GlobalData surveying indicates that the series of new measures introduced by the UK government to increase the installation of charging points may speed up the shift from conventional to electric vehicles (EVs).

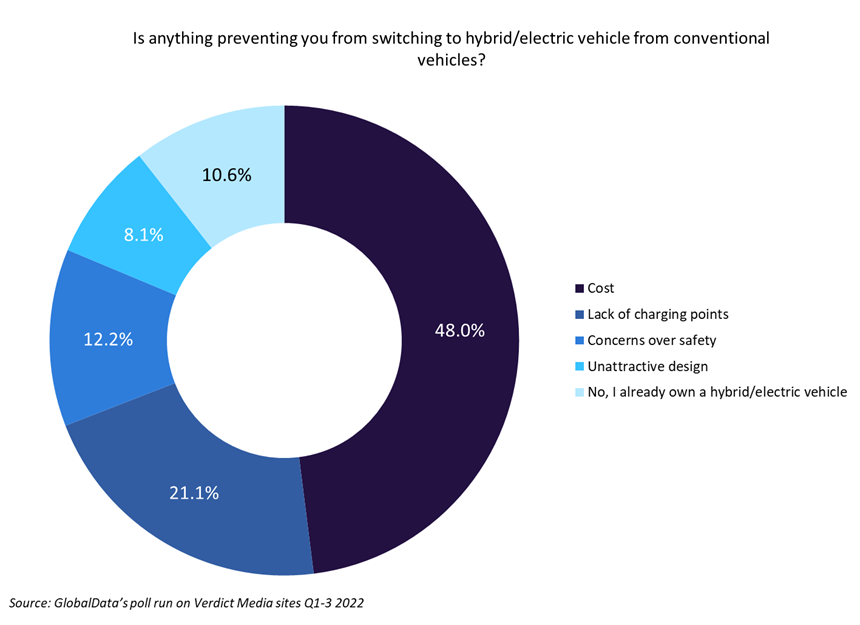

According to GlobalData’s poll run on Verdict Media sites in Q1–Q3 2022, the two main constraints in switching from conventional vehicles to EVs are cost (48.0%) and a lack of charging points (21.1%). Likewise, concerns over safety (12.2%) and unattractive designs (8.1%) are also factors preventing consumers from making the switch.

In an attempt to support the shift to EVs, the UK government has recently launched a £381m Local Electric Vehicle Infrastructure (LEVI) fund alongside an additional £15m for the On-Street Residential Charging Scheme (ORCS). Taken together, the funding will support the installation of tens of thousands of new chargers across the country, increasing EV infrastructure in numerous areas and ensuring the UK’s charging network can support the increasing number of EV drivers and those considering the switch. This will likely encourage and speed up the transition to EVs as a lack of charging points is a key barrier to entry for many consumers.

Insurers must prepare for the shift from conventional vehicles to EVs. Unlike internal combustion engine (ICE) vehicles, insuring EVs presents insurers with a variety of difficulties. Battery-powered automobiles operate very differently to ICE cars, so the cars must be fixed by specialists using parts that are not often utilised in conventional cars. For the time being, this will make insurance more expensive, but as more people start driving EVs, this will shift. More mechanics will become familiar with fixing EVs, and more companies will produce the necessary parts, which will lower the cost of repairs. This will result in lower premiums over time as repairs become less complicated and more frequent. As a result, insurers will have a better grasp of the pricing methods and resources required to set rates for EVs.

However, before these networks mature, insurers may have significant issues in underwriting/pricing insurance for EVs. In the motor insurance market, it is already taking considerably longer for vehicles to be repaired or replaced due to supply chain problems. One can reasonably expect this problem to be heightened due to the complexity of EV components. Additionally, the infrastructure for repairs and servicing is fairly thin and owned primarily by EV manufacturers. This means insurers may be unable to use their own repair networks and benefit from economies of scale.

Overall, consumers are increasingly starting to move towards EVs and alternative fuel vehicles. With the ban on the sale of new petrol and diesel vehicles set to start from 2030, insurers must adapt to changing consumer trends and market conditions if they wish to stay competitive.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData