokers must stress the importance of having this coverage in place, as SMEs may be unable to recover from any action taken against them.