Aon suggests that some UK commercial markets, including property and cyber, will remain challenging in 2022, with GlobalData noting that these lines also saw strong GWP growth in 2021. GlobalData found that 84.6% of national brokers say they experienced increases in the volume of gross written premiums (GWP) handled in 2021, primarily driven by higher rates across most lines.

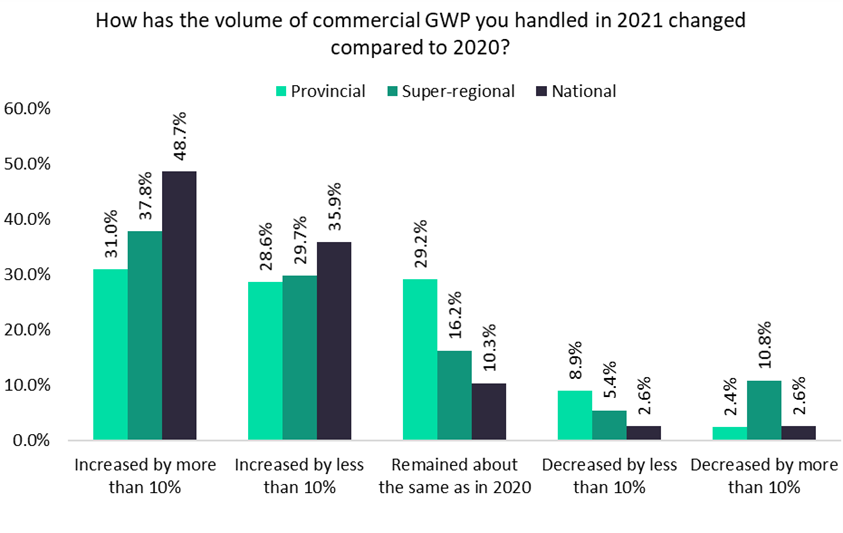

According to GlobalData’s 2022 UK Commercial Insurance Broker Survey, 59.6% of provincial brokers, 67.5% of super-regional brokers, and 84.6% of national brokers indicated that they had handled a greater volume of GWP in 2021 compared to 2020. These findings can be attributed to hardening market rates in UK commercial lines, driven by COVID-19-related factors as well as claims inflation. Larger brokers are more likely to be exposed to clients with complex risk requirements and therefore gaps in cover, creating more cross-selling and upselling opportunities in order to plug these gaps. This in turn leads to greater benefit from this market hardening.

Looking into 2022 and beyond, the continuation of events and geopolitical tensions in Ukraine (and wider Eastern Europe) will exacerbate the challenges within the cyber insurance market. Rate increases accompanied by reductions in cover levels are likely to persist, with further challenges remaining in the time-consuming and difficult underwriting process. In a separate report, Aon says global cyber rates increased by 30% in Q1 2022 compared to the same period of 2021 – emphasizing the scale of the challenge the market has faced and will continue to battle going forward.

After a challenging period during the height of the pandemic, commercial property will slowly stabilize. However, rates will remain high due to claims inflation, underinsurance, insurers’ losses from earlier non-damage business interruption payouts, and the persistent threat of climate change-induced weather incidents. Brokers (and insurers) must continue to engage with clients, actively advising and assisting with proactive risk management strategies to minimize these issues and contain market rates.

After a year of healthy growth in terms of GWP handled for brokers in 2021, challenges on both a local and global scale are likely to generate more growth in 2022. Returning or growing insurer risk appetite may help alleviate some of these concerns, gradually improving market conditions for businesses.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData