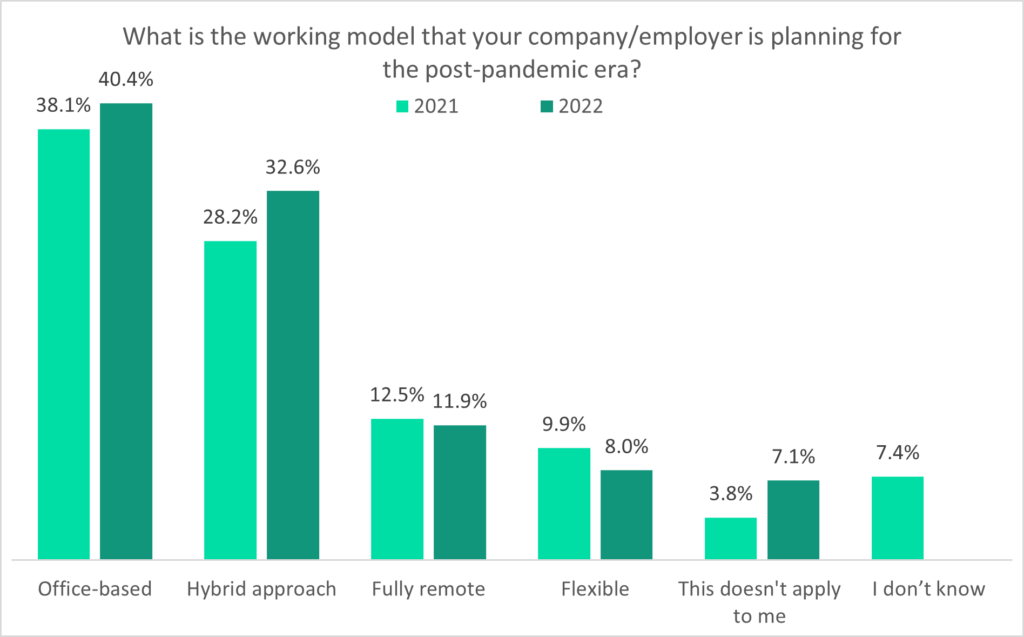

Increasing consumer demand for flexible working models, not just in an office, will present challenges and opportunities for insurers. One of the pandemic’s most significant long-term repercussions is the transition to remote working in 2020, which has shifted working to a hybrid/flexible approach in 2021 and beyond. Full-time office jobs are frequently not a viable short- or medium-term answer, and this is probably because businesses need to meet the demands of their staff. Around a third of employers are now adopting a hybrid working model in 2022, an increase from 2021.

According to GlobalData’s 2021–22 UK Insurance Consumer Survey, more than half of employees do not anticipate returning to work full-time in the office following the pandemic, with only 40.4% anticipating such a return in 2022.

Moreover, just over half (51%) of employees reported having flexible working arrangements in their present employment as of April 2022, according to the Chartered Institute of Personnel and Development, and this percentage is expected to rise. More than a third of organisations (37%) have noticed an increase in requests for flexible working since November 2021. This change in workplace behavior will cause new insurance requirements and pose challenges to insurers if companies choose to scale down and reduce their cover.

The percentage of employees who combine working from home with their regular place of employment, or “hybrid working,” has been increasing during 2022, according to the Office for National Statistics, while the percentage of those who work solely from home has decreased. The proportion of workers hybrid working has risen from 13% in early February 2022 to 24% in May 2022.

For insurers, this change in the nature of office labour represents an opportunity. There will be greater prospects for new companies because so many businesses are wanting to relocate their offices to save costs or scale down. Instead of renewing with their present carrier, moving companies will probably look to evaluate their insurance options. Additionally, some businesses value flexibility more now than they did before the outbreak. Some businesses sought rolling one-month rental agreements during the height of the pandemic to lessen the impact lockdowns would have on employee attendance. Insurance companies might provide such plans to businesses seeking this flexibility given the general outlook for the overall economy in 2022.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData