The importance of incorporating sustainability into business models is highlighted by how valuable the concept is becoming to consumers when purchasing insurance. Proposed changes to the Solvency II rules will liberate capital, which could be used to aid the transition into a sustainable future while attracting new customers through environmental, social, and governance (ESG) benefits.

When Britain left the European Union in 2020, it continued to abide by the Solvency II capital rules that came into effect from January 1, 2016. As of 2022, the UK has proposed the reform or relaxation of these rules. As a result, the UK is likely to liberate “tens of billions of pounds” in insurance sector capital according to the Association of British Insurers (ABI). It is likely the industry will invest some of these funds into combatting ESG challenges, as well as stimulating the economy by investing in long-term productive assets such as infrastructure.

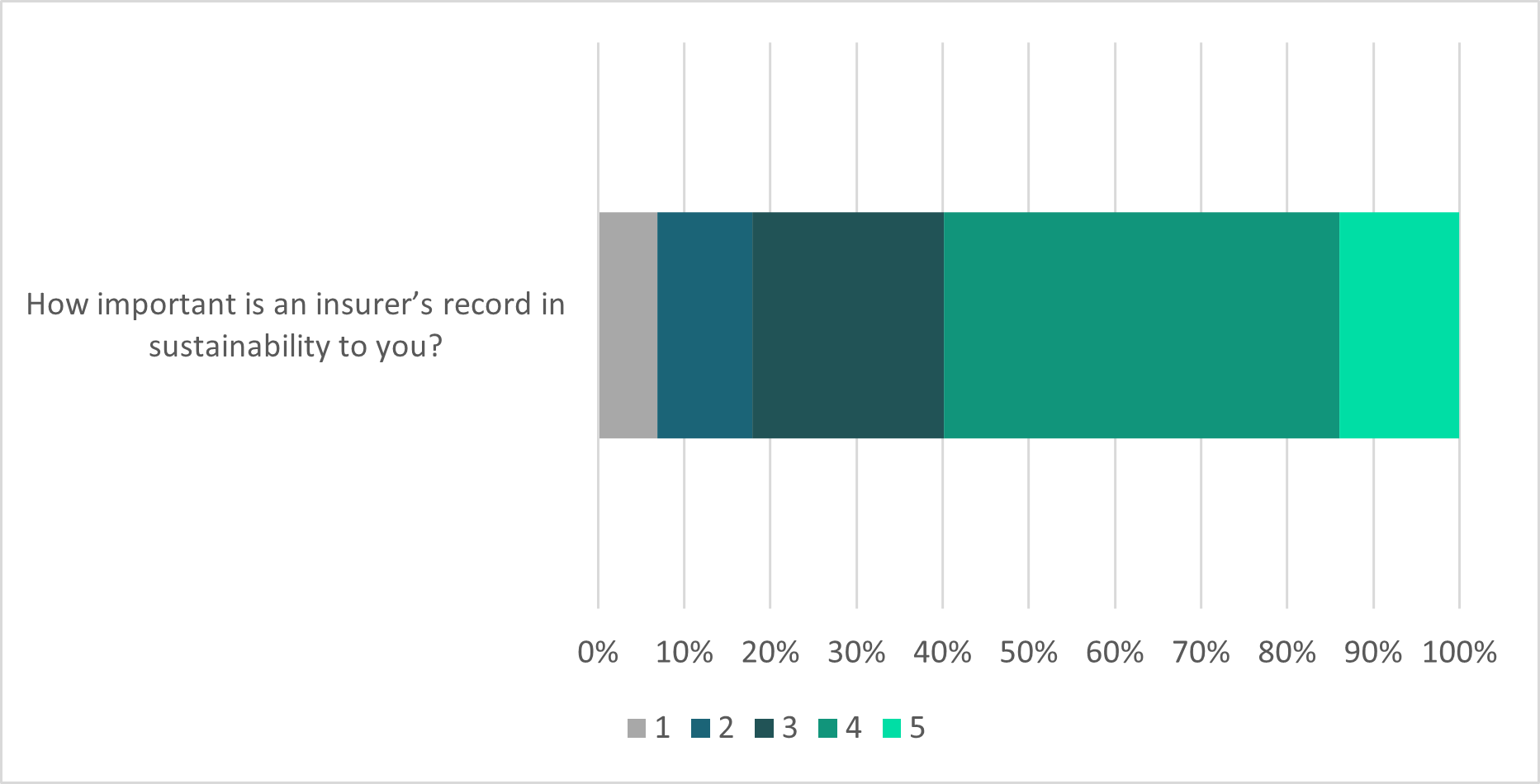

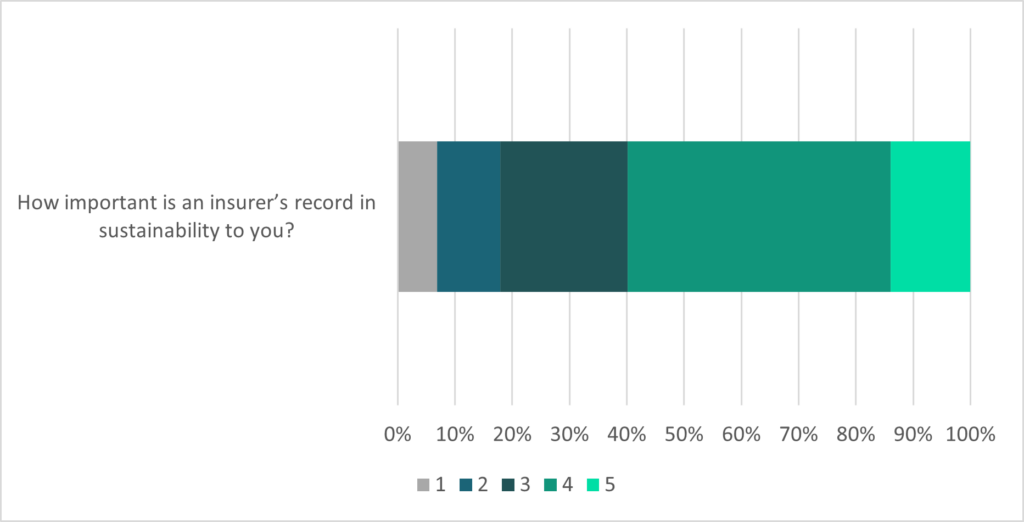

This is important given that GlobalData findings show UK consumers value their insurers’ record on sustainability. As part of GlobalData’s 2021 UK Insurance Consumer Survey, consumers were asked “How important is an insurer’s record in sustainability to you?” (with 1 being “not important at all” and 5 being “very important”). The survey concluded that 59.9% of consumers find it important for insurers to have a good record on sustainability when choosing a provider. This shows that sustainability is an issue insurers need to focus on going forward.

Insurers and Brexit supporters see the long-awaited reform as an early test of how Britain can use its independence to design its own financial regulations. Meanwhile, the government is eager to demonstrate tangible gains from leaving the EU. Changes to the risk margin, matching adjustments, and decreasing reporting requirements are among the ABI’s main priorities for unlocking capital.

Regarding the risk margin, the UK government plans an in-depth consultation later in 2022 about calls for a significant drop (maybe as much as 60–70%) for long-term life insurers. As a result, insurers will have more freedom to invest in long-term assets like infrastructure to help the economy tackle climate change, as well as benefitting from a decrease in reporting and administrative requirements.

As highlighted at the COP26 conference in 2021, the movement towards net-zero emissions is important in the insurance industry, with leading players such as Allianz taking the initiative. The Allianz Net Zero Accelerator (ANZA) hopes to assist brokers in their ESG transformation – aiding in setting reduction goals and lowering carbon footprints.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe government also intends to re-evaluate the fundamental spread used in the Matching Adjustment calculation. The financial spread is calculated using long-term average default rates, which have historically been low as a result of more than a decade of quantitative easing. To determine a financial spread, the Prudential Regulation Authority (PRA) prefers to consider current and recent average spreads. However, if credit spreads expand, this could lower Matching Adjustment benefits more quickly, which could be a disadvantage for UK life insurers, as long-term investments in illiquid assets would be less appealing if the spread changed often. This would be the precise opposite of the government’s desired outcome. Furthermore, a large reduction in the credit quality of insurers’ investment portfolios, or a significant increase in asset concentration risk, would clearly be a credit negative rating, leaving insurers at risk of failure.

The reform of Solvency II offers both opportunities and threats. However, the importance of insurers’ record on sustainability to consumers when choosing an insurance provider cannot be ignored. The “tens of billions of pounds” that could enter the sector due to potential changes would allow insurers to boost their image with the use of sustainable long-term investments, given that the credit spread does not change too often.